In May 2019, we released the article "The Question Every Community Banker Is Asking: Are You Ready for CECL?" in anticipation of CECL’s original effective date. The aim of the article was to demonstrate an example framework which would help ensure financial institutions were on track for adoption of the CECL standard. For those financial institutions that have not yet adopted and are hoping for another delay by the Financial Accounting Standards Board, we believe that time has long passed. In fact, financial institutions should be well down the path to implementation for the fast-approaching effective date in January 2023.

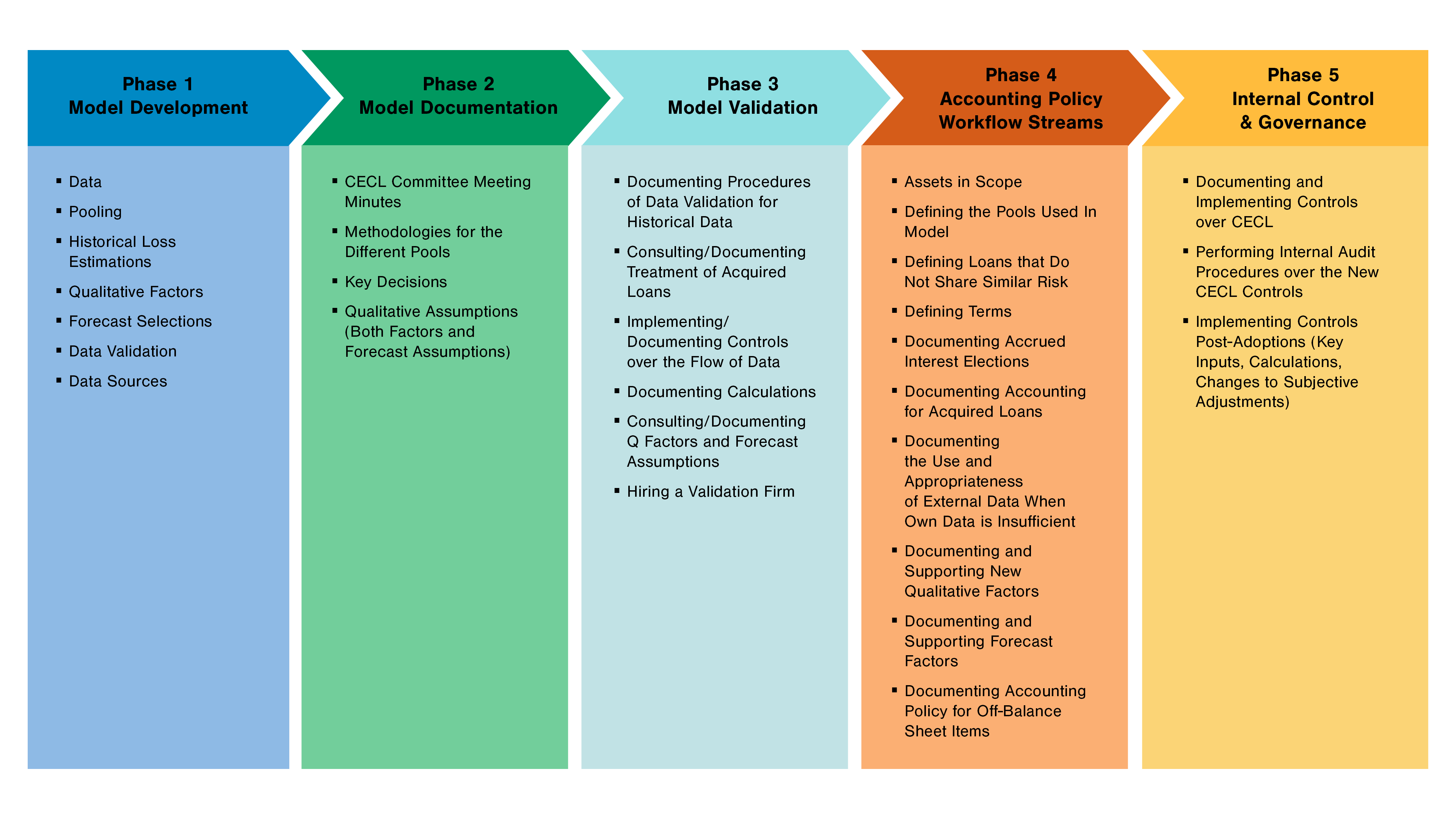

You may be asking, where should my institution be in the adoption process? The following graphic illustrates some common items that should be part of your detailed project plan. While the phases are presented in linear form, it is likely that many of them are running concurrently as you work to meet your implementation date.

Financial institutions should have completed the general development and documentation of their model. At this time, the model should be in the validation process and running parallel to the institution’s existing historical loss model. Validating the CECL model before implementation allows the institution to troubleshoot and correct issues prior to adoption. Running a parallel CECL model also allows the institution time to develop and document the internal control structure, ensuring a seamless transition for the new processes.

Contact us if you have questions about your institution’s readiness for adoption or if you would like to discuss your progress to date. Each financial institution is unique, and Forvis Mazars can assist as you prepare for CECL implementation.