On July 31, 2025, CMS released its fiscal year (FY) 2026 Inpatient Prospective Payment System (IPPS) final rule. CMS estimates hospital inpatient payments will increase by $5 billion nationally (4.3%) in FY 2026. This is significantly higher than the $4 billion estimate in the proposed rule. In addition to payment updates, CMS finalizes refinements to the mandatory Transforming Episode Accountability Model (TEAM), which begins on January 1, 2026 for more than 700 hospitals.

Below are takeaways from the final rule.

Payment Update Less Than Anticipated Input Price Inflation

CMS finalizes a net IPPS market basket update (MBU) of 2.6% (increased from 2.4% as proposed) for hospitals that meet quality reporting and promoting interoperability requirements, and a capital update of 2.8% (increased from 2.6% as proposed). The resulting base operating and capital rates are available here (pg. 1986). The net MBU is the result of a gross MBU of 3.3% reduced by the ACA-mandated productivity reduction of 0.7%.

Despite the increase from the proposed rule, the finalized MBU is still considerably lower than the Medicare Payment Advisory Commission (MedPAC)’s recommendation to Congress of 3.6% (current law MBU of 2.6% plus 1%). The nonpartisan advisory body contends an increase in Medicare payments to PPS hospitals is merited, given that even “relatively efficient” hospitals1 have negative Medicare margins. The issue is driven in part by CMS’ continued use of the Employment Cost Index as a proxy for labor cost growth in the MBU, which does not accurately capture more recent changes in contract labor utilization.

It is worth noting the MBU does not account for anticipated increases in supply costs due to tariffs, so healthcare organizations should consider strategies to mitigate these margin impacts. In addition, given that nursing and other clinical staff make up a high percentage of hospital cost structures, it is difficult for hospitals to improve productivity at the same rate as the general economy. Therefore, hospitals will need to explore opportunities to reduce non-clinical labor costs and non-labor costs to help offset the compounding productivity reduction.

TEAM Mandatory Bundles in Select Markets

CMS confirms that TEAM will begin on January 1, 2026 for the hospitals in selected core-based statistical areas (CBSAs) and those Bundled Payments for Care Improvement Advanced (BPCI-A) and Comprehensive Care for Joint Replacement (CJR) participants that opted into the model. However, CMS will provide a one-year participation deferment for certain new hospitals in TEAM CBSAs. Any hospital that receives a deferment will be required to participate on January 1 of the next performance year.

In the FY 2026 rule, CMS makes these modifications to TEAM:

- Target Price Setting: In the rule, CMS addresses concerns about adjusting episodes for future changes to MS-DRGs and HCPCS codes by finalizing its proposal to remap episodes during the baseline period. CMS also finalizes its proposals to reconstruct the prospective trend and final normalization factor, and to replace the Area Deprivation Index with the Community Deprivation Index.

- Risk Adjustment: CMS expands the diagnoses lookback period to 180 days (from 90 in the FY 2025 IPPS proposed rule) and moves to Hierarchical Condition Categories (HCC) model version 28 for beneficiary risk adjustment.

- Episode Attribution: The rule aligns the date range used for episode attribution. Episodes will be assigned to a baseline year based on the anchor hospitalization/anchor procedure end date, i.e., discharge date, rather than the date of admission.

- Quality Measures: Beginning in the third performance year of TEAM (2028), CMS adds the Information Transfer Patient-Reported Outcome-Based Performance Measure (PRO-PM). This will not require new reporting, as the measure is included in the Outpatient Quality Reporting Program beginning in 2027. CMS will also apply a neutral quality score for TEAM participants with insufficient quality data.

- Referral to Primary Care Requirement: CMS modifies the referral to primary care services requirement. Based on the final rule, TEAM participants must include in hospital discharge planning a referral to an established supplier of primary care services, as recorded on admission to the hospital or hospital outpatient department, for a TEAM beneficiary, on or prior to discharge from an anchor hospitalization or anchor procedure. In the event an established supplier of primary care services is not recorded on admission to the hospital or hospital outpatient department, the TEAM participant must include in hospital discharge planning a referral to a supplier of primary care services for a TEAM beneficiary, on or prior to discharge from an anchor hospitalization or anchor procedure.

- Low Episode Volume Hospitals: CMS eliminates downside risk for episode categories when participants do not meet the low volume threshold of 31 baseline period episodes in that category. These hospitals are still required to participate in all episodes in the model, and each episode category will be reconciled. For those episode categories with more than 31 episodes in the baseline period, there will be both upside and downside risk (if applicable based on year and risk track selection). For those episode categories with fewer than 31 episodes, there will be reconciliation, but no downside risk.

Selected hospitals should prepare for TEAM by utilizing Medicare claims data to develop a current state assessment of their performance in the model and developing an implementation strategy aimed at capturing opportunities for improvement in patient outcomes and performance.

Uncompensated Care (UC) for Disproportionate Share Hospitals (DSH) Payment Increase

CMS finalizes increasing the UC DSH dollars available for distribution to qualifying hospitals by $2 billion (up from $1.5 billion proposed) in 2026 compared to the FY 2025 IPPS final rule. This is the result of an increase in both projected 2026 Medicare traditional DSH dollars (Factor 1) and an increase in the 2026 projected uninsured rate (Factor 2) relative to 2025 and the proposed 2026 rule.

- Factor 1: In the 2026 proposed rule, CMS projected that Factor 1 (75% of empirically justified Medicare DSH payments) was $11.761 billion. In the final rule, this increased by approximately $652 million (5.5%) to $12.413 billion. This was driven by an increase in the net MBU and a slight increase in assumptions about inpatient utilization.

- Factor 2: In the proposed rule, CMS projected a one percentage point increase in the calendar year (CY) 2026 uninsured rate from 7.7% in CY 2025 to 8.7%, for a composite FY 2026 uninsured rate of 8.5%. In the final rule, CMS adjusts its projection of the 2025 and 2026 uninsured rates (based on more current National Health Expenditure Accounts uninsurance data) upwards to 7.9% and 9.0%, respectively, resulting in an FY 2026 final rule composite uninsured rate of 8.7%.

While CMS potentially acknowledges the impact on the uninsured rate of the expiration of the Inflation Reduction Act’s enhanced health insurance exchange subsidies, even this increase may be an under-projection. The Kaiser Family Foundation estimates the number of individuals receiving advanced premium tax credit subsidies grew from 9.6 million in 2020 (the year before the enhanced subsidies began) to 19.7 million in 2024.2 The loss of these subsidies will likely cause greater increases in the rates of uninsured individuals in non-expansion states.

For FY 2026, CMS will continue to use the same methodology and data sources (three years of audited cost reports—FYs 2020, 2021, and 2022) to calculate Factor 3 in the UC DSH formula. Factor 3 is used to distribute dollars available in the UC pool to eligible hospitals. Given CMS’ likely under-projection of the UC DSH pool, it is incumbent on DSH hospitals to capture all eligible UC costs on Worksheet S-10 for cost reports that will determine Factor 3. An in-depth understanding of the Worksheet S-10 instructions and exhibit requirements is imperative to receive your hospital’s share of these funds.

Wage Index

The FY 2026 wage index adjustment is based on cost reporting periods beginning in FY 2022 from cost report data collected on Worksheet S-3, along with Occupational Mix survey data from CY 2022.

- Rebasing Labor-Related Share (LRS): CMS finalizes rebasing the LRS, resulting in a decrease from 67.6% in the 2025 final rule to 66.0% in 2026 for hospitals with an area wage index value greater than 1.00. The downward revision to the LRS is primarily the result of incorporating the more recent 2023 Medicare cost report data for wages and salaries, employee benefits, and contract labor costs.

- Rural Floor Calculation: Based on reclassifications submitted by the deadline for the final rule, CMS estimates 961 hospitals (up from 565 in the proposed rule) will receive their state’s rural floor wage index value in FY 2026. CMS notes that in FY 2026, approximately 70% of geographically urban hospitals will receive a wage index equal to their state’s rural floor, imputed floor, or frontier floor prior to any outmigration, or 5% decrease cap adjustments. This is up from 58% in FY 2025.

- Low Wage Index Policy Terminated: Following the D.C. Circuit Court’s decision in Bridgeport Hosp. v. Becerra, CMS discontinues the low wage index hospital policy for FY 2026 and subsequent years. The agency will no longer apply a low wage index budget neutrality factor to the standardized amounts. However, like in the FY 2025 interim final rule, CMS will provide a transitional policy for low wage index hospitals significantly impacted by the discontinuation of the policy. Under the transitional policy, for those benefiting from the FY 2024 low wage index hospital policy, CMS will compare the hospital’s FY 2026 wage index to the hospital’s FY 2024 wage index. If the FY 2026 wage index is more than 9.75% lower than the FY 2024 wage index, the transitional payment exception for FY 2026 would equal the additional FY 2026 amount the hospital would be paid if its FY 2026 wage index were equal to 90.25% of its FY 2024 wage index. This transitional payment exception would be applied after the application of the 5% cap.

Low-Volume Adjustment (LVA):

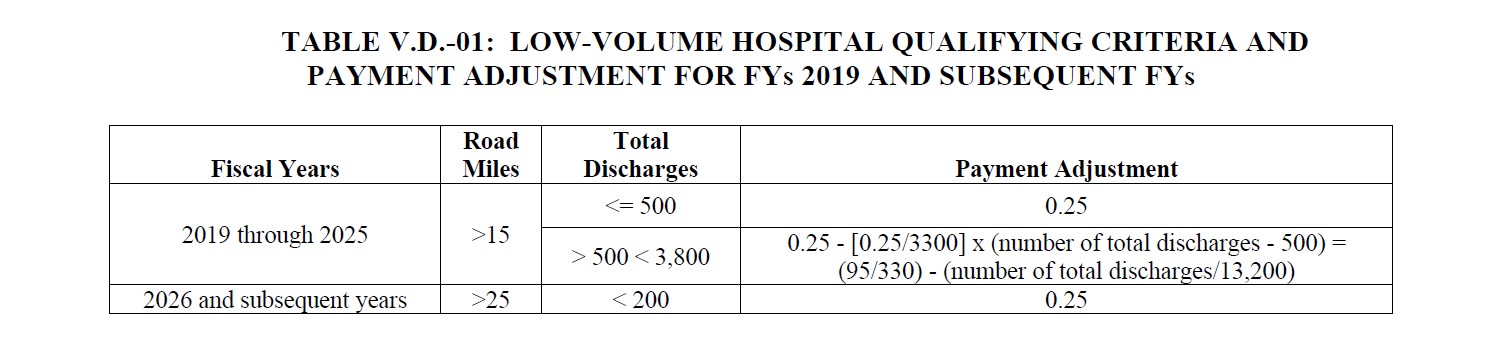

The final rule reminds hospitals receiving the LVA that unless Congress acts to extend the current eligibility criteria and payment mechanism, it will revert on October 1, 2025 to the statutory requirements in effect prior to the ACA. Below is a summary of the criteria and payment mechanisms for FY 2025 and FY 2026.

LVA Qualifying Criteria & Payment Adjustment for FY 2019 & Subsequent Years3

Click here to open image in a new tab

Click here to open image in a new tab

| Fiscal Years | Road Miles | Total Discharges | Payment Adjustment |

|---|---|---|---|

| 2019 through 2025 | >15 | <= 500 | 0.25 |

| > 500 < 3,800 | 0.25 - [0.25/3300] x (number of total discharges - 500) = (95/330) - (number of total discharges/13,200) | ||

| 2026 and subsequent years | >25 | < 200 | 0.25 |

Medicare Dependent Hospital (MDH) Status

The final rule reminds hospitals that, by statute, MDH status expires for discharges occurring on or after September 30, 2025, unless Congress passes another extension before FY 2026 begins. CMS has revised its sole community hospital (SCH) policies to allow MDHs to apply for SCH status in advance of the MDH program’s expiration and be paid as such if they qualify. However, an MDH that classifies as an SCH in anticipation of the MDH program expiration would have to reapply for MDH classification and meet qualifying criteria if the MDH program is extended and the provider wishes to return to its classification as an MDH.

Outlier Threshold

CMS finalizes a fixed loss acute outlier threshold of $40,397 (decreased from $44,305 as proposed) for FY 2026. This is lower than the FY 2025 final rule threshold of $46,217 (decrease of 13%). The decrease in the threshold will result in an increase in outlier payments relative to FY 2024.

Graduate Medical Education (GME)

The final rule “restates and clarifies” CMS policies related to full-time equivalent counts and caps for cost reporting periods other than 12 months.

Long-Term Care Hospital (LTCH) Payment Update

CMS finalizes a net 2.7% payment update (up from 2.6% in the proposed rule) for LTCHs. The update consists of a 3.4% MBU reduced by the 0.7% ACA productivity adjustment. Based on all changes, LTCH payments in FY 2026 will increase by $72 million (3%), up from a proposed $52 million (2.2%), compared to the FY 2025 final rule. CMS finalizes an FY 2026 standard rate of $50,824.51 (up slightly from the proposed $50,728.77) for LTCHs that meet reporting requirements. This is an increase from the current $49,383.26. CMS finalizes a LTCH fixed loss outlier threshold of $78,936 (down considerably from $91,247 in the proposed rule). The FY 2026 finalized amount is a slight increase from $77,048 in the FY 2025 final rule. The increase in projected LTCH payments from proposed to final is largely due to the decrease in the fixed loss outlier threshold.

Inpatient Quality Reporting (IQR)/Value-Based Purchasing Program (VBP) Updates

CMS removes four measures and modifies four measures in CY 2026 in the IQR program.

- Removals: As of the end of the 2024 reporting period, CMS removes four measures related to health equity and COVID-19:

- Hospital Commitment to Health Equity

- COVID-19 Vaccination Coverage Among Healthcare Personnel

- Screening for Social Drivers of Health

- Screen Positive Rate for Social Drivers of Health

- Modifications: CMS finalizes including Medicare Advantage (MA) data and shortens the measure application period from three to two years for:

- Hospital-Level Risk-Standardized Complication Rate (RSCR) Following Elective Primary Total Hip Arthroplasty (THA) and/or Total Knee Arthroplasty (TKA)

- Hospital 30-Day, All-Cause, Risk-Standardized Mortality Rate (RSMR) Following Acute Ischemic Stroke Hospitalization With Claims-Based Risk Adjustment for Stroke Severity

- For Hybrid Hospital-Wide Readmission (HWR) and Hybrid Hospital-Wide Mortality (HWM), CMS lowers the submission thresholds to allow for up to two missing laboratory results and vital signs, reducing the core clinical data elements submission requirement to 70% or more of discharges, and reducing the submission requirement of linking variables to 70% or more of discharges.

CMS also finalizes these proposed changes to the VBP program:

- Removing the health equity adjustment from the scoring methodology from the program in FY 2026.

- Modifying the Hospital-Level RSCR Following Elective Primary THA and/or TKA measure for the FY 2033 program year.

- Updating the Hospital-Level RSCR Following Elective Primary THA and/or TKA measure’s risk adjustment model.

- Updating the five condition- and procedure-specific mortality measures and the THA/TKA Complications measure to include patients with a principal or secondary diagnosis of COVID-19 in the measures’ numerators and denominators for the FY 2027 program year.

- Updating the CDC NHSN HAI chart-abstracted measures with the new 2022 baseline used in the FY 2029 program year and subsequent years to calculate performance standards and calculate and publicly report measure scores.

CMS estimates the VBP program will redistribute approximately $1.7 billion in FY 2026 (unchanged from the proposed rule).

Hospital Readmissions Reduction Program (HRRP)

CMS finalizes the following changes applicable to all six measures included in the HRRP:

- MA Data: Incorporate MA patient data into the calculation of HRRP measures. However, MA data will not be included in the calculations of aggregate payments for excess readmissions.

- COVID-19 Exclusions: Remove COVID-19 risk adjustment and exclusions from readmission measure calculations.

- Applicable Period: Reduce the measure performance period from three to two years beginning with the FY 2027 program year.

- Extraordinary Circumstances Exception (ECE) Policy: Clarify that CMS has the discretion to grant extensions of an ECE in response to a hospital’s request.

How Forvis Mazars Can Help

Our professionals at Forvis Mazars are committed to helping healthcare organizations achieve regulatory excellence by understanding and adapting to the impact of evolving Medicare payment policies. If you have questions about how changes finalized in the FY 2026 IPPS rule may affect your organization, please reach out to a professional on our team.