There was a time not too long ago when you walked into the local computer or big box store and purchased a boxed CD if you wanted software for a personal computer or small business. Sales tax collection was easier then because stores simply charged the item price plus the applicable sales taxes based on the applicable rate at the physical store location. The item was generally taxable since states impose tax on sales of tangible personal property and the purchased software was delivered on a tangible CD.

Growth of the Software as a Service (SaaS) Industry

With the growth of the SaaS industry, it is now increasingly common for users to access business software online through a laptop or mobile device. No more store visits or loading software on a device from a CD. The removal of the physical item (CD) and physical store location from the software license transaction adds significant complexity to sales tax collection. Businesses now must understand certain things:

- Whether the state the customer resides in is a state that imposes SaaS tax (more than half of states currently do not)

- Even if the state does impose tax, whether the state can place the burden on the out-of-state seller to collect and report the sales tax in the customer’s state

This issue is increasingly noted among SaaS businesses as they grow and attract investments or potential buyers in the market.

South Dakota vs. Wayfair Ruling

The 2018 U.S. Supreme Court decision in South Dakota vs. Wayfair changed the game in terms of sales tax collection for out-of-state sellers, significantly expanding the tax collection responsibilities of SaaS companies and other sellers that serve customers across the United States.

Sales Tax Compliance Considerations

When considering sales tax compliance, a tech company should bear in mind three things.

First, the physical presence of the company in a state via physical location as well as the location of remote workers.

The second consideration is the economic nexus thresholds that all states now have in place (note: although Missouri has passed an economic nexus law, it is not effective until 2023). In a larger number of states, if a business has over $100,000 in sales or more than 200 transactions (each monthly subscription payment can be treated as a separate transaction), then it has an obligation to collect and remit sales tax on charges to customers in those states.

The third and final consideration is whether the state will impose a sales tax on SaaS if a business has established nexus with a state through a physical or economic presence. Almost half of the states with sales tax now impose tax on SaaS, part of a growing trend among states to avoid losing tax revenues as more software transactions move to the SaaS model.

If a SaaS provider determines it has sales tax collection obligations, implementing sales tax systems and processes to accurately collect and report sales tax from customers across various states becomes critical. In addition, if past sales tax collection was missed, remediation of historical tax exposure and registration for future compliance will be needed. Finally, consulting with tax advisors to identify the best model for your organization to manage sales tax will be important to help with future compliance.

R&D Credit Considerations

Tech companies (especially start-up companies) need to be aware of the availability of R&D tax credits at the state and federal levels.

- This is an immediate cash opportunity.

- Thirty-six states offer R&D tax credits.

- Eight states offer refundable credit.

- Some states permit offsetting R&D credits against payroll tax.

- Qualified Small Businesses (“QSB”) can offset up to $250,000 in payroll taxes.

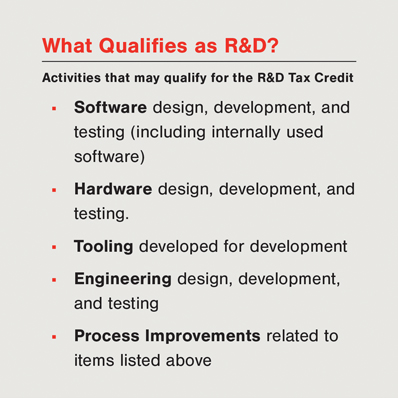

R&D encompasses software, hardware, tooling, engineering, process improvements, direct support, and direct supervision. (See infographic below.)

Further, R&D tax credit can be carried forward up to 20 years, so it is important to know your state’s credit offerings.

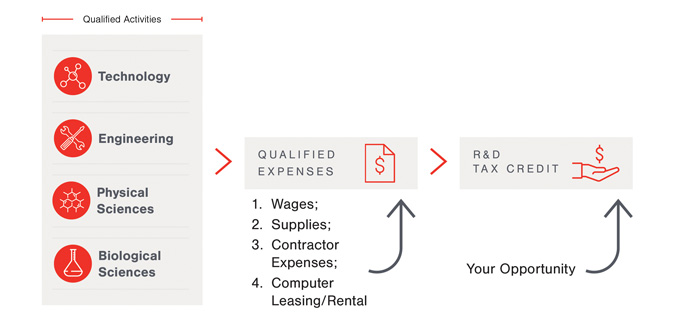

When thinking about qualified activities for R&D credit, consider the following graphic:

Other Tax Considerations for SaaS Companies

Questions to ask yourself when thinking about sales tax compliance and R&D tax credits:

- Is my product hybrid or fully SaaS?

- Does my company offer other services to SaaS customers that may be subject to sales tax?

- Am I sourcing sales to the customer’s location?

- Do I have proper documentation on file for customers who claim tax-free treatment on services?

- Does my company have processes in place to track nexus and register in additional states as my business expands?

- Does my company have processes in place to ensure any new products or services are mapped properly in my sales tax/billing software?

How Forvis Mazars Can Help

Forvis Mazars helps technology and software companies understand and navigate sales tax compliance and R&D tax credits. Our multidisciplinary approach can help your company estimate the credits and develop a plan for sales tax compliance. Contact a professional at Forvis Mazars