SEC Comment Letter Trends: 2021 Through 2023

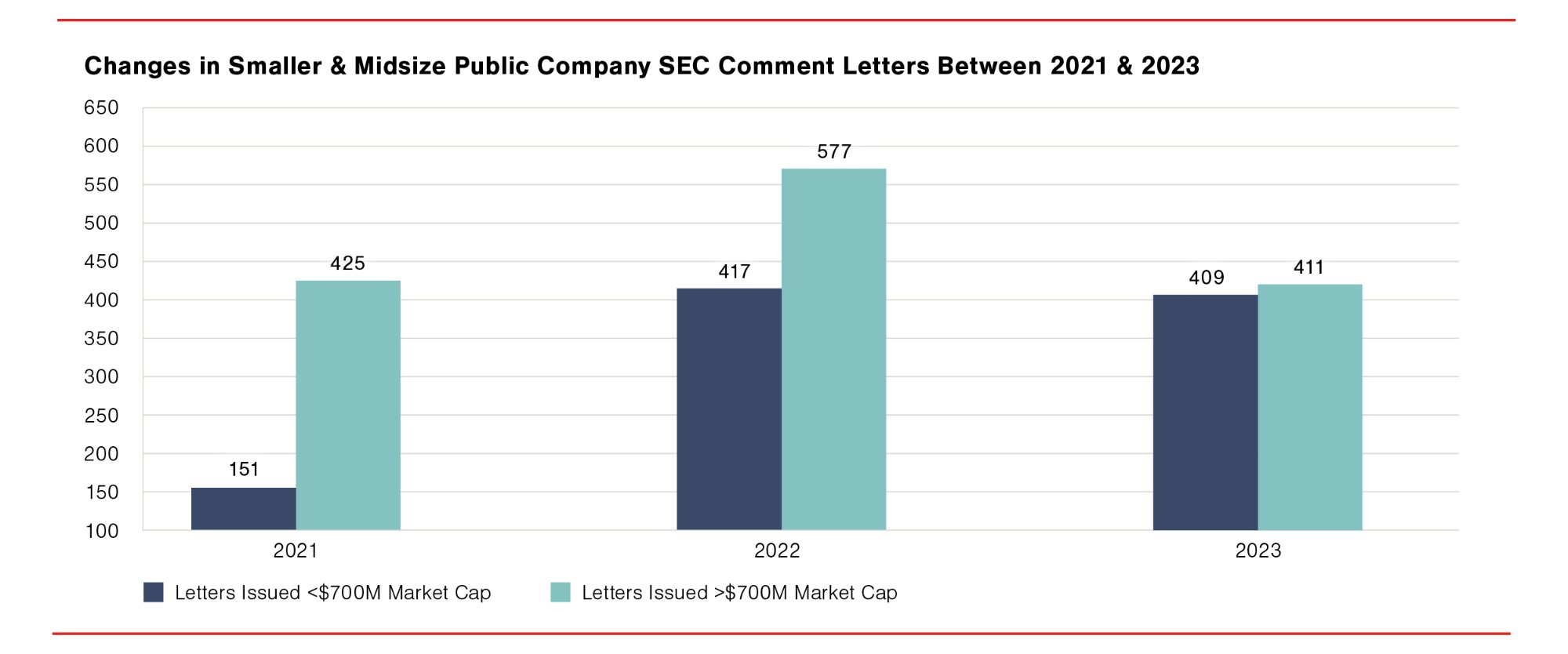

The number of SEC comment letters received by smaller and midsize public companies for 2023 has increased more than two-and-a-half times compared to 2021. This is significantly greater than the comparable 3% decline for larger companies for the same years. Smaller and midsize public companies typically face different challenges than larger companies. Forvis Mazars has investigated underlying comment letter trends and SEC focus areas to help CFOs and CAOs of these companies anticipate and respond to the financial reporting risks inherent with being a publicly traded company.

Our Methodology

For our analysis, we have defined smaller and midsize public companies as those with a market capitalization of less than $700 million. For SEC reporting purposes, those entities are typically classified as accelerated filers, non-accelerated filers, smaller reporting companies, and emerging growth companies.

Our comment letter trend information has been derived from our analysis of data obtained from Audit Analytics. The Audit Analytics data was filtered as follows:

- Registrants with market capitalization of less than $700 million1

- Letter type “UPLOAD”

- Referencing filings on Form 10-K, 10-K/A, 10-Q, and 10-Q/A2

- Excluding the “closing letter” issued by the SEC communicating that a review is complete

- Letters issued during the 12 months ended October 31 of each respective year

Then the resulting comment letters were grouped using Audit Analytics’ taxonomy for the statistics presented.

SEC Review Process

The SEC’s Division of Corporation Finance and its staff hold the responsibility to review and provide feedback for filings made under the Securities Act of 1933 and Securities Exchange Act of 1934. The Sarbanes-Oxley Act of 2002, Section 408, requires the SEC staff to review a registrant’s filings at least once every three years. However, the nature and depth of the review is not specified in the law.

The SEC staff uses a risk-based approach to select periodic filings of registrants with the largest market capitalization for review more frequently. However, in the last two years, there has been a general increase in the volume of comment letters issued to smaller and midsize public filers, as evidenced by the trends noted above.

In its filing reviews, the SEC staff concentrates on critical disclosures that appear to conflict with SEC rules or applicable accounting standards and on disclosures that appear to be materially deficient in explanation or clarity. The SEC generally views the comment letter process as a dialogue with a registrant whereby the company will typically respond to any comments in a letter to the SEC staff and, based on the outcome of that process, amend its filing(s) if appropriate.

The SEC generally requests a response to their comments within 10 business days; however, more time may be requested if needed to respond sufficiently to the matters raised. A registrant’s robust explanation or analysis of an issue often resolves a comment. If a company does not understand a comment or the SEC staff’s purpose in issuing it, the SEC staff encourages a company to seek clarification from the examiner or staff member who approved the comment before responding. The names and phone numbers of the SEC staff members involved in that review are included in each comment letter. Depending on the nature of the issue and the registrant’s response, the SEC staff may issue additional comments following its review of the response and any related amendments. Resolved comment letters are made public on the SEC’s EDGAR system no sooner than 20 business days after the SEC has completed its review.

Frequent Comment Areas

Top SEC Comment Letter Topics for Smaller & Midsize Public Companies

Specific Area | 2023 | 2022 | 2021 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Rank | Count | Percent | Rank | Count | Percent | Rank | Count | Percent | |

| Risk Factors | 1 | 150 | 37% | 2 | 129 | 31% | 9(T) | 10 | 7% |

| Management Discussion & Analysis | 2 | 99 | 24% | 1 | 142 | 34% | 1 | 59 | 39% |

| Non-GAAP Measures | 3 | 75 | 18% | 3 | 94 | 23% | 2 | 42 | 28% |

| Acquisitions, Mergers, & Business Combinations | 4 | 55 | 13% | 4 | 60 | 14% | 9(T) | 10 | 7% |

| Internal Control (404) Over Financial Reporting | 5 | 49 | 12% | 5 | 55 | 13% | 4 | 21 | 14% |

| Revenue Recognition | 6 | 37 | 9% | 8 | 34 | 8% | 6 | 15 | 10% |

The table above presents important data to analyze regarding the upcoming filing season. This information shows the increased focus the SEC has placed on smaller and midsize issuers reviewed over the last two years. In addition, it shows that the primary areas of focus for comments have been those that relate not only to technical accounting and disclosure issues, but also those that require qualitative disclosure to readers either in a Form 10-K or a Form 10-Q. We have analyzed specific considerations related to these comment letter topics to identify common pitfalls for registrants and have presented example comment letters issued this past year.

Collectively, these top six areas are present in 78% of all comment letters received by smaller and midsize public companies in 2023. Many of these areas of focus have been frequent areas of comment for several years as exhibited above, and we expect the SEC staff to continue to focus on these topics in the future.

SEC Disclosure Issues

SEC Comments on Risk Factors

During 2023 and 2022 there has been a substantial increase in the amount of SEC comments referencing risk factor disclosures. Regulation S-K, Item 105, requires registrants to include a discussion of the material factors that make an investment in the registrant risky. In its reviews, the SEC often issues comments related to current economic conditions and global events that may be applicable to a registrant based on consideration of their disclosures included in SEC filings or other publicly available information.

Many of these comments during 2023 and 2022 were issued to special purpose acquisition companies (SPACs). SPACs completed initial public offerings (IPOs) at an unprecedented volume during 2021. These registrants are generally required to complete an initial business combination with a target company within 18-24 months following the IPO. Many such comments focused on the disclosure of risks relative to a SPAC’s ability to complete an initial business combination within the required timeline. Comments often were issued when there was an indication that the SPAC’s sponsor either is itself, is controlled by, or has substantial ties with, a non-U.S. person as that may limit and/or delay a SPAC’s ability to complete an initial business combination. As the number of SPAC registrants has declined more recently, we expect the volume of this comment type to decline commensurately in future years.

SEC Comments on Management Discussion & Analysis (MD&A)

As seen from the analytics above, management’s discussion and analysis of financial conditions and result of operations (MD&A) has been a sustained leading source of SEC comments. The requirements for this section are derived from Regulation S-K, Item 303, and at their core, are designed to provide material information relevant to an assessment of the financial condition and results of operations of the registrant as if looking “through the eyes of management.” MD&A includes a specific discussion of a registrant’s liquidity and capital resources, results of operations, and critical accounting estimates.

While each of the required areas of MD&A are often challenged in SEC reviews, the most frequently targeted topic has been a registrant’s discussion of their results of operations. Specifically, these comments often relate to a lack of sufficient disclosure of the favorable or unfavorable impact of unusual or infrequent events, significant economic changes, and known trends or uncertainties. In addition, when material changes from period to period in net sales or revenue are presented, the SEC staff will often request additional discussion surrounding the extent to which such changes are attributable to changes in prices, changes in the volume of goods or services being sold, or introduction of new products and services into the market. When multiple factors are cited without quantification, the staff will frequently ask for a quantified metric.

The following is an example in which the registrant did not provide sufficient information within the discussion of the results of operations to quantify the effect of material changes. When discussing matters in MD&A, a registrant should describe the underlying reasons for such material changes in both qualitative and quantitative terms. When multiple factors are cited to have had a material financial statement impact but are not specifically quantified, the SEC staff will often request additional information in response to their current letter and in the company’s next filing, as shown below.3

Example Comment: Quantification of Multiple Drivers

We note your discussion of multiple drivers for changes in Gross Profit including a partial offset comprised of “price increases to offset inflation pressures, combined with a more favorable sales mix of higher-margin products.” In future filings, where you describe two or more factors that contributed to a material change in a financial statement line item between periods including offsetting factors, please quantify each material factor that contributed to the overall change in that line item. In addition, to the extent that inflation is a material driver, please also disclose actions planned or taken to mitigate inflationary pressure. Refer to Item 303 of Regulation S-K and Section III.D of SEC Release No. 33- 6835. As part of your response, provide us with examples of your intended disclosures based on current financial results.

Industry Focus: Life Sciences

Within the life sciences industry, registrants often incur significant R&D expenses. The SEC staff will frequently request these registrants provide disaggregated disclosure within MD&A of costs incurred for each key R&D project or program such as in the example comment below.

Example Comment: R&D by Project

Please revise your future filings to disclose the costs incurred during each period presented for each of your key research and development projects or key programs, including but not limited to [Product candidate 1]. If you do not track your research and development costs by project or program, please disclose that fact and explain why you do not maintain and evaluate research and development costs by project or program. For amounts that are not tracked by project or program, provide other quantitative or qualitative disclosure that provides more transparency as to the type of research and development expenses incurred (i.e. by nature or type of expense) which should reconcile to total research and development expense on the Statements of Operations.

SEC Comments on Non-GAAP Measures

In addition to the qualitative and quantitative analysis required in MD&A, registrants often include disclosure of non-GAAP measures. Non-GAAP disclosures are measures that exclude or include amounts versus the requirements for the most directly comparable GAAP measure. Registrants that include these measures need to pay special attention to SEC Regulation G and Regulation S-K, Item 10, which set forth the related reporting requirements. Registrants can find further guidance related to the SEC’s positions around such requirements in the Compliance and Disclosure Interpretations (C&DIs) which the SEC publishes to clarify further some of their more complex or highly emphasized rules.

The primary emphasis in many SEC reviews is to ensure that any non-GAAP metric is not misleading, does not have greater prominence than comparable GAAP measures, and does not represent individually tailored accounting. The SEC staff have shown, both in the comments they’ve given registrants and in clarifying documents, e.g., the C&DIs, that they believe there should be a priority placed on consistency, clear labeling, and reconciliation to comparable GAAP measures.

A frequent type of comment addressing the SEC staff’s emphasis on clear labeling and consistency can be seen below. Registrants must be mindful of the requirements within non-GAAP C&DI Question 102.03, which prohibits adjusting a non-GAAP financial performance measure to eliminate or smooth items identified as non-recurring, infrequent, or unusual when the nature of the item is reasonably likely to recur within two years, or there was a similar item within the prior two years.

Example Comment: Non-Recurring Expenses

We note that you have identified certain adjustments to the non-GAAP measures presented in your filing as “Non-recurring.” Please revise your presentation to comply with Item 10(e)(1)(ii)(B) of Regulation S-K and Question 102.03 of the Compliance & Disclosure Interpretations regarding Non-GAAP Financial Measures.

Another frequent comment topic regarding non-GAAP measures is related to prominence. C&DI 102.10 provides various examples of non-GAAP measures that are more prominent than the comparable GAAP measures. The SEC staff issues comments related to undue prominence when a registrant presents non-GAAP measures before the most directly comparable GAAP measure, in a more prominent style of presentation, e.g., bold, larger font, etc., or as a full non-GAAP income statement. It is important for registrants to exercise prudent discretion relative to prominence.

Below is an example of a comment to correct undue prominence when the most directly comparable GAAP measure was not similarly presented.

Example Comment: Prominence

The table on page 30 appears to give more prominence to the non-GAAP Adjusted EBITDA measure over the GAAP net loss since you only include the non-GAAP measure. Please revise future filings to include your GAAP net loss in that table or revise to remove Adjusted EBITDA. Refer to Item 10(e)(1)(i) of Regulation S-K and Question 102.10 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations Updated December 13, 2022.

In addition to prominence concerns, one of the most complex considerations relative to disclosure of non-GAAP measures is avoiding presentation of individually tailored accounting. The concept of tailored accounting was included in an update to the C&DIs made by the SEC in 2016. Since its inclusion, there has been confusion within the industry about what exactly this means and what registrants need to consider.

At its core, individually tailored accounting refers non-GAAP measures presented that have, or appear to have, the effect of changing or altering GAAP measurement principles, which could mislead the reader about the company’s financial results. C&DI 100.04 provides examples the SEC staff may consider to be tailored accounting, including changing the pattern of recognition, e.g., acceleration of revenue recognition or changing between point in time vs. over time, changing net revenue to gross (or the inverse), or changing the basis of accounting for revenue or expenses, e.g., from an accrual basis to a cash basis. Comments are not limited to these specific examples as the SEC staff broadly considers various matters as potentially individually tailored accounting.

As demonstrated in the comment below, the SEC staff often challenges any non-GAAP adjustments to net sales or revenue as individually tailored accounting.

Example Comment: Individually Tailored Accounting

We note your presentation of organic sales, net of an adjustment for “sales of disposed businesses that did not qualify for discontinued operations.” As the divested operations did not meet the criteria for being presented as discontinued operations pursuant to ASC 205-20, please clarify how these non-GAAP measures do not represent individually tailored accounting measures per Question 100.04 of the Non-GAAP Compliance and Disclosure Interpretations.

SEC Comments on Internal Control (404) Over Financial Reporting Issues

Although non-accelerated filers typically do not require auditor attestation on the effectiveness of internal control over financial reporting (ICFR), these companies are still required to provide specific disclosures and assertions related to internal control. These include (1) management’s assertion on the effectiveness of disclosure controls and procedures [Rule 13a-15 or 15d-15 of the Securities Exchange Act of 1934 and Regulation S-K, Item 307]; (2) management’s assertion on the effectiveness of ICFR [Sarbanes-Oxley Act of 2022, Section 404(a) and Regulation S-K, Item 308(a)]4; (3) disclosure of material changes in ICFR [Regulation S-K, Item 308(c)]; and (4) CEO and CFO certifications [Sarbanes-Oxley Act of 2022, Section 302 and 906].

These rules include prescriptive requirements regarding each disclosure’s form and content. As part of Forms 10-K and 10-Q reviews, the SEC verifies that these disclosures comply with the related requirements and often issue comments when the disclosures appear to be incomplete, inconsistent, or do not include clear conclusions. These comments usually require a registrant to file an amended Form 10-K or 10-Q to remedy the issue.

Many of these comments highlight clear omissions of required items, such as missing or unsigned 302 and 906 certifications, as shown in the example below.

Example Comment: Certifications

We note you have listed in the Exhibit Index the respective Exhibit 31 and Exhibit 32 Certifications of the Chief Executive Officer and Chief Financial Officer. However, the actual Certifications have not been filed or provided with the [date] Quarterly Report on Form 10-Q. Please amend the Form 10-Q in its entirety to also provide the Certifications required by Section 302 and Section 906 of the Sarbanes-Oxley Act of 2002.

Additionally, the rules require a specific statement that the registrant's disclosure controls and procedures [Regulation S-K, Item 307] and internal control over financial reporting [Regulation S-K, Item 308(a)] are effective. As demonstrated in the example below, when such statements do not express a clear conclusion, including the words “effective” or “ineffective,” SEC comment letters often require revisions.

Example Comment: Incomplete Conclusion

We note the disclosure that you performed an assessment of your internal control over financial reporting as of September 30, 2022; however, you did not clearly disclose your management’s conclusion. Please tell us and revise to disclose management's conclusion on whether or not your internal controls were effective at the end of the period. Refer to the guidance in Item 308(a)(3) of Regulation S-K.

As part of Forms 10-K and 10-Q reviews, the SEC staff considers other information in a registrant’s filing that may indicate an inaccurate assertion of effectiveness of disclosure controls and procedures and ICFR. Circumstances that give rise to these comments often include a material restatement (or immaterial correction) of historical financial statements, identification of internal control deficiencies in a comment letter discussion, or inconsistent conclusions between disclosure controls and procedures and ICFR. The SEC has consistently reminded registrants that the severity of a control deficiency does not depend on whether a misstatement actually has occurred but rather on whether there is a reasonable possibility that the company’s internal control will fail to prevent or detect a misstatement on a timely basis, as set forth in their June 20, 2007 interpretative release.5

The example comment below demonstrates a situation where there was conflicting information, including an assertion that ICFR changed from effective to ineffective, despite no disclosure of changes in ICFR. In addition, as most elements of ICFR are part of the definition of disclosure controls and procedures, the SEC will often ask registrants for further analysis when there is an assertion that disclosure controls and procedures are effective while ICFR has been concluded to be ineffective.

Example Comment: Inconsistent Conclusions

We note that Disclosure Controls and Procedures and Internal Control over Financial Reporting were effective in your [2021] Form 10-K. However, you indicate in this filing that you concluded as of [Q3 2022], the Company’s disclosure controls and procedures were not effective. We also note your disclosure that there have not been any changes to internal control over financial reporting. Please explain to us why you concluded that controls and procedures were not effective as of [Q3 2022], including providing details of any material weaknesses that were identified in your assessment.

Accounting Rule Issues

In recent years, the landscape of technical accounting has seen significant changes from the FASB, which has driven an increase in disclosure requirements to ensure users of the financial statements have the information they need. There has been significant focus on acquisitions, mergers, and business combinations, as well as a continued focus on revenue recognition standards and required disclosures. These two technical areas are leading drivers for comments related to accounting rule and disclosure-type issues.

Industry Focus: Banking & Financial Services

Looking ahead, certain public companies were required to adopt ASU 2016-13, Financial Instruments – Credit Losses (ASC 326) (CECL) during 2023. This standard, which changes the timing of recognition of credit losses and requires numerous expanded disclosures, significantly impacts companies in the banking and financial services industries. SEC comment letters issued to accelerated filers and larger accelerated filers who adopted CECL in prior years have focused on the accounting changes and adequacy of disclosures required by ASC 2016-13. Similar SEC focus is anticipated for companies disclosing the impact of adoption for the first time in their 2023 Form 10-K filings. For further guidance related to the impact of this standard, see the Forvis Mazars CECL resources page.

SEC Comments on Business Combination Accounting

We observed a significant increase in comments related to acquisitions, mergers, and business combinations during 2022, which was sustained through 2023. Many of these comments were issued to SPACs and their disclosure of risks relative to a SPAC’s ability to complete an initial business combination within the required timeline. See further discussion of this topic within the Risk Factors section above.

In addition, the SEC staff has historically issued comments to a registrant’s accounting conclusions and disclosures under ASC 805, Business Combinations, for significant business combinations. When a business combination is such that it is unclear which entity should be the accounting acquirer, the SEC staff will often ask registrants for further analysis as demonstrated in the example below.

Example Comment: Accounting Acquirer

We note your disclosure that the [date] acquisition of [Acquired Entity] was accounted for as a business combination under ASC 805. Please explain to us, and revise future filings to disclose how you determined the accounting acquirer in this transaction. As part of your response and revised disclosure, please refer to the guidance in ASC 805- 10-55-10 through 55-15.

Other areas of frequent comment for material business combinations include if the transaction should be accounted for as an asset or business combination, identification and valuation of assets and liabilities acquired, accounting for contingent consideration, and the related disclosures required by ASC 805. The following example comment demonstrates questions registrants are often asked when significant goodwill and intangible assets are recognized, absent clear disclosure of the nature of the underlying assets.

Example Comment: Identification & Valuation of Assets & Liabilities Acquired

As a result of the acquisition of [Acquired Entity] we see that you recorded goodwill of [$] and an intangible asset of [$]. Please address the following:

- Identify the intangible asset acquired and its amortization period.

- Tell us why no other intangible assets were recognized in accordance with ASC 805- 20-25-10 and the examples in ASC 805-20-55-11 through 55-45.

- Describe to us the qualitative factors that make up the goodwill recognized, such as expected synergies from the combined operations, intangibles asset that did not qualify for separate recognition or any other factors in consideration of ASC 805-30-50-1a.

SEC Comments on ASC 606, Revenue From Contracts With Customers

Revenue recognition and the related disclosures required by ASC 606, Revenue from Contracts with Customers (ASC 606) is a perennial leading source of comments for smaller and midsize public companies. Within ASC 606’s revenue framework, there are multiple layers of significant judgments required to be made by registrants including:

- Identification of performance obligations

- Determination of the transaction price

- Allocation of transaction price to performance publications

- Determination of the specific input or output method of recognition

- Consideration of principal-versus-agent assessment

SEC comments, as shown in the example below, often request issuers to provide additional analysis of these judgments and result in additional disclosure to ensure transparency to users.

Example Comment: Significant Judgments

Provide us an analysis of your revenue recognition under ASC 606, including your determination of the performance obligations, the transaction price, the amount allocated to each performance obligation, and your revenue recognition method (i.e. over time or point in time) for each performance obligation.

Industry Focus: Technology & Services

Within the technology industry, as well as other industries where digital transformation is leading to the emergence of diverse tech-enabled platforms, registrants are required to exercise significant judgment in identifying performance obligations. These platforms often result in revenue arrangements that include both hardware and SaaS platforms within one contract. As shown in the example below, the conclusion of whether performance obligations are distinct may be questioned by the SEC staff when there is integration between a specific product and software service.

Example Comment: Identification of Performance Obligations

We note that during the year ended December 31, 2022, the Company began shipping [Device 1] with features that function independently from its proprietary software subscription (“distinct Devices”) that are recognized as a separate performance obligation in hardware revenue. We further note that when distinct Devices are included in a contract, the hosted services performance obligation is comprised of only the Company’s proprietary software. Please help us better understand why when the distinct Devices are included in a contract, they are recognized as a separate performance obligation from the hosted services performance obligation. We refer you to ASC 606-10-25-19 through 22.

ASC 606 also requires robust disclosures for which completeness and accuracy are a consistent source of comments from the SEC staff for smaller and midsize public companies. Required disclosures include those related to disaggregation of revenue, contract balances, information about performance obligations, the transaction price allocated to remaining unsatisfied (or partially unsatisfied) performance obligations, timing of the satisfaction of performance obligations, determining the transaction price, determining amounts allocated to performance obligations, and use of practical expedients.

As part of Forms 10-K and 10-Q reviews, the SEC will often consider information outside of the financial statements such as the description of the business, MD&A, and other publicly available information in press releases and the registrant’s websites. If there is conflicting information indicating disclosures are potentially not accurate or complete, the SEC staff often issues comments requesting further analysis and potential modification of disclosures as the following example shows.

Example Comment: Revenue Disclosures

We note from page [X] that you offer various product categories, including [Product 1], and [Product 2], as well as other products. Please tell us how you considered the guidance in ASC 606-10-50-5 and ASC 606-10-55-89 through 55-91 when evaluating whether to disclose disaggregated revenue by product categories in addition to revenue by sales channel in the notes to your financial statements.

How Forvis Mazars Can Help Smaller & Midsize Public Companies

Although not all-inclusive, the SEC comment letter topics herein most often affect smaller and midsize registrants. Such registrants should consider consulting with accounting advisors and legal counsel to help enable continued compliance.

Forvis Mazars works with hundreds of public companies as both auditor and accounting and financial reporting advisor. Our professionals have significant experience helping public companies navigate financial reporting challenges and resolve SEC comment letters. Connect with us today to learn more.

- 1Greater than $700 million for “larger companies.”

- 2Note that comment letters on registration statements (Forms S-1, S-3, S-4, et cetera) were not included in our analysis.

- 3All example comments come from EDGAR at https://www.sec.gov/edgar/searchedgar/companysearch.

- 4Generally not required for newly public companies in the first 10-K filed after the initial public registration statement is declared effective [Regulation S-K, Item 308, Instruction 1].

- 5https://www.sec.gov/files/rules/interp/2007/33-8810.pdf.