To address unforeseen events and unexpected changes affecting their business, owners should consider having an ownership—or buy-sell—agreement to help mitigate a variety of risks. However, the execution and maintenance of these agreements can sometimes be an afterthought for owners, leading to ownership disputes that can result in costly litigation.

In part one of our Buy-Sell Agreements series, we examined triggering events, key provisions, types of agreements, and methods to determine the purchase price. During part two, we’ll look at how to avoid complications and disparate opinions of value in buy-sell agreements even if one were to choose a protocol involving a valuation performed by a qualified business appraiser.

Avoiding Complications With Buy-Sell Agreements

On the surface, retaining an appraiser to perform an appraisal may result in the most reliable estimate of value from which a purchase price may be determined. However, ambiguity in the buy-sell agreement—as it pertains to the following essential elements of an appraisal—can lead to complications and disparate opinions of value, including standard of value, level of value, valuation date, appraiser qualifications/governing standards, and scope/methodology.

Standard of Value

The standard of value provides a road map for the appraiser on certain fundamentals of how a valuation will be conducted. Common standards of value include:

- Fair market value

- Investment value

- Intrinsic value

- Fair value (state legal matters)

- Fair value (financial reporting)

Unfortunately, many buy-sell agreements are unclear as to what standard of value should apply. Ambiguous terms such as “market value,” “market price,” “value,” and “appraised value” may be used in the agreement with no clear definition of what it is or its intent. Maybe more troublesome is when the term “fair value” is used in a buy-sell agreement, and it is unclear if the author of the agreement is referencing the specific definitions in judicial proceedings that vary by state or the definition for the purposes of financial reporting under generally accepted accounting principles.

In drafting a buy-sell agreement, the author should be very clear with respect to the intended definition of the standard of value. For example, explaining the standard of value, providing a source for the definition of that standard of value, and giving an example of the impact of the standard on a particular shareholder could be helpful in administering the buy-sell agreement. Failure to do so may result in disparate appraisal opinions inconsistent with the intent of the parties to the agreement.

Level of Value

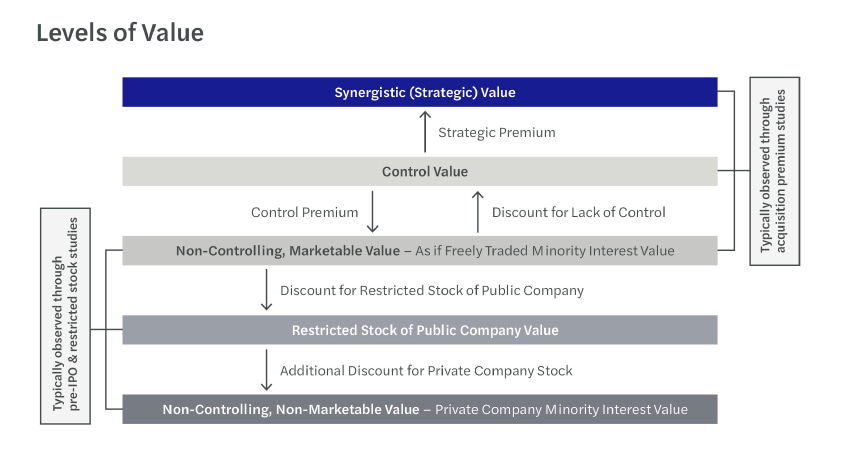

In a business valuation, the level of value serves to conceptualize the complex dynamics of the owners engaged in the company and the transaction. Ownership interests provide owners certain rights, and the value of the ownership interest will be impacted by the particular rights bestowed upon the owner. The specific rights belonging to an ownership interest, and whether those rights entitle the owner to more or less relative corporate power, are important factors in assessing the value of the rights. The following chart depicts the various levels of value and their relationships to one another, with synergistic value being greater than all other levels of value.1,2

The appropriate level of value often dictates which methods and assumptions an appraiser may apply in the valuation assignment, which can drastically impact the final value of a particular ownership interest. Discounts for lack of control, lack of marketability, or lack of voting rights and control premiums may be impacted by the particular level of value. These discounts/premiums can be significant to value and cause confusion among shareholders as various classes of stock with varying ownership rights may have varying values. The level of value also may cause disagreements between business appraisers in certain situations.

Valuation Date

A thorough buy-sell agreement will generally provide an exact valuation date, which is typically tied to a triggering event. Examples include the date of death, the date of retirement, the date of separation/filing, the date of transactions, etc. Doing so helps eliminate the inherent ambiguity of the timing of certain triggering events, and the date should be clearly defined in the buy-sell agreement. The valuation date is important because it establishes temporal boundaries for information that the appraiser may consider in their business valuation.

Appraiser Qualifications & Appraisal Standards

Buy-sell agreements may be silent or vague with respect to defining the qualifications of an appraiser retained to perform a valuation pursuant to the agreement, which may lead to disagreement in the appraiser selection process. In the interest of clarity, it may be prudent for a buy-sell agreement to define or characterize the requisite professional qualifications and knowledge. Further, in evaluating the selection of an appraiser or appraisal firm, it may be appropriate to consider specific valuation experience, continuing professional education, and professional activities when assessing sufficient qualifications and experience for a unique type of business or industry.

Scope of Appraisal Procedures

The appraiser will typically consider two potential scopes of work under professional valuation standards. These standards generally provide for full-scope valuations, i.e., an “appraisal” or “valuation engagement,” or a more limited-scope valuation, “calculation engagements.”

To establish a purchase price in a valuation performed by a qualified business appraiser, the valuation engagement—or full-scope appraisal—would likely produce the most credible indication of value through more thorough appraisal procedures and reporting requirements. However, a limited-scope valuation could potentially produce a result that meets the objectives of the parties from a cost-benefit standpoint, and the parties may not desire a full, detailed narrative report. Finally, the buy-sell agreement should provide clarity regarding the requisite scope of work and reporting to be performed so as to eliminate any potential disagreement.

Forvis Mazars has valuation and transaction professionals engaged to assist others with evaluating, administering, or disputing ownership agreements. It’s prudent to periodically look at the provisions of ownership agreements in view of evolving characteristics of the business and the objectives of its owners. If you have any questions or need assistance, please reach out to a professional at Forvis Mazars. In case you missed it, take a look at part one of this series, “Buy-Sell Agreements: Helping Protect Your Business,” where we examine triggering events, key provisions, types of agreements, and methods to determine the purchase price.

Forvis Mazars Private Client services may include investment advisory services provided by Forvis Mazars Wealth Advisors, LLC, an SEC-registered investment adviser, and/or accounting, tax, and related solutions provided by Forvis Mazars, LLP. The information contained herein should not be considered investment advice to you, nor an offer to buy or sell any securities or financial instruments. The services, or investment strategies mentioned herein, may not be available to, or suitable, for you. Consult a financial advisor or tax professional before implementing any investment, tax or other strategy mentioned herein. The information herein is believed to be accurate as of the time it is presented and it may become inaccurate or outdated with the passage of time. Past performance does not guarantee future performance. All investments may lose money.