This article is the second in our three-part series exploring ways a loan pricing model may help your institution achieve a strong return on investment (ROI). For a refresher, view the first article in our series covering enhanced loan yield and loan fee collection. This second piece will focus on how loan pricing models can help with compensating deposits and decreasing instances of lost lending opportunities from customers.

Compensating Deposits

During the loan origination process, a common strategy for negotiating proposed loans with an initial return on equity (ROE) less than the minimally acceptable rate is to request or require that the borrower create or increase certain deposit balances held at the institution. Suppose these compensating deposit balances are of sufficient amount and priced appropriately. In that case, they may be useful in improving overall customer relationship profitability and allow for loan approval at a rate less than would be the case without these deposit balances. At times, the effect on profitability and the resulting loan price of these accounts are considerable. The smaller the requested loan amount, the greater the potential impact of this compensating balance strategy.

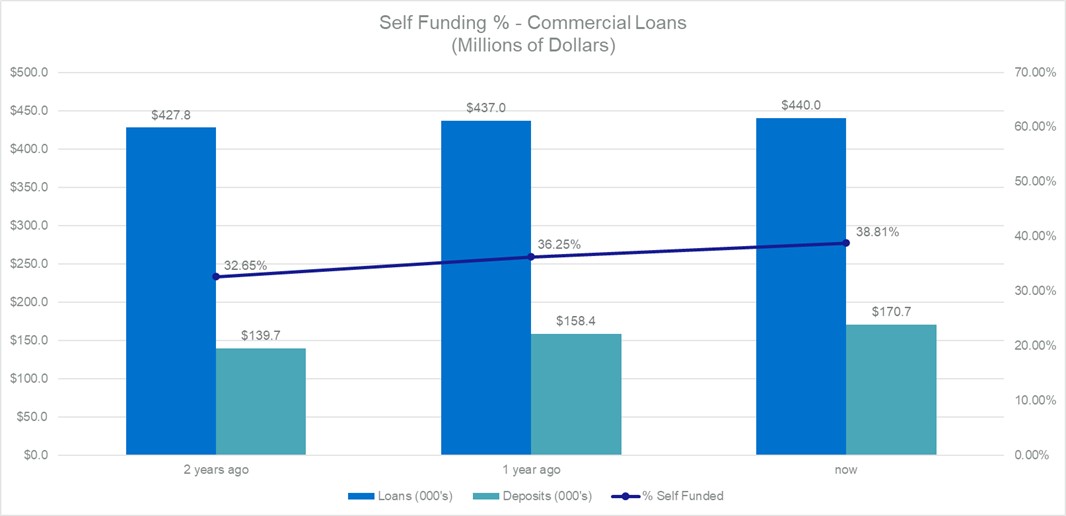

To illustrate this, consider an example bank with $905 million in total assets that began using this strategy two years ago. This institution tracks the “self-funded” ratio of commercial customers and the percentage of borrowing customers that maintain their primary operating accounts with the bank. These statistics are tracked both on a bankwide basis and an individual lender basis. The self-funded ratio represents the long-term dollar balance of deposits maintained at the bank by commercial borrowers. The bank tracked its performance based on the self-funded ratio for the first 24 months following the routine implementation of this strategy, as shown in the chart below:

Click here to open image in a new tab

Click here to open image in a new tab

When dealing with loan applicants who did not currently have their primary operating accounts with the bank, lenders were encouraged to provide commercial loan applicants with two rate quotes, one based on the rate given a loan-only relationship and a second lower rate based on the presence of a compensating deposit balance, i.e., the borrower’s primary operating checking account. The second rate was usually between 15 and 25 basis points lower. Thus, most applicants opted to move their checking account in exchange for the lower loan rate.

When the applicant had already maintained their primary operating account with the bank, a firm commitment to a fixed minimum dollar balance to remain in the account was obtained. Typically, this is targeted as a percentage of the outstanding loan balance and normally represents a 10% to 25% increase in average deposit balances over time, i.e., “new money.” In the two years following the implementation of this new pricing policy, the bank saw its self-funded ratio increase from 32.65% to 38.81%, and it is continuing to grow.

Based on the bank’s product profitability analysis, the bottom-line net income impact of this policy change and the growth in balances was approximately $100,000 in the first year and rose to approximately $164,000 in the second year. These policies were well supported by the ROE and risk-adjusted return on capital (RAROC) calculations included in the bank’s loan pricing model and would likely not have been achieved without the discipline provided by the consistent use of the system.

Commercial loan pricing systems, such as LoanPricingPRO® from Forvis Mazars, can help institutions improve profitability, fuel growth, and streamline the pricing process.

Decrease in Lost Opportunities

Another benefit institutions may experience when using a commercial loan pricing model is a decrease in lost lending opportunities to customers who meet the institution’s credit underwriting standards. In other words, this can improve an institution’s “batting average” for winning new opportunities.

To show this effect, consider this example of a $500 million commercial bank with a commercial real estate (CRE) loan portfolio of approximately $135 million. Individual CRE loans within this portfolio range in size from $50,000 to $2 million but average around $300,000 each. The portfolio comprises approximately 450 loans; the most common term is 60 months or five years. Due to the bank’s normal loan turnover rate, roughly 20% of the portfolio (or about 90 loans) is up for repricing and/or renewal each year.

In addition, the bank’s sales efforts to grow the portfolio mean that another 250 prospective new loans are looked at each year, with around 20 new loan applications taken each month. Of these, some percentages do not meet the bank’s underwriting standards or are deemed undesirable for other reasons, e.g., a customer requests too long of a loan term, collateral is outside a familiar market area, there is industry concentration, etc. Due to this, the bank chooses not to compete for these loans.

Based on the institution’s previous experience, roughly 14% of initial new loan applications, or about 50 loans, were passed on due to creditworthiness. Another 15 loans (6%) were voluntarily foregone due to unfavorable loan terms. This left nearly 200 loans the bank wished to compete for within its market area. Historically, the bank’s actual success rate was as follows over a year:

| Total Loan Applications Analyzed by Credit | 250 |

| Passed on Due to Credit | (35) |

| Passed on Due to Other Terms | (15) |

| Acceptable Loan Applications Competed for | 200 |

| Lost to Regional/National Banks | (40) |

| Lost to Other Community Banks | (60) |

| Lost to Credit Unions | (25) |

| Lost to Alternative Financing Alternatives | (30) |

Applications Withdrawn/Not Acted Upon | (15) |

| Number of New Loans Closed | 30 |

| Overall Win/Loss Percentage | 15% |

| Dollar Value of New Loans Closed | $9,000,000 |

Using this new loan pricing model improved the bank’s overall win/loss percentage. Most of this stemmed from offering more competitive rates that still meet the bank’s ROE threshold, by substituting fees or compensating balances to meet ROE targets, and correctly establishing ROE targets in relation to the bank’s current portfolio earnings levels and marketplace dynamics.

The bank found that its “batting average” improved from below 15% to above 20%, equating to a pick-up of approximately 10 additional loans won in year one. With an average loan size of $300,000 and an average ROE of 15%, this improved closing rate translated into roughly $45,000 additional profitability per year. In addition, the bank found that each of these new loans came with an average $25,000 relationship-based operating account, thus adding an extra $12,500 of profitability due to increased deposits. The combined effect of this new business, over the average five-year term of the new CRE loans added, equated to roughly $275,000.

How Forvis Mazars Can Help

Institutions can glean several benefits from loan pricing models based on those covered above (and future benefits detailed in our series). Solutions such as LoanPricingPRO can help lenders build strong client relationships and support profitability goals.

At Forvis Mazars, our experienced professionals can assist you in strategically pricing loans with real-time profitability analysis and relationship value metrics. Our teams are ready to configure the platform to help meet your institution’s needs and guide you through a profitability analysis of your existing lending products, which can help drive assumptions and targets to balance short-term growth and long-term profitability.

For more information to help grow your loan portfolio or to request a complimentary demo of LoanPricingPRO, please reach out to a professional at Forvis Mazars.