Today, success in the higher education industry hinges on institutional awareness and engagement in innovation, as we highlighted in the 2025 Annual Higher Education Outlook. We discussed awareness and innovation taking place on three fronts:

This brief update will show important areas of focus that have changed since the 2025 Outlook was originally published.

Looking Beyond 2025

Why is a forward focus on awareness of change and innovation so important? Numerous factors have converged this year to trigger the need for deep thinking about institutional mission, strategy, and capacity. These factors include:

- Demographic decline hits the first year of “the cliff,” which starts this fall, even though some characterize it as something less foreboding than a cliff. They are probably correct, depending on the part of the country they primarily operate in.

- Increasing costs for most personnel, administrative, and capital items continue.

- Rising student debt (especially now that collections have resumed).

- Technological disruptions from artificial intelligence (AI), digital learning, and cybersecurity threats.

- Funding issues that include:

- New federal legislative mandates around student aid (including loan limits) and research funding.

- State public university total education revenue decreasing 1% from 2023 to 2024 despite state funding increasing 3.7% between 2023 and 2024. This is due to net tuition revenues dropping 8.1% in the last five years and 3.7 % in 2023 to 2024 alone.

- Cultural issues including:

- A growing student mental health crisis.

- Increased ROI expectations from families and government agencies.

- The dismantling of DEI programs.

Many of these factors will be addressed in more depth in future versions of the Annual Outlook and supporting articles later this year and into 2026.

Strategic Financial Health

The Annual Outlook laid out seven key strategic financial health indicators to watch. In two samples (successful schools and failing schools), these seven indicators were found to be the leading barometers of financial success or failure. This was performed to fine-tune an approach to measuring the opportunities for success and the evidence of failing financial health in as few metrics as possible. The samples included highly “successful” private colleges defined by their enrollment growth, brand strength, and economic strength, and “failing” schools that had either announced or were near announcement of closure (regardless of size). After the study, our seven indicators were selected and included two student data points, two balance sheet measurements, and three income statement metrics. Three of the seven (one from each of the three categories) are updated here. These indicators included:

- Institutional Size

- Return on Net Assets

- Endowment

Institutional Size

Our original sample of growing and brand-recognized private institutions (termed successful colleges) had an average total enrollment of 3,810 students in 2022. The range of these schools was as large as 16,000 students and as small as 822 students. Our sample list of failing schools (mostly under 2,800 students) had a median enrollment size of 960. We noted that small schools (under 2,000 students) did exist on both successful and failing schools’ lists.

Updating the enrollment data at these schools, we found the successful schools continue to grow with an updated average total enrollment of 3,933 students, a 3.2% increase. It appears as though size is still an important factor in predicting institutional financial health, which sheds some light on why we’re hearing so much about shared services from industry leaders.

Return on Net Assets

Another strategic success indicator gauged was the return on net assets. A 2% return on net assets was present in our original work using fiscal year 2023 numbers. We found the sample included a substantial number of schools that entered large fundraising campaigns since the fiscal 2023 year-end. This resulted in a large increase in median return on net assets of 13.9% for successful schools. Median return on net assets at the failing schools remained negative.

Endowment

Endowment was the third strategic indicator measured. The median successful school increase in per student endowment was $11,830. Median endowment with restrictions in the successful school sample was $58 million in 2024, an increase of $21 million from the prior year. The average endowment in the sample was $140 million, an increase of $67 million.

Conclusion

Successful schools overall appear to be growing enrollment, improving annual net asset return performance, and increasing endowment. None of the failing schools in the sample made significant improvement financially or in enrollment.

There were 13 college closure announcements this year in the first six months. These included both outright closures and acquisitions/mergers. The previous average rate of merger among closed colleges was 34%. The group of closures this year (2025) included 61% that were acquisitions/mergers instead of straight closures.

Bifurcation of financial results trend rates continues. This trait has been noted by rating agencies and others in their outlook data and predictions about the future of higher education. The exception to this rule were a few small (under 2000 student) schools that had recently grown substantially, and some had gained significant capital investment from large endowment gifts.

Value Delivery

Our earlier observations and fears about deteriorating public perceptions of the value of higher education remain intact. The demand for higher education due to the decreased college-age population continues to receive attention and study. Added to the concern over the demographic cliff are concerns expressed about the career alignment of higher education programs and what needs to be done to rework curricula to orient training to workforce relevance and sensitivity to specific industry needs.

Recent research considers various action steps that could result in increased belief of value for higher education.

These action steps include ideas about:

- Academic program development

- Workforce alignment

- Academic portfolio review

- Alternative credentials

- Updated branding and brand awareness

Conclusion

Perceptions of the value of higher education, given rising prices, continue to be a challenge that deserves study and action on individual college campuses.

Change Management

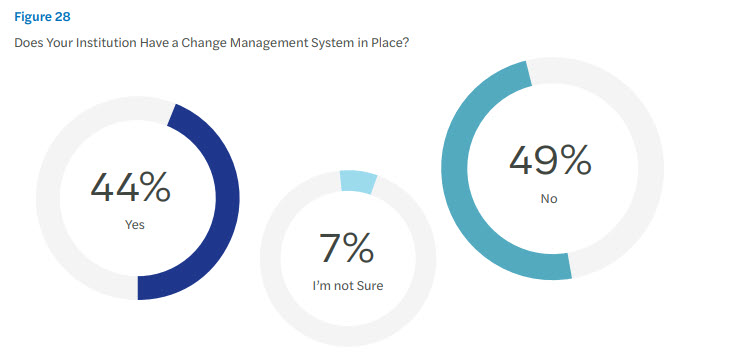

The survey from Forvis Mazars supporting the 2025 Annual Higher Education Outlook sought to find the extent to which colleges used formal change management systems or technology to support their change initiatives. Nearly half (49%) of the colleges surveyed said they had no change management systems in place.

Models of change include the Kotter model (eight steps), the Lewin model (three steps), and an iterative approach (five steps). These models must be cyclical and adaptive, allowing for adjustments and modifications as change initiatives unfold. The presence of well-defined change management models has not influenced half of the colleges in the survey that had no formal models or technology to process change.

With the rate of change continuing to accelerate, slow or late adopters to change management models will have difficulty maintaining programs, margin, and reputation.

Conclusion

In a rapidly shifting environment, change readiness of school leadership will be a requirement to maintain economic and reputational viability.

Looking Forward

The three factors reported on in the 2025 Annual Higher Education Outlook continue to highlight key trends that could influence the level of success schools experience in the years to come. Future Annual Outlook reporting will include observations about the influence of legislative issues and other macro factors influencing the well-being of the higher education industry.

The Higher Education Outlook

Want to be notified when our next Higher Education Outlook is available? Subscribe to the Education list so that you’re the first notified!

For ways in which Forvis Mazars can help support your institution as the higher education landscape continues to evolve, check out our Higher Education Consulting services, or contact a professional at Forvis Mazars today.