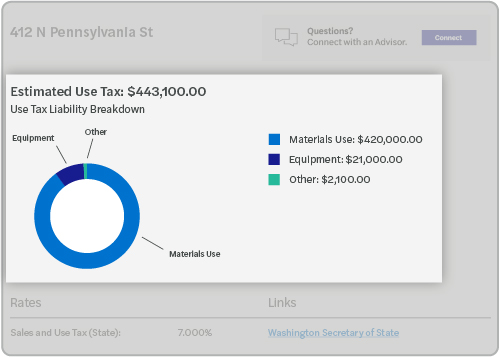

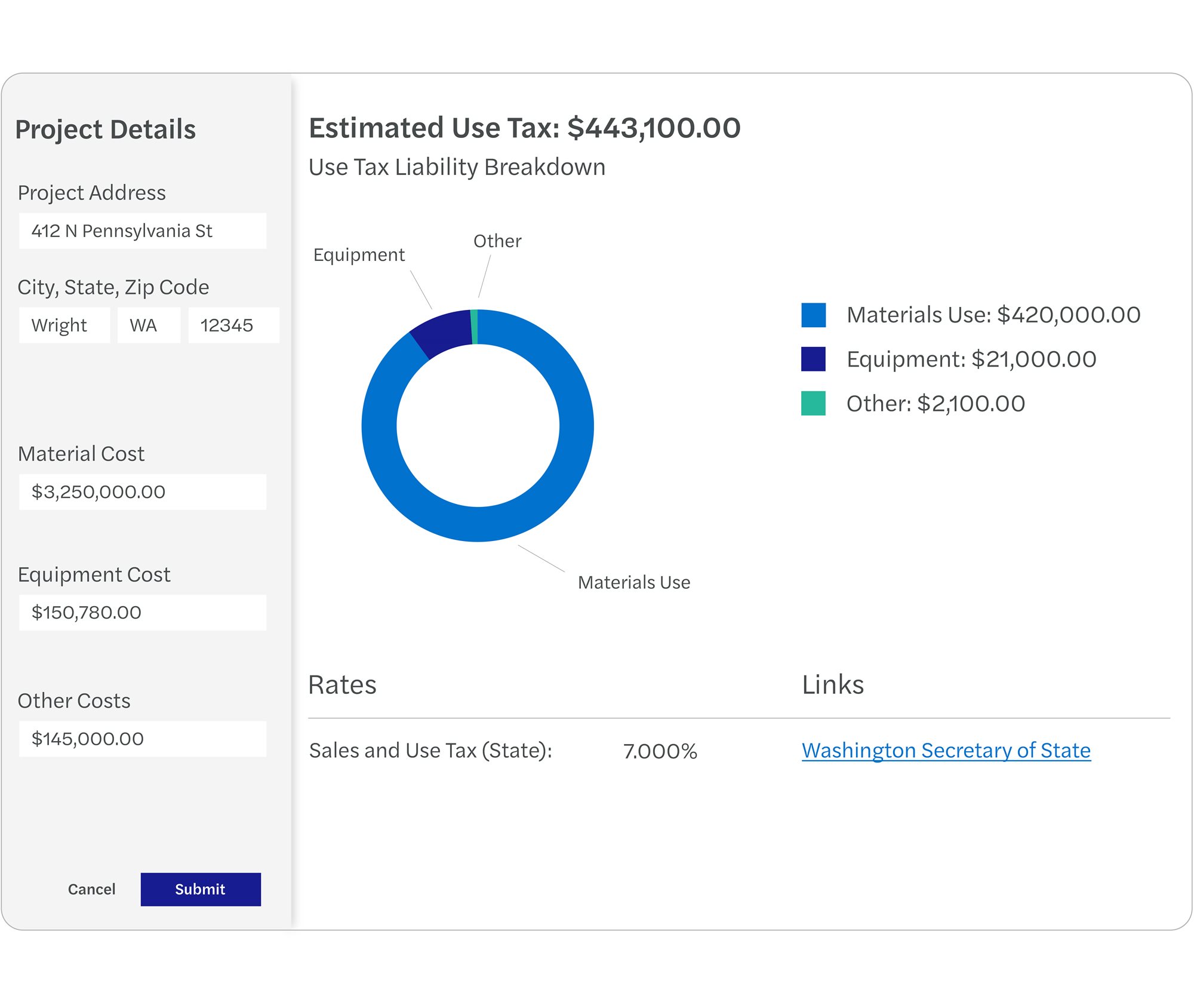

Estimate your project’s sales and use tax liability with ease.

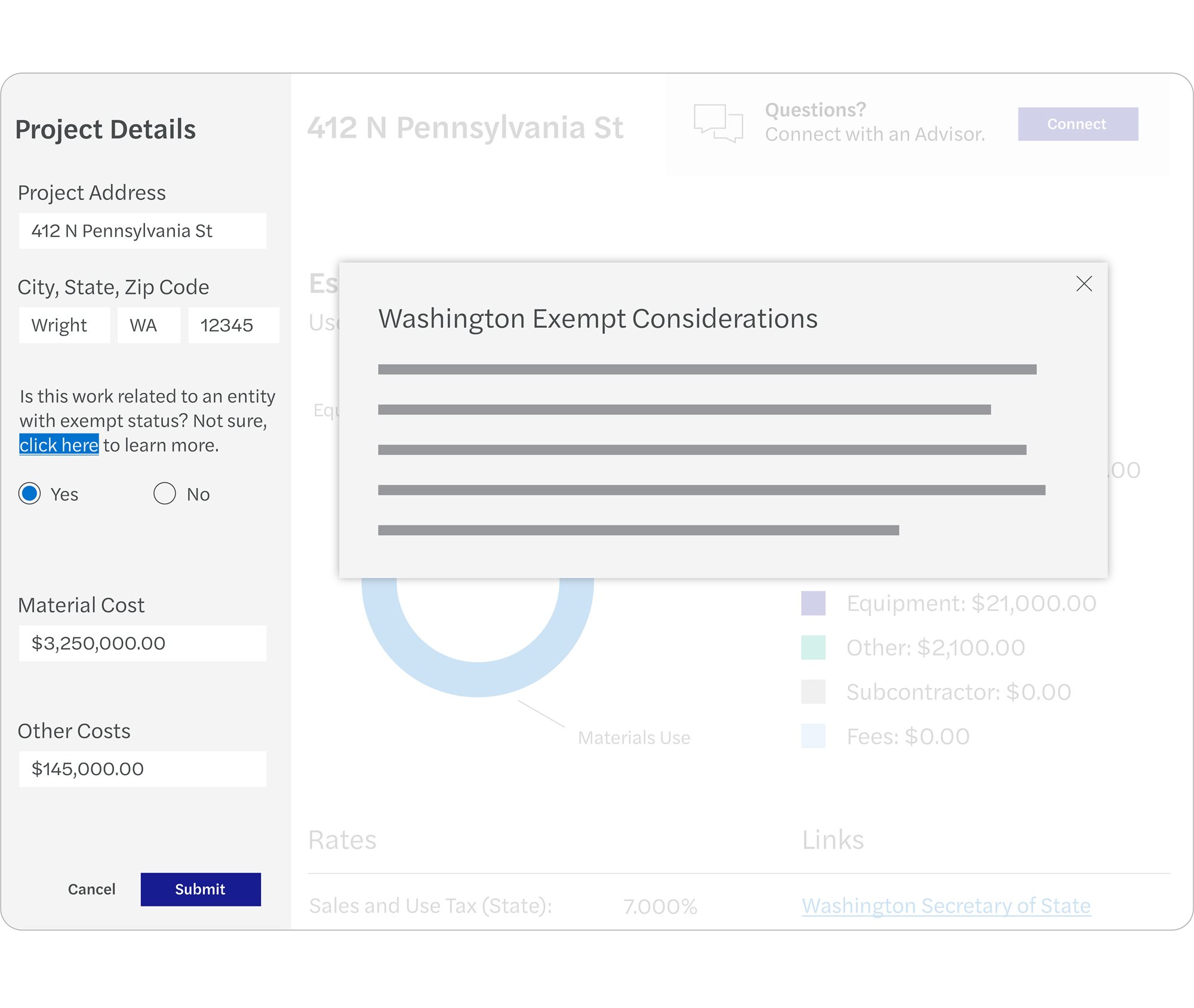

Understanding sales and use tax for construction projects is a complex, time-consuming challenge. Tax rules are inconsistent across states. Navigating unclear government websites or out-of-date PDFs can lead to costly errors that hurt your bottom line. That’s why we created SALT Explorer.

Our platform delivers fast, accurate, and project-specific tax estimates for multistate construction bids. We combine years of state and local tax (SALT) experience with powerful automation to help you:

- Streamline complex tax research

- Integrate exempt entity treatment and gross-receipt tax estimates

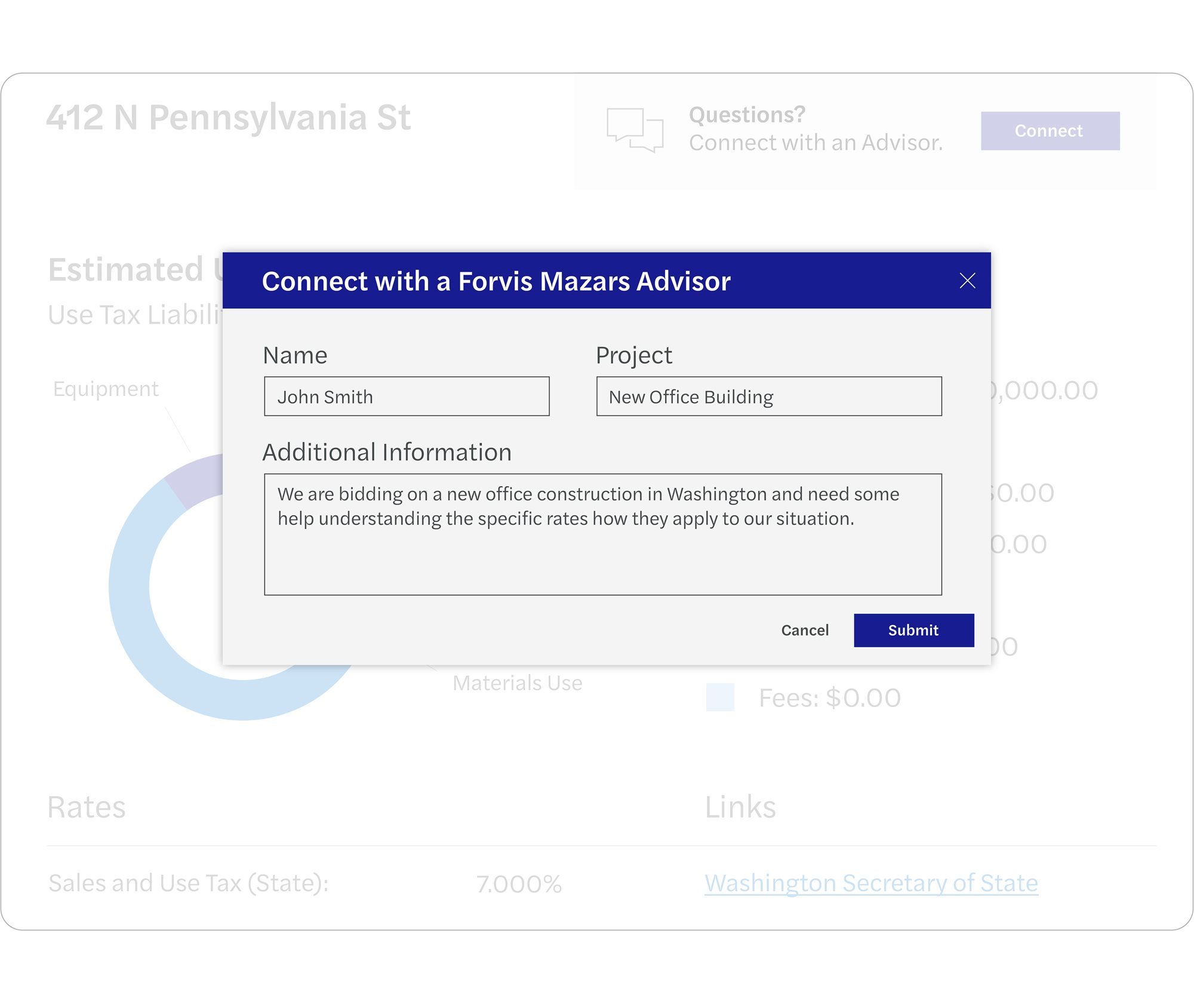

- Get curated insights from SALT professionals

- Protect your margins and keep bids moving forward