The healthcare and life sciences sector presents unique opportunities for private equity (PE) investors. It’s one of the largest, broadest, and, in certain segments, highly fragmented sectors. Investing in healthcare is supported strategically by the increasing demand for healthcare services, medical technology advancements, biosciences and patient care innovations, and a growing aging population. Conversely, healthcare is heavily regulated, deeply impacted by policy shifts, and inherently complex. PE deal volume in healthcare services declined 15% in 2024 compared to 2023,1 reflecting heightened scrutiny from regulators and operational challenges such as increased labor costs and physician turnover. For PE investors, understanding these dynamics is essential for boosting returns while managing risks.

This article is the first in a series focusing on the challenges of doing deals in the healthcare and life sciences sector and includes the following major subsections: healthcare services, pharmaceuticals, biotechnology and medical devices, health technology, and managed care (payors).

Healthcare Services Due Diligence

Historically, healthcare services are the largest subsectors, based on PE deal count (65% and 63% of 2022 and 2023 healthcare and life sciences deals, respectively2). Healthcare services companies include hospitals, outpatient clinics, e.g., physician practice management (PPM) companies, behavioral health, home health, hospice, healthcare staffing, pharmacy services, and specialty facilities, e.g., ambulatory surgical centers, skilled nursing facilities (SNFs), and inpatient rehabilitation facilities. Regardless of the type of services the entity provides, several prevailing deal risks are consistently encountered. They should be considered when gauging the earnings quality of a healthcare services entity in the United States.

Quality of Revenue Analyses

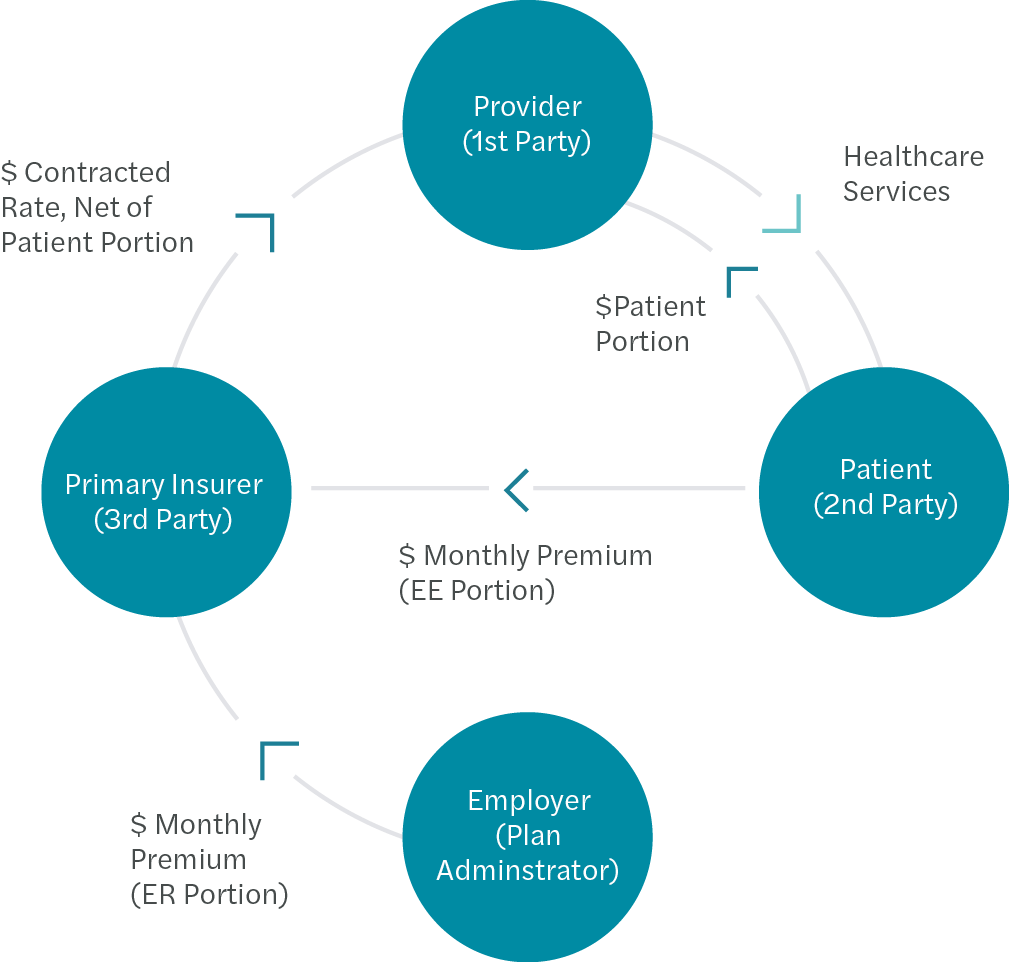

The predominant accounting challenge for healthcare service companies is revenue recognition. This is because a large portion of revenue is subject to third-party reimbursement, which can be complex, as illustrated below.

Third-Party Reimbursement

Third-Party Reimbursement

The goal of revenue recognition on an accrual basis is to record revenue when a service is performed. Reimbursement by the third party can be linked to individual procedures (fee-for-service), visits, days of service (per diem), membership/participant count (per member per month), or some other predetermined metric. The amount recorded in any monthly period should reflect the cumulative sum the company expects to be paid over time in total (for all payors combined) net of any overpayments. Due to the estimation involved, the risk that an entity’s reported revenue is materially misstated is relatively high. For this reason, during due diligence, we spend significant time and budget assessing an entity’s revenue quality.

At a high level, this analysis aggregates transaction-level billing and collection data to construct cash “waterfalls” of cascading collections by the month of service and the month of payment. These waterfalls are used to formulate an independent view of accrual-basis revenue that is compared to the entity’s comparably recorded revenue. The difference can impact earnings and have notable implications for calculating enterprise value.

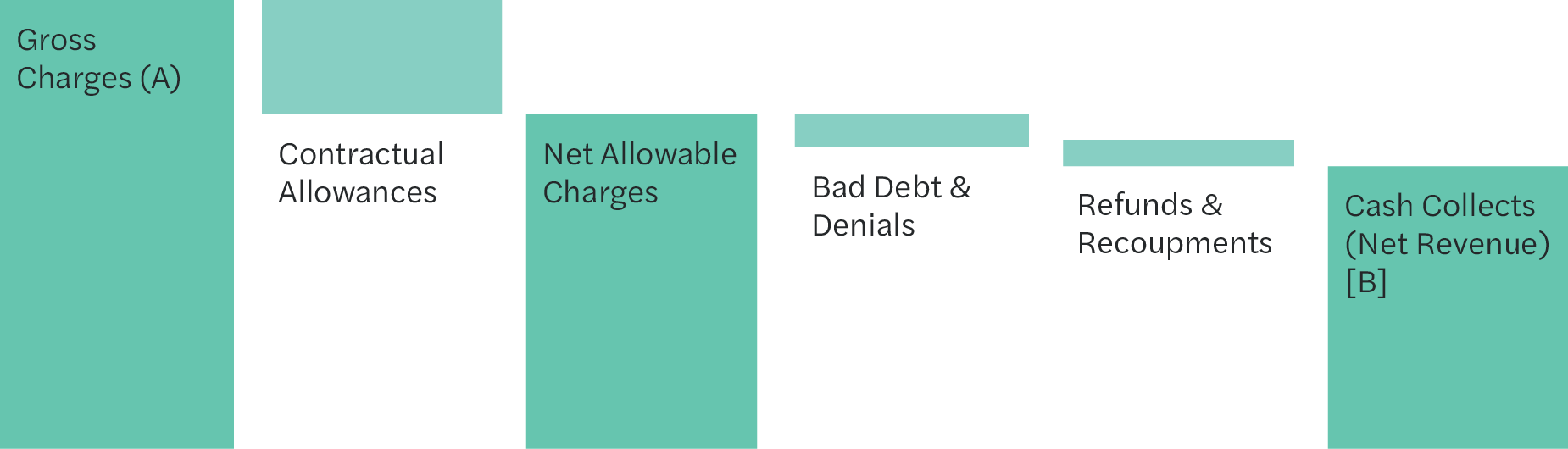

The exhibit below summarizes the relationship between gross charges [A] and actual collections [B] used in the cash waterfalls to estimate net revenue.

Gross to Net Revenue

Gross to Net Revenue

A quality of revenue analysis can be time-consuming and requires special skills to collate and analyze enormous data sets. A seasoned healthcare diligence professional can perform integrity checks on the data before proceeding, identify outliers (such as payors and modalities) that could skew blended collection rates if not isolated, analyze historical collection patterns and speed trends using multiple metrics, and estimate the collections expected to occur in the future for “immature” dates of service.

Reimbursement Rate Influences

While the quality of revenue analysis is critical, revenue analysis will only identify some types of reimbursement risk. Certain risks will not show up in the cash waterfalls. They must be addressed through different means, including services that could be denied and/or recouped (refunded) in the future and recent or upcoming changes in reimbursement rates yet to be reflected in the historical period of the cash waterfalls.

For the first type of risk, billing and coding (regulatory) compliance due diligence is designed to identify potential flaws in an entity’s clinical coding practices that could result in potential exposures. A regulatory chart review involves selecting a predetermined number of claims and scrutinizing the underlying clinical documentation for each. Often, the selection is heavily weighted to include claims for patients insured by Medicare and/or Medicaid, which tend to be the most at risk. Independent billing and coding professionals perform these diligence procedures, and their findings can determine whether or not a PE suitor decides to complete the transaction.

The second type of risk—changes in reimbursement rates—can occur for many reasons. PE investors need to consider the impact these rate shifts can have on the underlying earnings power of the entity. Sometimes, these rate changes are set to occur outside the historical period and aren’t addressed by traditional diligence procedures. Annual contractual changes for governmental and in-network commercial payors are common, and the increase or decrease can sometimes be significant. Other irregular events can also create reimbursement uncertainty, as illustrated by the external factors in the exhibit below.

Healthcare Services Reimbursement Influences

Internal Factors

- Chargemaster changes

- Auto-contractualize or manual

- EMR System Conversions

- Billing department turnover

- Credentialing of medical staff

- Timely submission of claims

- Denial management

- Timely posting of cash payments

- Insourcing vs outsourcing of RCM

- Bad debt reserve policy

- Cybersecurity protocols

External Factors

- Annual changes in contracted raises

- Bundling/de-coupling of CPT codes

- Medical necessity determinations

- Increase in patient portion

- Clinical documentation changes

- Credentialing requirements

- Shift to in-network or out-of-network

- Payor delays in payment

- Deductible thresholds met

- Pre-authorization requirements

- Shift in demographics/employers

Diligence teams can tailor a work plan to identify and quantify potential rate changes. However, hiring diligence professionals with experience in the entity’s sector is a way for PE dealmakers to help ensure that elusive rate changes are identified and addressed early in a process.

Clinical Personnel Costs

Provider salaries and wages, coupled with payroll taxes and fringe benefits, represent the largest category of expenses on most healthcare companies’ income statements. PE backers rely on diligence teams to study and dissect these expenses and, if necessary, include adjustments to historical earnings to normalize abnormalities.

In many healthcare settings such as PPMs, physician pay is the largest clinical personnel expense. PE investors tend to impose new incentive-based compensation arrangements for physicians post-transaction, i.e., pinning pay to revenue generated by the physician. Diligence teams will often quantify the impact of this new compensation structure on historical periods in the form of a pro forma adjustment to earnings. Similarly, the retirement and hiring of physicians and/or new clinic openings may also need to be considered.

Lastly, the division of labor among employee physicians, physician assistants, nurse practitioners, and contractors can significantly impact an entity’s profitability. In addition to the wage variations, the revenue realized for the same services performed by a mid-level practitioner and a physician can differ significantly. Sustained staffing shortages can compress margins when more expensive nursing agencies fill in for cheaper, employed nurse practitioners. Investors will want to consider what the staffing strategy looks like going forward and, if necessary, quantify the impact of the difference between the historical model and an optimal model under new ownership.

Other Healthcare-Specific Matters

In addition to the earnings considerations and risks discussed above, other elements of healthcare services transactions may seem foreign to an unseasoned healthcare investor. For example, medical malpractice insurance is a major expenditure for healthcare service providers, and it comes in numerous shapes and sizes. Unlike entities in other sectors, many healthcare service companies must submit annual “cost reports” and comply with other complex regulatory reporting requirements. They may also be subjected to periodic audits by government agencies that go back three or more years.

In any given subsector of healthcare, PE financiers may encounter regulatory mechanisms that are intended to either encourage certain behaviors or prevent abuse. These structures can fundamentally impact unit economics and have massive implications on a PE investor’s investment thesis, i.e., hospice caps, Stark Law on self-referrals, and home health wage parity restrictions. For this reason, inexperienced investors should spend considerable time researching a new healthcare arena before proceeding.

Also, hiring counsel with deep healthcare knowledge is essential when drafting and executing a purchase agreement, and helps reduce deal risks overall. In addition, they can assist in pinpointing an effective deal structure, navigating the state laws that govern the corporate practice of medicine, making sure the Medicare provider numbers can be transferred to the buyer, and drafting protective language in the purchase agreement to limit the transfer of unwanted liabilities.

How Forvis Mazars Can Help

Investing in healthcare services presents significant opportunities and distinct challenges for PE investors. Successful healthcare investing requires a deep understanding of regulatory landscapes, a calculated due diligence plan, and an emphasis on operational improvements. By adopting a strategic approach and leveraging knowledgeable professionals’ insights, PE sponsors can help enhance returns while potentially lessening inherent risks of the healthcare sector. With our in-depth healthcare capabilities and fluency working with PE, our healthcare and life sciences team at Forvis Mazars can provide a variety of financial, regulatory compliance, tax, and information technology due diligence services. If you have questions or need assistance, please contact a professional at Forvis Mazars.