Imagine a bustling international airport. You enter through departures and pass the airline check-in counter. After shuffling through security, you navigate the terminals to your gate, passing retail shops and restaurants as you stroll or, depending on the person, power walk the moving walkways. Did you know that these types of travel epicenters are historically owned by local, state, or federal governments?

Indeed, most major airports boast ownership from governmental entities. To that end, the IRS recently issued private letter ruling (PLR) 202510011, which ruled for the first time on the treatment and qualification of rental and interest income earned by a real estate investment trust (REIT) from leasing real property to airlines on land leased from a public agency.

This article dives deeper into the nuances of PLR 202510011, which ruled that rents received from airline users are qualified “rents from real property” under Section 856(d) and qualified §856(c)(2) and (3) interest income earned on a deemed loan created by a §467 rental agreement.

Background Information

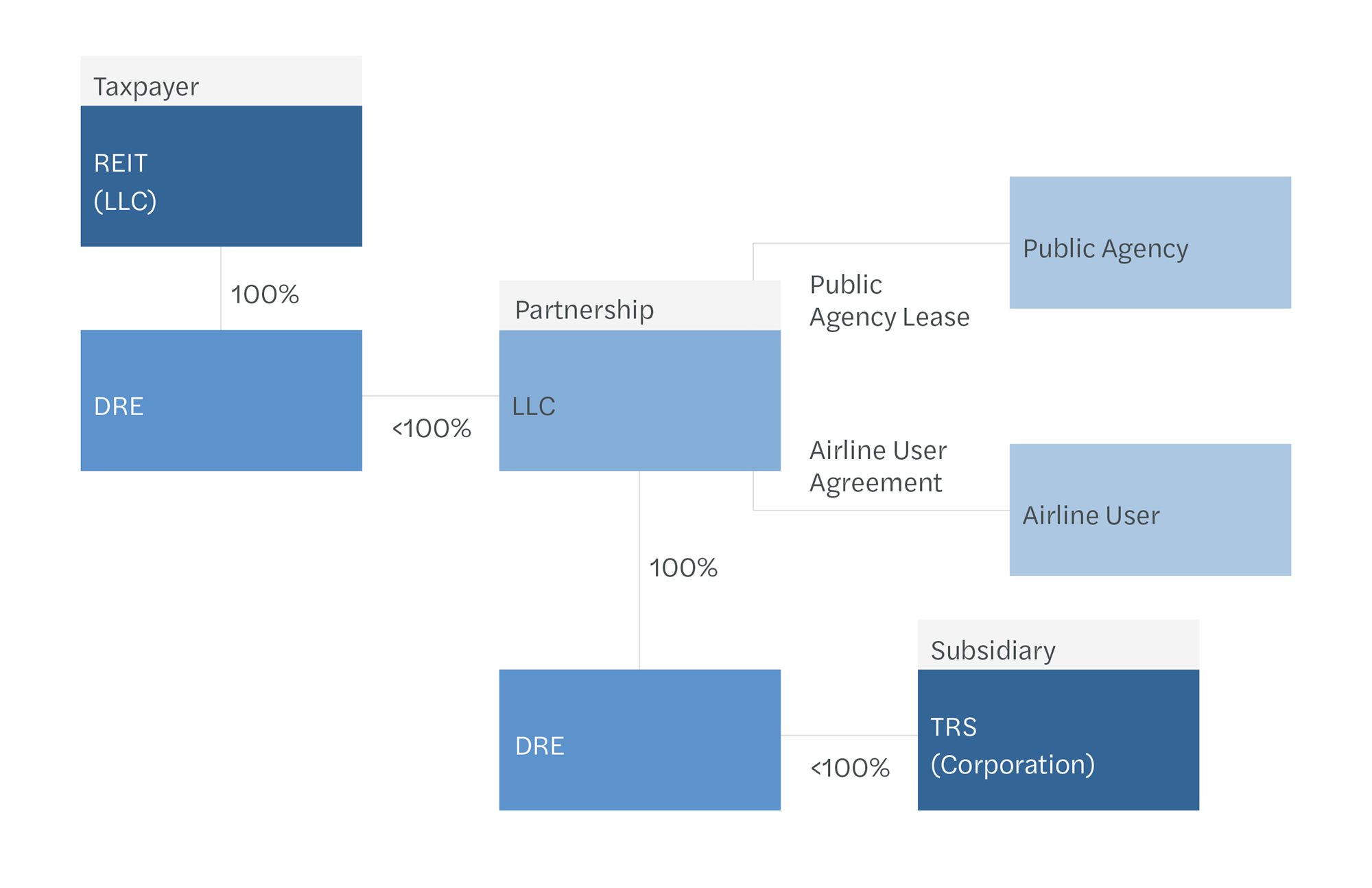

Understanding the structure and assignment of contracts is helpful in understanding the PLR 202510011 ruling. Briefly, the taxpayer was a state limited liability company (LLC) that had elected to be taxed as a REIT. The taxpayer, through a disregarded entity (DRE), owns a percentage of an LLC taxed as a partnership for federal income tax purposes. The partnership’s purpose was to lease the land from the public authority, design and construct airport terminals on the leased land, and lease the completed facilities to airlines and retailers.

The partnership, through a DRE, owns a percentage of the subsidiary, a state LLC that has elected to be treated as a corporation for U.S. federal income tax purposes. The taxpayer and subsidiary made a joint election for the subsidiary to be treated as a taxable REIT subsidiary (TRS) with respect to the taxpayer. A TRS is a corporation owned by a REIT that, through a joint election, is subject to regular corporate income tax rates and allows the REIT to perform activities through the TRS that would otherwise disqualify the REIT from the special tax treatment.

Ruling Requested on Airline Leases

Amounts received from airline users under certain leases, licenses, or other similar agreements are rents from real property under §856(d) of the IRC for purposes of §856(c)(2) and (3). One of the requirements to maintain REIT status is to meet the 95% and 75% gross income tests, respectively, under §856(c)(2) and (3). These tests are designed to ensure that the REIT’s income is passive in nature, i.e., collecting rents and interest.

Lease Agreements

The partnership held a lease for the airport real property with the public agency. It also agreed to design and construct certain land improvements, none of which are or will be part of the leased premises (collectively known as the off-premises facilities). The partnership will assign its rights and obligations with respect to the off-premises facilities to the subsidiary.

In PLR 202510011, the taxpayer REIT engaged an unrelated, third-party independent contractor to be responsible for designing and constructing the terminal, managing the construction, and managing airport operations. The REIT further represented it will not derive or receive any income from any of the independent contractors fulfilling those services. In addition, it was noted that the portion of the contract associated with the off-premises facilities was between the independent contractor and the subsidiary. This representation aligns with the requirements for independent contractors in §856(d)(3).

Once the airport facility is complete, the partnership will enter into user agreements with the airlines. The airline users’ agreements stipulate the use of certain common space in the terminal, including gates, ramps, and taxiways, and may also entitle the airline to the use of specified, exclusive space, such as an area for a sky club.

The partnership will allocate gate slots to each airline user based on the flight schedule for the scheduling season. The gate allocation schedule is a binding, contractual obligation of the partnership to each airline user. The allocation of common space is directly correlated to the airline user’s allocated gate slots, including the right to use certain shared equipment in the airline common space such as check-in desks, computer equipment, and related software.

The taxpayer represented that the amounts received under the airline user agreements were rents for the right to use the airline exclusive space, if applicable, and the airline common space and common equipment. In addition, to meet the 15% personal property gross income test, the taxpayer represented regarding each airline user agreement that rent attributable to personal property, including the common equipment, will not exceed 15% of the total rent for the taxable year attributable to both.

In order to meet Regulation §1.856-4(b)(1) requirement, which provides that rents from real property include charges for services customarily furnished or rendered in connection with the rental of real property, whether or not the charges are separately stated, the taxpayer represented that services typically furnished to airline users in the common space (such as customary utilities and airport security, as well as services performed by an unrelated, independent contractor in the common space like repair and maintenance of common equipment and services assisting passengers with disabilities), would be services that are customarily rendered in airports. Moreover, the taxpayer represented that the airline user agreement specifically excluded non-customary services associated with airline operations, i.e., aircraft deicing and baggage handling, that would disqualify the rent income from meeting the income tests.

Based on the REIT’s representations, the IRS ruled that the rents received from the airlines were qualified rents under §856(c) (2) and (3).

Another component to consider is the retail user agreement between the retail lessees and the partnership. The taxpayer represented that rent will generally be calculated as a specific dollar amount per square foot of leased space plus the greater of a percentage of gross receipts or a specified minimum amount. The IRS cited Rev. Rul. 74-198, 1974-1 C.B. 171, in which it held that the rental payments described in the ruling qualified as rents from real property as defined by §856(d).

Section 467 Deemed Interest as Qualifying REIT Income

The taxpayer requested that pursuant to §856 (c)(5) (J), the interest on the deemed loan created by the §467 rental agreements would be treated as qualifying income for purposes of §856(c)(3).

As a part of the public agency lease, the partnership would pay for the tenant improvements associated with the terminal building and the off-site premises facilities and treat them as prepaid rent. The rent would then be amortized straight-line over the duration of the public agency lease. The taxpayer represented that the terms of the public agency lease will cause the public agency lease to be treated as a §467 rental agreement within the meaning of §1.467-1(c)(1). In addition, based on the §467 rent schedule, the public agency lease included a prepaid rent loan within the meaning of §1.467-4 made by the partnership to the public agency. Under §467, the partnership represented it would recognize interest income on the prepaid rent loan.

Regulation §1.467-1(e)(3) provides that §467 interest on a deemed loan is treated as interest for all purposes of the tax code. §856(c)(3) provides that 75% gross income includes interest secured by mortgages on real property or on interests in real property.

Per §856(c)(5)(J), to the extent necessary to carry out the purposes of Part II of Subchapter M of the Code, the Secretary is authorized to determine whether any item of income or gain does or does not qualify within the meaning of §856(c)(2) or (3).

The taxpayer did not request a §856(c)(3) ruling. Rather, it requested a §856(c)(5)(J) ruling.

It would appear that the taxpayer should have been entitled to treat the interest as §856(c)(3) interest without a ruling since it was de facto secured as a lien against the landlord’s property interest.

The IRS, without citing any support, states that the interest on the deemed §467 loan does not constitute §856(c)(3) interest income. Rather, the IRS ruled that it would use its discretion under §856(c)(5)(J) to treat it as good 75% gross income.

Our Observations

This was the first time an IRS ruling addressed REIT’s rental income from leasing an airport facility to, as well as the treatment of interest on, §467 deemed loans.

Regarding the issue of the rental income being qualified income, the IRS applied a volume-based analysis (passenger departures), which was treated as a proxy for rents for the use of space.

With regard to the deemed §467 loan interest, the IRS took a broad position that the interest did not qualify under §856(c)(3), but rather required taxpayers to go to the IRS to use their discretionary authority under §856(c)(5)(J). Due to this, there will need to be a more definitive ruling as the PLR will cause one-off rulings.

Our team monitors the REIT landscape for new developments and is here to assist with any questions on REIT taxation of real property and interest on actual or deemed loans. Please reach out to a professional at Forvis Mazars for more information.