Overview

The merger and acquisition (M&A) environment was changed in 2021, perhaps permanently. Following the COVID-19 pandemic in 2020, in which the U.S. private equity (PE) deal count increased 1% despite draconian forecasts, the deal count increased 55% in 2021.1

As we noted in our “Q3 2024 Middle-Market M&A Insights,” there were record-setting activities from Q4 2020 through Q2 2022.

A confluence of factors led to earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples rising in 2021. Per PitchBook, all U.S. PE transactions saw an increase in EBITDA multiples from an average of 10.4 from 2014 to 2020 to 13.7 in 2021.2 Increasing multiples leads to increased risk for the buyer, which has led to increased scrutiny during the due diligence period. This article examines the nuances of factors impacting EBITDA and EBITDA multiples and explains the importance of preparation before a transaction.

The Importance of Due Diligence

The more expensive an asset is, the more cautious a potential buyer may be when considering the purchase of that asset. Similar to how buyers react when considering a car or a home purchase, sellers inherently face more scrutiny when deal valuations increase. Potential buyers have return on investment (ROI) expectations, and increased multiples present a unique challenge to managing the achievement of those ROI requirements.

Sellers may worry that increased diligence could lead to extended timelines to close, which is not in the sellers’ best interest. As a result, sellers often prepare ahead of time to have multiple potential buyers analyzing their company simultaneously. This strategy puts the pressure back on the buyers, requiring them to submit more definitive terms to get deal exclusivity. But this also requires sellers to field questions from various parties simultaneously.

The Impact of Multiples

While multiples can and will be negotiated, market forces tend to determine an acceptable range of multiples for a given transaction based upon many factors, including industry, company size, margin and growth profile, quality of the management team, and more. Many buyers and sellers have access to industry publications, such as the PitchBook statistics referenced earlier.

Given that many PE transactions use a valuation based on adjusted EBITDA x EBITDA multiple, once the EBITDA multiple is agreed upon, the gorilla in the room is for the parties to agree upon the level of adjusted EBITDA to be used in the valuation. Unsophisticated parties in a transaction may believe EBITDA comes directly from their financial statements, as in the definitional sense of Earnings Before Interest, Taxes, Depreciation, and Amortization. However, experienced parties know that the definitional sense is just the beginning. EBITDA is very subjective and can lead to significant conflict and disagreement between buyers and sellers.

The Process of “Normalizing” EBITDA

When buying a vehicle or home, have you often wondered if you are in a “normal” market? Is the price you are paying today going to be significantly different one year from now? If so, how does that impact your ability to sell the vehicle or home and purchase your next one when you are ready? Buyers of companies are wrestling with the same questions, except their challenge is deciding what represents “normal” EBITDA for a particular company.

Let’s start with the basics. PE buyers often require financial statement audits post-closing, meaning they prefer to evaluate accrual basis financial statements in accordance with GAAP. If the seller has only produced cash basis financial statements historically or perhaps modified accrual basis financial statements (a hybrid of cash basis for some items and accrual basis for others), the buyer and seller may have different views of what normalized EBITDA is during the most recent year.

For example, assume the seller operates on a cash basis and received a discount from a supplier to purchase two years’ worth of supplies last year. That means last year’s EBITDA will be understated because it will have two years of supplies expense, whereas EBITDA this year will be overstated because it will have sales but no corresponding supplies expense. Imagine a scenario where the seller received a large deposit from a customer last year for work to be performed this year. On a cash basis, the revenue will be recorded last year (when received), and the expense will be recognized this year (when completed), creating a disconnect in EBITDA. Timing differences like these need to be normalized to recognize revenues and related expenses in the next period.

But, for you, this should be easy because you have monthly accrual basis financial statements that even have been audited at year-end. Your EBITDA must be “normal” then, right? Wrong. A variety of items may increase or decrease your EBITDA compared to what you have reported in the financial statements. One way to think about these items is whether you would expect them to happen again next year. It is important to point out that these items often should be viewed in aggregate at the financial statement line item rather than asking whether each individual item will recur again next year. For example, many companies have a constantly changing customer base. If you sold $2 million of product to one customer this year and do not expect to sell to that customer next year, does that mean the $2 million should be removed from EBITDA? Not necessarily, assuming you expect to replace that with sales to other customers.

Likewise, if you incurred $200K of legal fees related to a particular legal issue this year, but that legal issue has been settled and will not recur next year, should the $200K be added back to EBITDA? It depends. If your legal fees over the last several years have fluctuated within a relatively consistent range, it may be reasonable to assume total legal fees will continue to be within the historical range, even when any specific legal fee may not recur next year. Alternatively, if your legal fees had been consistently $50K per year and then increased to $250K because of the legal issue, that would be more defendable as an EBITDA addback.

The Impact of Changes in Materials Margin

Now, as a seller, you have a solid understanding of your accrual basis financial statements and have identified any one-time revenues or expenses that, in aggregate, appear unusual compared to most other years. What is left? One item we often see buyers and sellers negotiating is the “normal” materials margin for a business that manufactures or distributes products. Recall the supply chain constraints experienced in 2020 and the inflation experienced in 2022. Companies responded to these changes in input costs and product availability in different ways. Some increased sales prices immediately, others delayed changing prices, and some decided to try to gain market share by not changing prices. The decisions made resulted in widely different material margins for a temporary period, making it difficult to assess a given company’s “normal” material margins.

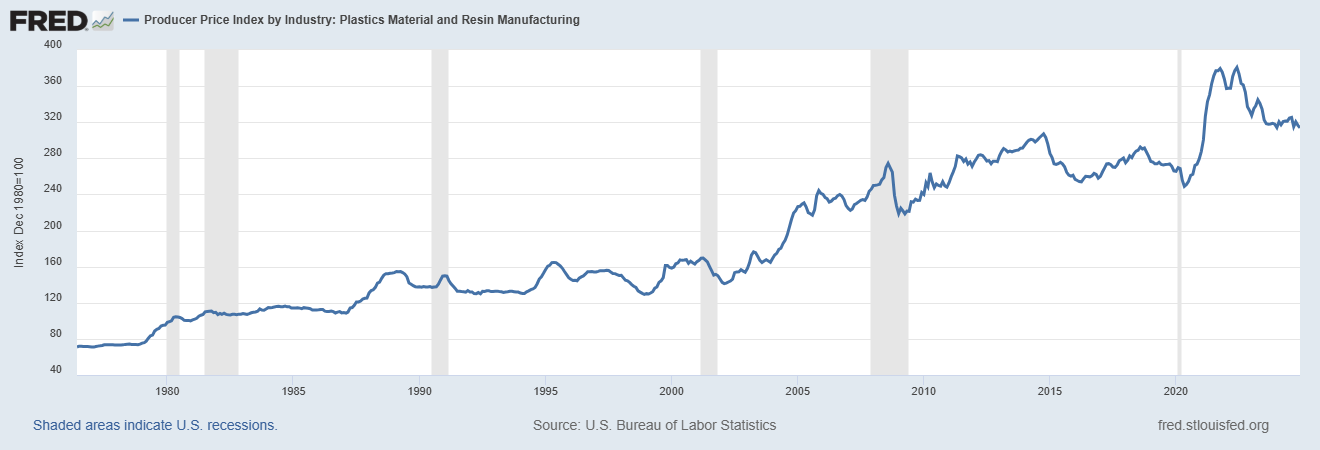

What if the seller’s business is sensitive to fluctuations in a particular commodity? The chart below illustrates the trend in the producer price index for plastics material and resin manufacturing over the last decade. This index spiked significantly during 2021, conceded a portion of that increase during 2022 and the first half of 2023, and has been relatively stable during the last 12 months. However, the seller’s materials margin will be significantly impacted by whether it has long-term purchase agreements in place and price protection agreements with its customers. For example, a company that chose not to change prices at all during this ten-year period would have experienced a significant decrease in materials margin during 2021, and while it would have improved subsequently, it would not have improved to pre-2020 levels. Alternatively, a company that used the increase in input costs during 2021 to raise prices with its customers, but did not lower prices during 2022/2023 as input costs receded, may be presenting record high materials margin during the most recent 12 months. These factors can be very complex and subjective when deciding what a “normal” materials margin is for a business. As a result, they require an in-depth understanding of the company’s vendor and customer contracts and the company’s practice of enforcing those contracts.

Source: Producer Price Indexes, fred.stlouisfed.org.

Source: Producer Price Indexes, fred.stlouisfed.org.

Preparing for a Transaction

At this point, you may begin to see the subjectivity inherent in the various issues that can arise during an M&A transaction. You may conclude that there is no easy answer to the question in the title of this article regarding the sustainability of your profits. However, that is not an invitation to cross your fingers and hope your transaction goes smoothly. Take Benjamin Franklin’s advice to heart: “By failing to prepare, you are preparing to fail.”

If you are a seller, start your preparation by looking in the mirror and trying to see your company as a buyer would. Consider:

- What exposures does your company have that could be improved prior to a transaction?

- Do you have:

- A well-built-out management team?

- An enterprise resource planning system connecting your financial statements and purchasing/invoicing to document customer and product line trends driving the changes in your company’s sales and margins?

- Strong growth prospects and an ability to tell your story?

- A sell-side quality of earnings analysis to help you process the various factors discussed in this article?

- An investment banker to help you identify buyers and navigate the diligence process?

If you are a buyer, likewise, you can put yourself in the seller’s shoes and consider what would be viewed favorably by them. Are you:

- Including industry experts in your discussions with the seller’s management team and highlighting your experience in the industry?

- Committed to the process and spending money on diligence workstreams to condense the timeline?

- Identifying synergies and why you are the right buyer?

- Separating the “nice to have” from the “must have” items so as not to overwhelm the seller?

How Forvis Mazars Can Help

Completing an M&A transaction is not a light undertaking. Still, with the proper planning and a team of knowledgeable professionals at your side, anxiety or fear can be replaced with excitement at the closing table! Before your next transaction, reach out to a professional at Forvis Mazars.