If you own cryptocurrency (crypto) such as bitcoin, you should expect to encounter new challenges when filing your 2025 tax return. The IRS recently issued a revised set of regulations that taxpayers will need to adhere to when reporting their crypto activity. The IRS is cracking down on underreporting of cryptocurrency and digital asset activity, and one of its tactics goes into effect for tax year 2025. This will be the first year in which brokers will be required to report information regarding taxpayers’ crypto activity to the IRS and taxpayers via Form 1099-DA. While some taxpayers might rejoice thinking all of their crypto-asset activity will now be reported to them in one place, this new form is likely to only increase the frustrations taxpayers face when preparing their income tax returns. This article will go into depth about the items that may cause frustrations, but it is first summarized in the table below for ease of review.

| Topic | Concern |

|---|---|

| Switch From Universal to Wallet-by-Wallet Lot Relief | Even if a taxpayer didn’t meet the safe harbor deadline in Revenue Procedure (Rev. Proc.) 2024-28, they still need to transition but have no penalty relief. |

| Requirement to Use FIFO or Specific ID | If taxpayers choose Specific ID, the lot must be specifically identified before the sale or exchange occurs. In the absence of Specific ID, the default is first-in, first-out (FIFO). |

| Missing Cost Basis | Forms 1099-DA will not report cost basis for many transactions. |

| Not All Transactions Will Be Included in a 1099-DA | Not all crypto transactions are required to be reported on a Form 1099-DA. Final regulations provided de minimis thresholds for qualified stablecoins and specified non-fungible tokens (NFTs). Six different types of transactions were deferred in Notice 2024-57. |

| Late 1099-DAs May Be Issued After Tax Return Due Date | The IRS provided transitional relief for brokers making a good faith effort to report 1099-DAs up to a year late via Notice 2024-56. |

| 1099-DAs Reporting Using UTC, Not Local Time of Taxpayer | Taxpayers could perform a transaction that occurs on December 31 in year 1, but the 1099-DA reporting won’t happen until year 2 because brokers are to report 1099-DAs using Coordinated Universal Time (UTC). |

Switch From Universal to Wallet-by-Wallet Lot Relief

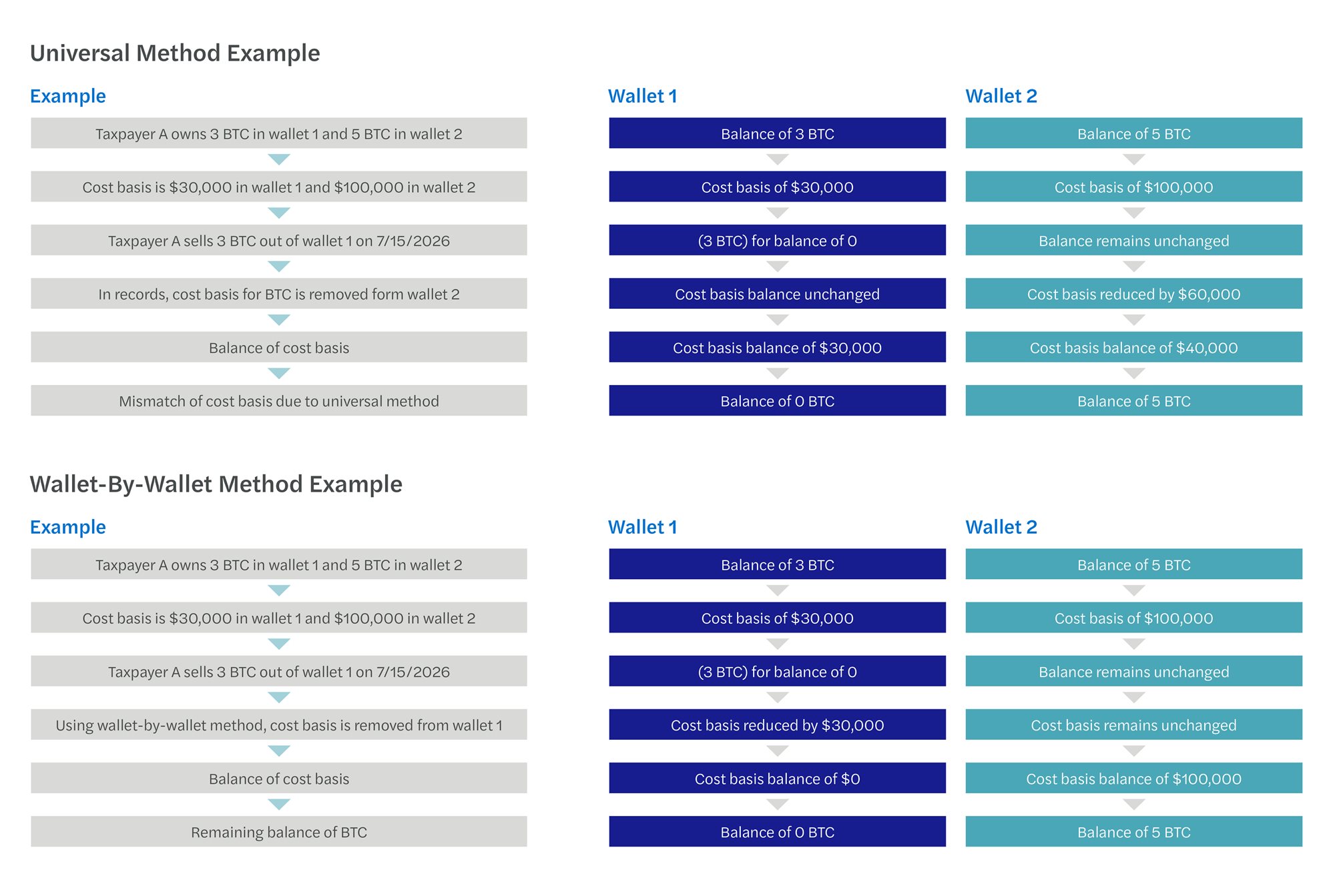

As of January 1, 2025, taxpayers are not permitted to utilize the “universal method” of reporting for their digital asset activity. Under the universal method, all digital assets under a taxpayer’s control, regardless of whether they are in separate wallets, could be considered when determining the cost basis for a sale. If, for example, a taxpayer was using the HIFO (highest-in, first-out) method for basis determination, under the universal method they would do so by selecting the asset with the highest cost basis from any wallet under their possession.

Beginning with the 2025 tax year, IRS guidance says taxpayers will have to utilize a wallet-by-wallet (or account-by-account) method. This method will require that taxpayers use cost basis from a token that is in the same wallet as the token being sold. To comply with the wallet-by-wallet method, taxpayers who had previously used the universal method will be forced to re-evaluate their assets to determine the basis of their holdings in each wallet. To assist with this process, the IRS published Rev. Proc. 2024-28, which provides a safe harbor for taxpayers to transition to the wallet-by-wallet method if they previously used the universal method. In this safe harbor, taxpayers were allowed to either allocate unused basis to specific units or to spread it across a pool of their remaining holdings. As many taxpayers use crypto tax software to summarize their transactions, it is recommended that they confirm which method was being used in prior years. While the deadline to comply with the safe harbor has likely passed for many taxpayers, they will still need to transition to wallet-by-wallet to adhere to this new guidance. Failure to transition to wallet-by-wallet (even if the safe harbor date was missed) could expose taxpayers to the risk of the IRS recalculating their cost basis, and thus overall gain or loss.

Click here to open image in a new tab

Click here to open image in a new tab

Requirement to Use FIFO or Specific ID

Another rule clarified in the final custodial digital asset broker regulations is the requirement to use either the FIFO or Specific ID method for determining which asset’s cost basis was used in a sale or exchange. Under the FIFO method, taxpayers would use the basis of the oldest token in their wallet to determine the gain or loss on a sale. Under the Specific ID method, taxpayers would have the option to specifically designate which unit and its associated acquisition date and basis were being sold in the transaction.

If utilizing Specific ID, taxpayers would need to make this determination before the transaction was initiated. Note that methods such as HIFO and LIFO (last-in, first-out) would be considered a form of Specific ID and can still be used by taxpayers, so long as taxpayers meet the specific ID requirements, such as identifying the lot before the sale occurs. If, for example, a taxpayer wants to use the asset with the highest basis first, they would need only to determine which unit this was, and to specifically identify that unit as being the one used in the sale prior to execution. Taxpayers working with a broker may have the ability to create standing orders that instruct the brokers to utilize the HIFO or LIFO method via Specific ID as well. Be aware that certain brokers may not have the ability to handle Specific ID requests at this time. The IRS has acknowledged this via Notice 2025-7, and in exchange has provided temporary relief allowing taxpayers to use additional methods for making an adequate identification for transactions that occur during 2025.

Missing Cost Basis

Form 1099-DA is the first tax information form specifically created for digital assets by the IRS. The goal of this form is to report information needed to determine the taxable gain or loss from sales and exchanges of digital assets. Information reported will include the taxpayer’s name, Social Security number, address, name of the digital asset, number of units sold, date the asset was originally acquired, (sometimes) the cost or basis of the assets when originally acquired, date the assets were sold, and proceeds received upon sale (along with a few other items of varying relevance). These forms will be provided to taxpayers and the IRS by those deemed to be “brokers” by the regulations. Brokers are currently defined by the IRS as “any person, U.S. or foreign, that, in the ordinary course of a trade or business during the calendar year, stands ready to effect sales to be made by others.” Examples would include companies such as Coinbase and Kraken, among others.

As with other tax information forms that taxpayers receive, the IRS will likely expect to find the figures from Form 1099-DA on the taxpayer’s income tax returns. If, for example, a taxpayer’s Form 1099-DA lists proceeds received of $1 million on sales of bitcoin in 2025, the IRS will likely expect to see at least $1 million of proceeds on the taxpayer’s Form 1040. One issue, however, is that the Form 1099-DA may not contain all the information that taxpayers need to complete their income tax return. Perhaps the most likely piece of information missing from the form will be cost basis. There are a few reasons for this:

- Brokers will not be required to report basis for sales that occurred during calendar year 2025. The IRS has delayed this obligation to give brokers time to adapt to these new reporting requirements.

- Brokers will only be required to provide cost basis if they are in the position to have all the information needed to determine it. Once a token has left a broker’s platform, they have lost their ability to track what the basis would be for that token. Making matters even more complex, transfer statements that would communicate cost basis from one broker to another are not currently required to be issued when a taxpayer transfers tokens from one broker to another. Essentially, taxpayers will still have the sole responsibility of tracking the basis for any token they possess that has not, at all times, metaphorically stayed within “all four walls” of the broker it was originally acquired from.

- Even if sales occur on or after January 1, 2026, brokers do not have to report cost basis if the sold digital asset was acquired before January 1, 2026. A scenario exists where a taxpayer first acquired a digital asset in 2023, sold the digital asset in 2026, and receives a 1099-DA without cost basis.

Not All Transactions Will Be Included in a 1099-DA

Final regulations exempt six specific types of digital asset transactions from being reported on a Form 1099-DA. IRS Notice 2024-57 specifically identified the following forms of transactions that, until further notice is provided, will not be required by brokers to cover on Form 1099-DA:

- Wrapping and unwrapping transactions

- Liquidity provider transactions

- Staking transactions

- Transactions described as lending of digital assets

- Transactions described as short sales of digital assets

- Notional principal contract transactions

Each of these transactions could have tax implications, so taxpayers will still be responsible for determining the tax impact of these activities even if they are not reported on a 1099. The current regulations also provide a de minimis threshold regarding certain transactions involving qualified stablecoins and specified NFTs. The annual de minimis thresholds are $10,000 and $600, respectively. This threshold offers brokers relief from reporting on transactions that are unlikely to have significant tax consequences. While there are several instances in which a taxpayer’s digital asset activity may not be reported on a 1099, if there is a taxable event, taxpayers will still bear the responsibility for accurately reporting their transactions on their income tax return. This includes transactions in which a broker is not involved, including when a taxpayer performs on-chain transactions using a non-custodial wallet.

Late 1099-DAs May Be Issued After Tax Return Due Date

Taxpayers who are accustomed to receiving their tax forms in the early part of the year may be in for a surprise in 2026. With Form 1099-DA being a new requirement of brokers, the IRS has decided to extend transitional relief that will reduce penalties brokers might otherwise incur for filing late Forms 1099-DA. Brokers making a “good faith” effort to file the form will likely not face penalties for Forms 1099-DA that they file up to a year late. This creates the uncomfortable position where a taxpayer could receive a 1099-DA after they had already filed their tax return. For this reason, taxpayers should plan on gathering and reporting their digital asset activity for 2025 in the same way that they had in prior years. If a taxpayer were to receive a late Form 1099-DA that contained information not previously reported by the taxpayer, they would need to consider filing an amended return. If a late Form 1099-DA contained no new information and was aligned with what the taxpayer had reported on their already filed return, the receipt of the 1099-DA form would typically cause no issue for the taxpayer.

1099-DAs Reporting Using UTC, Not Local Time of Taxpayer

In regard to timing, note that the current regulations require brokers to use a consistent time zone when determining in what year a transaction occurred. It’s likely that brokers will use UTC because the regs require UTC to determine if a stablecoin qualifies as a stablecoin that meets the safe harbor reporting, so to remain consistent, they may use UTC for the remaining information reporting requirements. We recommend checking your broker’s website to determine what time zone they are using. If a taxpayer living in the EST time zone executed a trade at 10 p.m. local time on December 31, 2025, that transaction would typically be reported on a 2026 Form 1099-DA, as it would have already been 2026 under the UTC time zone. As such, there could be a mismatch between what is reported on a taxpayer’s 2025 tax return and what is reported on all Form 1099-DAs for the 2025 tax year because the taxpayer’s income tax return may reflect the sale based on their local time zone instead of UTC.

Conclusion: 1099-DAs Might Cause More Headaches for Taxpayers

While taxpayers who own digital assets now have more official tax guidance than ever before, they should not expect their 2025 tax filings to be less complicated than prior years. Taxpayers will still bear the bulk of the burden to accurately track and report their activity. In addition, they will now need to consider if they are tracking this activity in a way that is compliant with the newly issued regulations. Given the responsibility placed on the taxpayer and the complexity of the transactions, taxpayers owning digital assets should strongly consider consulting with a tax professional when filing their tax returns.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.

Forvis Mazars Private Client services may include investment advisory services provided by Forvis Mazars Wealth Advisors, LLC, an SEC-registered investment adviser, and/or accounting, tax, and related solutions provided by Forvis Mazars, LLP. The information contained herein should not be considered investment advice to you, nor an offer to buy or sell any securities or financial instruments. The services, or investment strategies mentioned herein, may not be available to, or suitable, for you. Consult a financial advisor or tax professional before implementing any investment, tax or other strategy mentioned herein. The information herein is believed to be accurate as of the time it is presented and it may become inaccurate or outdated with the passage of time. Past performance does not guarantee future performance. All investments may lose money.