Beginning in 2016, CMS established the requirement of Payroll-Based Journal (PBJ) reporting, a reporting system for skilled nursing facilities (SNFs) that collects and records employee-level data. One of CMS’ founding beliefs is that to administer exceptional patient care, SNF providers must have quality staffing. While CMS is using PBJ data in good faith to measure and promote quality patient care, many organizations have found the reporting process to be somewhat cumbersome. SNF providers may not have the appropriate steps in place to compile detailed and accurate PBJ data. While completing PBJ reporting has its challenges, it is a function essential to an organization’s operating model and long-term success.

To learn more about our Healthcare Market Point of View, view this webpage.

Info to Help You Submit an Accurate PBJ Report & Achieve a Five-Star Rating

PBJ staffing data must include the following for the SNF Five-Star Quality Rating System:

- Employee ID: All direct care staff (employees, contract, and agency staff) must be assigned an employee ID. The ID must be a unique identifier and not duplicated with any current or previous staff. The ID should not contain any personally identifiable information, such as their name or Social Security number.

- Date: The date associated with the number of hours paid to work.

- Hours: The number of hours paid for each day worked.

- Job Title Code: The job role performed by the individual during the hours paid to work. There are 40 defined PBJ Job Title Codes allowed by CMS.

- Pay Type Code: Specific Pay Type Codes allowed by CMS, which consists of exempt, non-exempt, and contract.

Providers also must submit hours for agency and contract staff, which may include agency nursing staff, pharmacists, dieticians, medical directors, and contract therapists.

CMS no longer requires facilities to report census data. The daily resident census is automatically derived from MDS resident assessments.

Avoid These Automatic “One-Star” Pitfalls

There are some situations with PBJ reporting that will automatically result in a one-star rating for the Staffing component in the five-star system. These include:

- Gaps in hours reported vs. validated in audit

- Four or more days in a quarter reported with zero RN hours

- Failure to submit PBJ by the submission deadline

- Failure to respond to an audit request

- Failure to submit requested documentation for a PBJ audit

Review Your Data for Potential Audit Risks

PBJ reporting is subject to audit by CMS and its contracted auditors. It is important to review your PBJ data to help identify these potential audit risks:

- Days without at least eight RN hours

- Exempt staff with more than 40 hours in a week

- Staff with more than 80 hours in a week

- Staff with more than 300 hours in a month

- Excessively high nurse staffing (more than six hours per resident day (HPRD))

- Excessively low nurse staffing (less than 1.5 HPRD)

- Changes in nurse staff (HPRD) by more than 10% since the previous quarter

Know Your Five-Star Quality Rating Components for Care Compare

Six staffing measures, census, the national average, and your acuity-case mix (MDS).

State-Specific Minimum Nurse Staffing Requirements

On top of the recently proposed CMS minimum staffing requirements, some states have established their own minimum staffing rules. Please continue to pay close attention to your individual state’s staffing requirements, as in some cases, noncompliance can result in civil monetary penalties. For example, in the state of New York, SNFs must now comply with a new regulation that requires facilities to meet the following minimum staffing requirements.

New York Staffing Requirements

- 3.5 hours of care per resident per day

- No less than 2.2 hours of care must be provided by a certified nursing assistant (CNA) or nurse aide

- At least 1.1 hours of care must be given by a registered nurse (RN) or licensed practical nurse (LPN)

Noncompliance Penalties

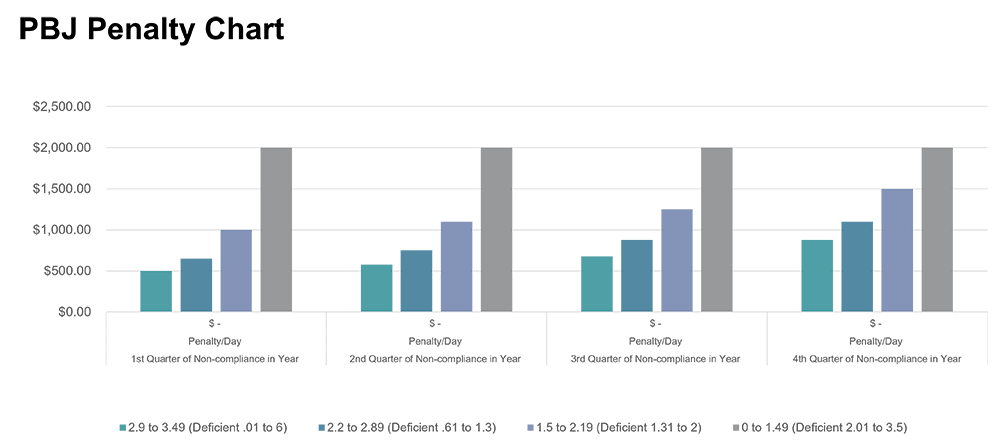

- Penalties begin at $500 per day for facilities with an overall HPRD of 2.9 to 3.49 for the first quarter in which they are unable to meet the required level.

- Penalties are capped at $2,000 per day for each quarter in which the facility fails (on average) to meet all three staffing level requirements.

The U.S. Department of Health and Human Services will issue an initial notice of noncompliance. Facilities have only 10 days to respond by requesting a redetermination or reduction in their penalties.

Conclusion

With the emphasis from both regulatory authorities and referral sources on quality outcomes and staffing for SNF providers, your CMS five-star rating is more important than ever. PBJ reporting can have a significant impact on star ratings. The source for monitoring this metric is the Care Compare website. Ever-changing CMS guidelines, in addition to new state-specific staffing requirements and potential civil monetary penalties for certain states, have made PBJ compliance increasingly complex and burdensome for long-term care facilities.

Forvis Mazars can help your team organize data and monitor your PBJ results to maintain compliance and help avoid potential negative PBJ results. To learn more about our senior living and long-term care services, visit this webpage. If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.

Related FORsights

- Significant October 1 MDS Changes to Impact Five-Star Ratings

- CMS Publishes FY 2024 Final SNF Rule

- Coffee with Clinicians: Payroll-Based Journal, Part I

- Coffee with Clinicians: Payroll-Based Journal, Part II

- Coffee with Clinicians: Payroll-Based Journal, Part III

- 1“DOH Issues FAQs Regarding Nursing Home Minimum Staffing Requirements,” leadingagency.org.