The U.S. Department of the Treasury (Treasury) and the IRS have issued several documents intended to communicate and clarify eligibility requirements for developers and investors seeking to qualify for clean energy credits under Internal Revenue Code Sections 45, 45Y, 48, and 48E. Those documents include:

Notice 2023-29 – The notice clarifies certain requirements in locating clean energy projects in energy communities.

Notice 2023-45 – This notice addresses the update to Notice 2023-29 that occurred on April 7, 2023, clarifying that this guidance applies to taxpayers that begin construction on or after January 1, 2023. This notice also adds clarification pertaining to the brownfield site safe harbor. Projects with a nameplate capacity of not greater than 5MW (megawatts) in alternating current (AC) are required to perform a Phase I Assessment to identify the presence or potential presence on the site of a hazardous substance or a pollutant or contaminant.

Notice 2023-47 – This notice provides three appendix lists that taxpayers may use to determine whether they meet certain requirements under the Statistical Area Category, or the Coal Closure Category as described in Notice 2023-29. Appendixes 1 and 2 of this notice pertain to the Statistical Area Category, and Appendix 3 of this notice pertains to the Coal Closure Category. Further details on these categories are included below.

FAQ – This list of frequently asked questions provides details on how areas may qualify as an energy community and how to determine whether a project is located in an energy community or brownfield site.

Here are some of the notable highlights.

What Is an Energy Community?

There are three categories of energy communities:

- Brownfield sites,

- Certain metropolitan statistical areas, and non-metropolitan statistical areas based on unemployment rates (MSA/non-MSA), and

- Census tracts where a coal mine closed after 1999 or where a coal-fired electric generating unit was retired after 2009 (and directly adjoining census tracts).

The increased credit amount for energy community provisions is up to 10% for the production tax credit (PTC) and up to 10 percentage points for the investment tax credit (ITC).

Notice 2023-29 provides clarification and even a mapping tool for the three location-based categories of energy communities. Further examination of each category is shown below:

Brownfield Site

Real property; the expansion, redevelopment, or reuse of which may be complicated by the presence of or potential presence of a hazardous substance, pollutant, or contaminant or real property that is “mine-scarred land.”

Safe Harbor: The site must meet one of the following conditions to be considered a brownfield site:

- Previously assessed through federal, state, territory, or federally recognized Indian tribal brownfield resources as per 42 U.S. Code §9601(39)(A);

- An ASTM E1903 Phase II Environmental Site Assessment has been completed and confirms the presence of a hazardous substance, pollutant, or contaminant; or

- An ASTM E1527 Phase I Environmental Site Assessment has been completed and the project has a nameplate capacity of not greater than 5MW.

Statistical Area

MSAs and/or non-MSAs with 0.17% or greater direct fossil fuel employment or 25% or greater local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas, and has an unemployment rate at or above the national average for the previous year.

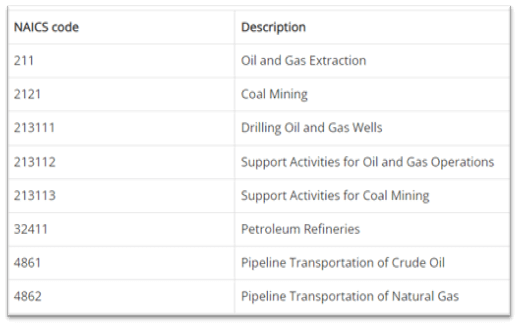

Direct fossil fuel employment is determined by dividing the number of people employed in certain industries (see the NAICS code listing in the graphic) by the total number of people employed in the area. A listing is available of MSAs and non-MSAs that meet the 0.17% threshold. The listing of Statistical Area Category based on Fossil Fuel Employment will be updated annually and generally available in May.

Source: IRS.gov

Annual unemployment rates are calculated with reference to certain annual data for counties. Therefore, annual unemployment rates for a calendar year generally are released in April of the following calendar year. As a result, taxpayers should be aware that tax return extensions may be required if trying to claim an additional clean energy credit via energy community qualification.

Coal Closure

Census tract or tract directly adjoining a census tract where a coal mine has closed after December 31, 1999, or where a coal-fired electric generating unit has been retired after December 31, 2009.

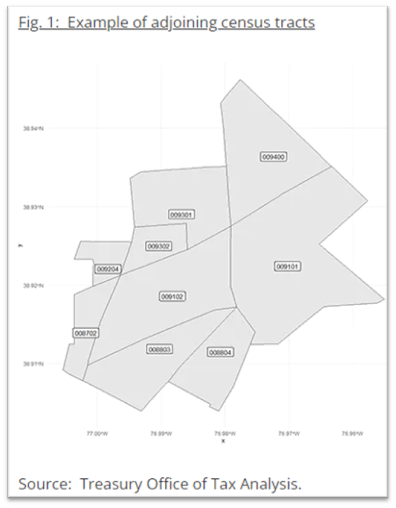

Census tracts with boundaries that touch at any single point are considered “directly adjoining.” See Figure 1.

Location Determination

An energy community project (ECP) is treated as “located in” (as per §45) or “placed in service within” (as per §48) an energy community if the project satisfies either the Nameplate Capacity Test or Footprint Test. In general, if a project has no nameplate capacity, then the Footprint Test is applied.

| Test | Description | Formula |

|---|---|---|

| Nameplate Capacity Test | 50% or more of the ECP nameplate capacity is in an area that qualifies as an EC. | Nameplate capacity % = Nameplate capacity of the ECP energy-generating units that are located in an EC/total nameplate capacity of all the energy-generating units of the ECP. |

| Note: See 40 CFR §96.202 for an expanded definition of nameplate capacity as well as measurements consistent with the prescribed test. | ||

| Footprint Test | 50% or more of square footage (sq. ft.) is in an area that qualifies as an EC. | Footprint % = Sq. ft. of the ECP that is located in an EC/total sq. ft. of the ECP. |

Final Thoughts

Forvis Mazars can help by evaluating whether your property is located in an energy community and what the resulting benefit could be. Certain requirements and safe harbors may require careful consideration, and our professionals can assist. If you’re considering a clean energy project or investment that may benefit from the energy community bonus credit, please reach out to a professional at Forvis Mazars.