Completing a sell-side quality of earnings (QOE) can be a significant task for a management team. In addition to their day jobs running a successful company, management is responsible for assisting the transaction team with data requests, responding to questions, and reviewing detailed reports and databook drafts. Once the sell-side QOE is complete, management will need to address questions from potential investors and potentially their buy-side due diligence teams. This can be a daunting task for management to tackle on their own.

However, professionals at Forvis Mazars have found that keeping your transaction advisors engaged throughout the deal process can lead to several benefits. This article studies certain issues we have encountered on buy-side engagements when evaluating another firm’s sell-side quality of earnings, and how keeping your advisor engaged can help prevent issues in your deals.

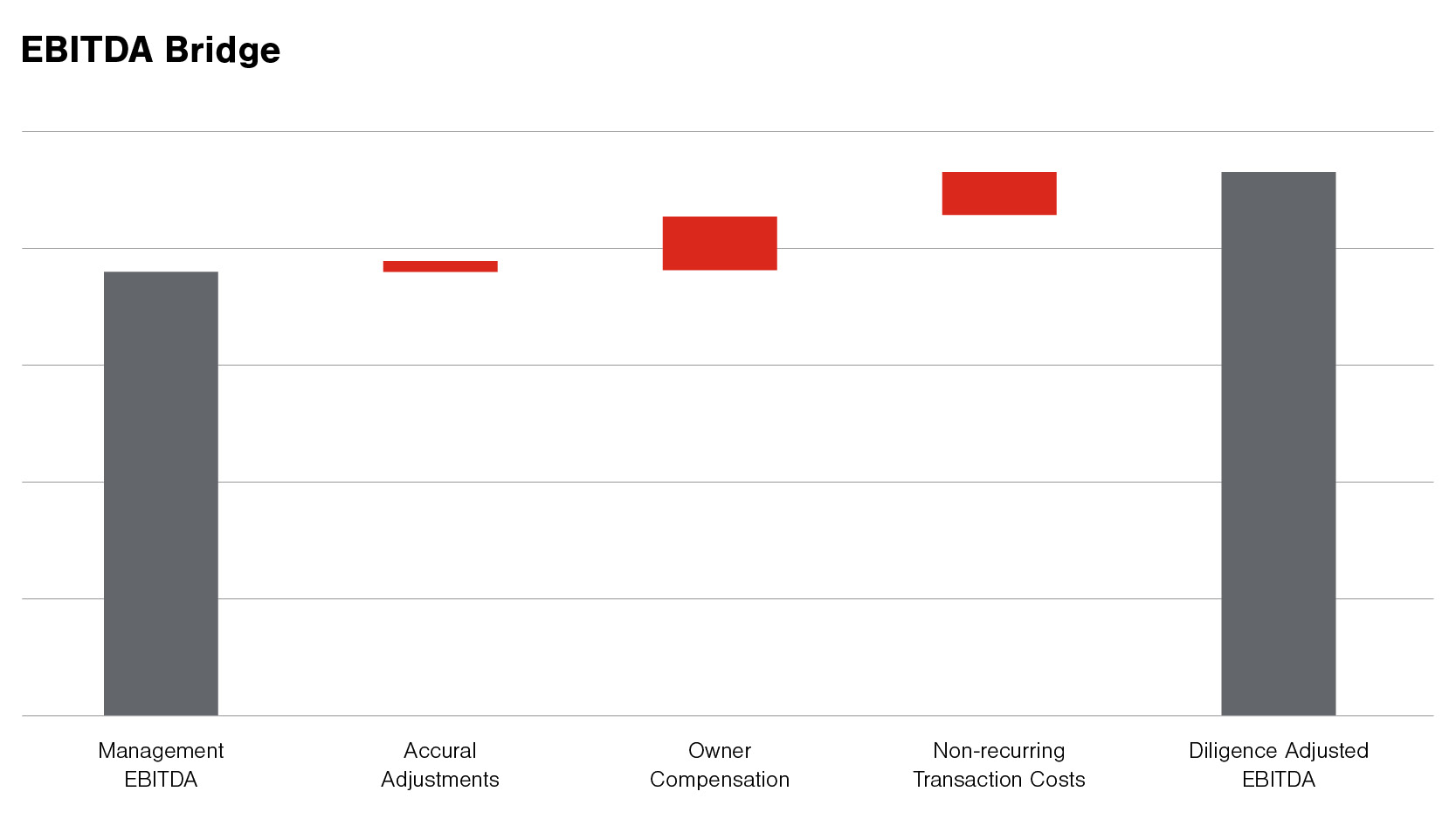

A common issue with a sell-side QOE is how to update numbers—particularly adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization). When the company is taken to market, management meetings are held and potential buyers are narrowed down. The QOE process itself can take a few weeks to months, depending on the size and complexity of the business being sold. The most recent period analyzed during sell-side due diligence can be at least two or three months old by the time the transaction team has drafted and the seller has approved the report.

There are several potential methods for updating the numbers in the QOE, but most come back to some sort of rollforward, ranging from a high-level analysis of reported results to applying the same level of due diligence as the original period or even a full report update. Given the time, effort, and resources put into the QOE by the management team, a temptation may exist to shortcut this process and handle it internally, through the investment banker or through another transaction advisor. However, we have encountered numerous issues with these shortcuts that could have been avoided had the original diligence provider been re-engaged to update their numbers.

The following examples are real issues our team has seen on past transactions when evaluating sell-side quality of earnings reports.

- Accrual Adjustments – A common issue with owner-operated businesses is improper monthly accrual accounting. Adjusting from cash basis to accrual basis can be simple (such as accruing year-end employee bonuses throughout the year) or more complex (such as accruing biweekly payroll, which fluctuates monthly based on the payroll schedule).

Two recent examples illustrate the potential pitfalls of not properly rolling forward these adjustments:- Bonus Accrual – The original due diligence adjustment accrued current-year bonus expense based on management’s estimate for year-end bonuses. When the adjustment was rolled forward, the prior monthly accrual adjustments were not properly offset by the payment of bonuses in December. This caused bonuses to be double counted for the most recent year (and the trailing 12 months) and resulted in significantly misstated EBITDA.

- Payroll Accrual – The sell-side team performed a detailed accrual calculation by allocating the proper number of days to accrue at each month and computing the portion of payroll that should be accrued. When the adjustment was rolled forward, a different methodology was utilized where estimated instead of actual payroll was used, and the number of days was not computed in the same manner. This resulted in monthly EBITDA being significantly skewed.

- Owner Compensation – Adjustments to historical owner compensation (either above or below market) are common in QOE projects. In a recent project, the owner was paid a normal salary plus a year-end bonus. When the rollforward was performed, this adjustment was assumed to be the same monthly salary, but the year-end bonus was overlooked, costing the seller nearly 10% of adjusted EBITDA.

- Non-Recurring Transaction Costs – This is another typical QOE adjustment. Particularly during a sale process, sellers should expect to pay non-recurring fees for due diligence, investment banking, legal support, and other transaction-related matters. During the original QOE period, these types of expenses typically have not begun to hit the general ledger. However, during a rollforward, sellers should be diligent in identifying these expenses and adding them back to adjusted EBITDA. In a recent transaction, both the sell-side due diligence and investment banking fees were overlooked, resulting in a significant EBITDA understatement.

These are but a few examples of potential issues that can be overlooked when a QOE is rolled forward without the assistance of the due diligence service provider. While a rollforward typically will result in additional expense to the seller, it also can help avoid costly mistakes that a seller may not ever realize are made. In most situations, the buyer has no incentive to reveal the impact of these mistakes—unless they result in a reduction to earnings and can be used to support a lower purchase price. Either way, performing a proper rollforward will help present buyers with accurate adjusted figures and can potentially save a seller a significant amount of purchase price.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.