If you have ever received—or plan to receive—federal grants or funding, it is important that you know the basics of unique entity identifiers (UEIs) and debarment and suspension requirements. The UEI and debarment and suspension requirements go hand in hand, and it is helpful to understand that relationship. This article will explore the UEI requirements and how properly obtaining a UEI can assist in meeting the federal requirements for debarment and suspension.

UEIs: What, Who, & How?

A UEI is a universal identifier required for those who apply for federal funds or receive federal funds. This requirement applies not only to federal award prime recipients, but also to subrecipients. A prime recipient is an entity that receives federal award/funds directly from a federal agency. Prime recipients can then choose to spend the award funds themselves, or they can choose to offer subawards to other entities. When an entity receives federal funding through a subaward with a prime recipient, it is called a subrecipient. It is important to note that the UEI requirements apply not only to those who actively receive federal funds, but for those who apply for federal funds as well.1 Before an entity can apply for federal funds, it must first receive a UEI. The numerical identification of federal awardees is not entirely new. In fact, the federal government used to require a DUNS number prior to switching to the UEI. The DUNS number was—and still is—issued by a third-party organization, though it is no longer accepted as an entity’s numerical identification required to receive federal funds. To streamline the process of entity identification, the federal government switched to using a UEI. UEIs are now applied for—and received—directly through the federal government.2 Entities must request a UEI—or register—through the System for Award Management (SAM.gov).3 Entities can choose to either fully register in SAM.gov or just request a UEI. A full SAM.gov registration is required for entities to apply for federal funds or to be a prime recipient of federal funds.4,5 Subrecipients of federal funds are not required to be fully registered, but being registered can be helpful. Being registered can make it more convenient for your entity to comply with the federal debarment and suspension requirements.6 Instructions on obtaining a UEI and registering in SAM.gov can be found on the site. After successfully registering in SAM.gov, entities must review and update the information annually to maintain their registration.5

Federal Guidance on Debarment & Suspension

In addition to the federal UEI requirements, there are also rules that prohibit federal agencies from spending funds or entering into contracts with entities that are debarred, suspended, or otherwise prohibited from participating in government contracts. This requirement applies not only to prime recipients but to subrecipients and contractors as well. These rules were instituted through executive orders 12549 and 12689. These executive orders further institute the requirement for tracking vendors and participants who have been debarred or suspended. 2 CFR Part 180 provides guidance to assist federal agencies with implementing this governmentwide debarment and suspension system for nonprocurement transactions. Federal guidance defines debarment as “an action taken by a federal agency to prohibit a recipient from participating in federal government procurement contracts and covered nonprocurement transactions.”7 Suspension has been defined as “an action taken by a federal agency that immediately prohibits a recipient from participating in federal government procurement contracts and covered nonprocurement transactions for a temporary period, pending completion of an investigation and any judicial or administrative proceedings that may ensue.”8 According to federal guidance, entities that fall under the purview of the debarment and suspension requirements are prohibited from entering into any contracts with entities or individuals who are debarred, suspended, or otherwise excluded from participating in federal contracts.

Who Does the Debarment & Suspension Requirement Apply To?

Covered transactions are defined as “nonprocurement or procurement transactions” that are subject to the debarment and suspension requirements.9 Nonprocurement transactions can include—but are not limited to—the following: grants, cooperative agreements, scholarships, fellowships, loans, etc.10 Applicability of the debarment and suspension requirements by agency/organization type and transaction type are indicated in the table below:11,12

| Does the Debarment & Suspension Requirement Apply to Me? | |||

|---|---|---|---|

| Federal Agency | Prime Recipients of Federal Financial Assistance | Subrecipients of Federal Financial Assistance | |

| Non-Procurement Transactions | Yes | Yes | Yes |

| Requires Consent of a Federal Agency | No | Yes | Yes |

| Subaward or Subrecipient Contracts | Yes | Yes | No |

| Procurement Contracts < $25,000 | No | No | No |

| Procurement Contracts ≥ $25,000 | No | Yes | Yes |

How Do I Comply With the Debarment & Suspension Guidance?

Once you have determined that you need to comply with the debarment and suspension guidance, the next step is to verify that the person you intend to do business with—or contract with—is not debarred, suspended, or otherwise excluded from participating in federal contracts. Below, you can read more about the three methods for meeting this requirement:13

SAM.gov

For entities/vendors registered in SAM.gov, SAM.gov will provide the most updated information about entities or individuals who are disqualified or excluded from participating in covered transactions. Below are the steps for utilizing SAM.gov to check entity debarment and suspension:

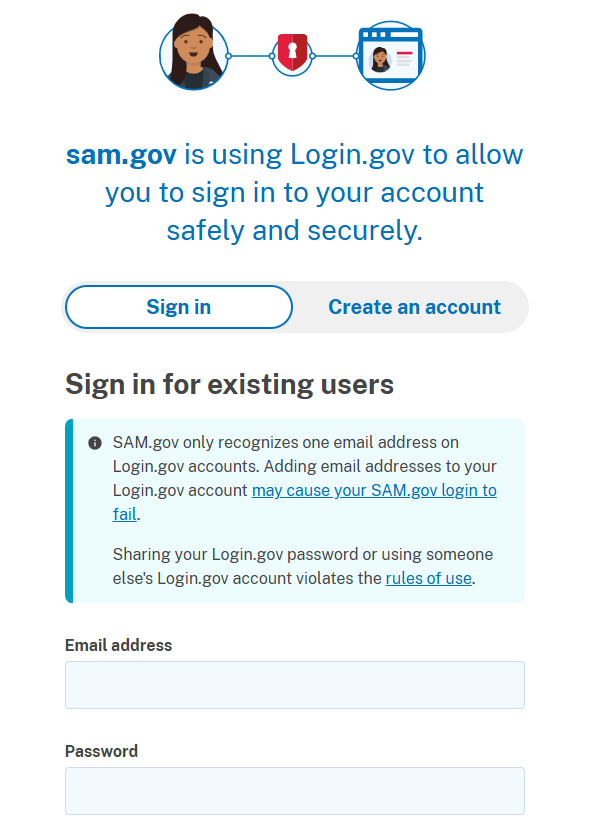

Step 1: Use your internet browser to go to SAM.gov.

Step 2: Click “Sign In” and either:

- Sign in to your account.

- If you do not have a SAM.gov account, click Create Account and follow the instructions to set up your account.

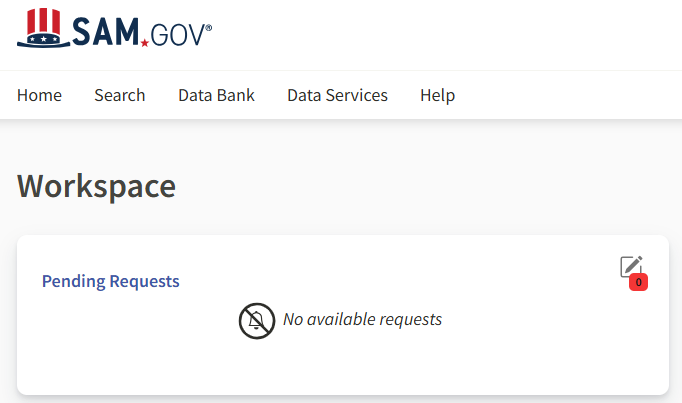

Step 3: Click “Data Bank.”

Step 4: Click “Search.”

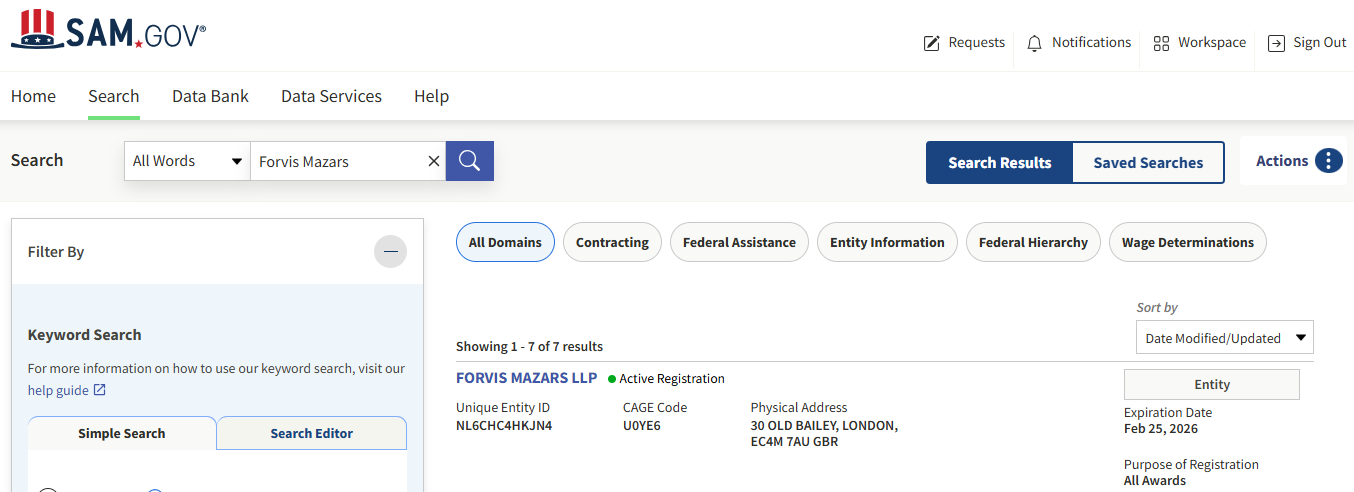

Step 5: In the search bar, type in the entity/organization and hit enter. Related entities that have a SAM.gov account* will show up on the right half of the page.

*Note that not everyone will have a SAM.gov account. If they do not have one, you can use one of the other two methods to check debarment and suspension.

Step 6: Click the entity/organization you were searching for and select exclusions from the menu on the left.

Step 7: Check the exclusions.

a). If there are no exclusions:

b). If there are exclusions:

Self-Certification

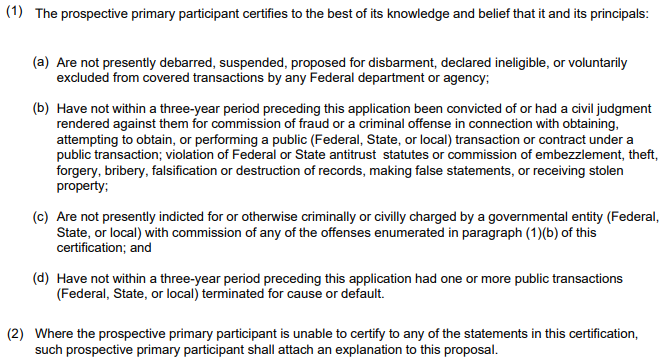

Having an entity/vendor fill out a self-certification indicating it is not debarred, suspended, or otherwise prohibited from participating in federal contacts may be sufficient to meet the debarment and suspension requirement. This certification must indicate that the entity/vendor is the following:14

- Not presently excluded or disqualified from participating in federal contracts.

- Has not, in the past three years, been convicted of—or had a civil judgment against them for—any of the offenses listed in 2 CFR 180.800(a).15

- Are not presently indicted for—or otherwise criminally or civilly charged by—a governmental entity for any of the offenses listed in 2 CFR 180.800(a).

- Has not, in the past three years, had one or more public transactions (federal, state, or local) terminated.

Offenses listed in 2 CFR 180.800(a):

- Commission of fraud—or a criminal offense—in connection with obtaining, attempting to obtain, or performing a public contract or subcontract.

- Violation of federal or state antitrust statutes, including those proscribing price fixing between competitors, allocation of customers between competitors, and bid rigging.

- Commission of embezzlement, theft, forgery, bribery, falsification or destruction of records; making false statements or claims; violating federal criminal tax laws; receiving stolen property; or obstruction of justice.

- Any other offense indicating a lack of business integrity or business honesty.

See below for example language from the U.S. Small Business Administration:16 Please note that signing debarment and suspension self-certification under false pretenses can be interpreted as making a false statement, which is grounds for an entity to be debarred or suspended (48 CFR 9.407-3(d)(3)).17

Contract Clause

The final option to meet the federal debarment and suspension requirements is to include a clause or condition in the contract. This clause needs to affirm that the entity/organization understands the federal debarment and suspension requirements. Further, by signing the contract, it would affirm they meet the same requirements listed in the self-certification section. At Forvis Mazars, we understand that managing federal funds can be a complex and daunting task. Federal funding comes with a host of regulatory and compliance requirements that are constantly evolving. It can become even more intricate if you contract with subrecipients or vendors to complete the work under the federal award. However, with the support of an experienced grants management professional, your organization can be better positioned to navigate these challenges to support the initiatives and outcomes of your federal awards.

How Forvis Mazars Can Help

Our dedicated Grants Management Services team at Forvis Mazars has extensive experience with federal, state, and local grants. We assist clients throughout the grant life cycle, from researching and applying for grants to helping manage awarded funds. Whether you need help with one part of the process or in-depth support, our team is here to guide you every step of the way. If you have questions or need assistance, please reach out to a professional at Forvis Mazars at [email protected].

- 12 CFR 25.105 – Applicability

- 2UEI Update

- 3Appendix A to Part 25, Title 2 – Use of SAM.gov

- 42 CFR 25.200(b)(1) – SAM.gov Before Application

- 52 CFR Appendix-A-to-Part-25(a) – Requirement for System for Award Management

- 62 CFR Appendix-A-to-Part-25(b) – Requirement for Unique Entity Identifier

- 72 CFR 182.630 – Debarment

- 82 CFR 182.670 – Suspension

- 92 CFR 180.200 – Covered Transaction

- 102 CFR 180.970 – Nonprocurement Transactions

- 112 CFR 180.220 – Procurement Contracts Included as Covered Transactions

- 122 CFR 200.214 – Suspension and Debarment

- 132 CFR 180.300 – What to Do Before You Enter Into a Covered Transaction With Another Person

- 142 CFR 180.335 – Information To Provide Before Entering Into a Covered Transaction

- 152 CFR 180.800(a) – Causes for Debarment

- 16U.S. Small Business Administration - Debarment and Suspension Certification

- 1748 CFR 9.407-3(d)(3) – Causes for Debarment