If you’ve been investing in the last few decades, you’ve undoubtedly heard the terms “private equity,” “hedge funds,” and “real estate trusts.” While they are investments you may not currently own, they are definitely part of the investment universe and have aspects that some (but not all) investors should consider. Alternative investments are generally defined as anything other than a traditional stock or bond. They are investments not traded on an exchange or in the public markets. You may have heard them referred to as the private markets.

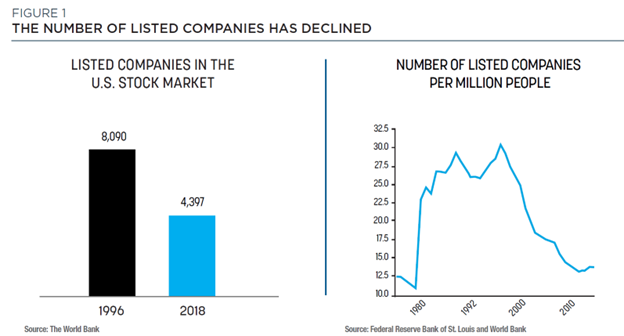

First, let’s go over why there has been a proliferation of these types of investments in the last few decades. With many changes in SEC regulations, namely Sarbanes-Oxley, the additional cost of being a public company has forced many companies away from the public markets. This does not mean that those companies are not profitable or valuable. It just means they are focusing on keeping their overhead lean and returns higher based on their specific strategies, while not having to comply with SEC regulations and answering to numerous investors and market analysts. This has created a significant opportunity for private capital to organize and deploy strategies specific to different sectors in the economy. Since the ‘90s, the number of public companies has almost been cut in half (see Figure 1). This, of course, also has shrunk the opportunities for regular investors to own U.S. domestic companies. Hence, many investors have looked to the private markets to diversify their portfolios.

However, this doesn’t mean all investors have the opportunity to invest in private equity. In fact, there are regulations around the qualifications of individual investors to even invest in these vehicles. For most investment opportunities, an investor needs to be known as an accredited investor. To qualify as an accredited investor, you either have to earn at least $200,000 a year over the past two years, or at least $300,000 as a couple. You also can qualify if your net worth exceeds $1 million, excluding the value of your personal residence. Someone at the higher level of qualification is known as a qualified purchaser. This means an investor has an investment portfolio exceeding $5 million, excluding personal residence or property used in the normal course of business.

Now that we’ve outlined how you qualify to invest in alternatives, it doesn’t mean you should! All investing starts with risk and that is specific to the individual investor. If you are a very risk-averse investor, you can probably stop reading now. However, if you’re willing to take on additional risk in your overall portfolio, alternatives can help you further diversify and potentially increase your total returns.

In their simplest form, private equity firms combine capital from individual or institutional investors to support a team of financial professionals while they deploy a strategy. This strategy typically involves the acquisition of privately held businesses with the idea of improving and growing their operations over a period of time and then “exiting” the business (selling to another firm or potentially going public through an initial public offering). These strategies can be diverse among the spectrum of firms and can include sector-specific strategies, like only working with restaurant groups. One of the downsides of investing in a private equity fund is that your investment is tied up for a period of time and is not liquid. There are sometimes losses in the first few years as the private equity manager works to grow and turn around the acquired businesses. The upside is that this illiquidity prevents you from making rash decisions and there is the potential for higher returns when the exit strategies are completed.

Private credit is another alternative option that can be attractive to investors. While these funds are not liquid on a daily basis, they often distribute regular income. These funds can function as a part of a diversified fixed income portfolio. However, because these funds are made up of private credit (as in higher interest loans to private businesses), there is a higher risk level.

Finally, real estate trusts or funds built around real assets (think real estate, natural resources, or infrastructure) can offer more immediate income as the fund components have a revenue stream. But again, these funds can be illiquid and will have more risk than a real estate investment trust that is traded on a public exchange.

Now that you have an overview of some of the more common alternative asset classes, you still need to start with asking yourself if they’re right for your individual portfolio. Your team at Forvis Mazars Private Client is available to walk you through this analysis and assist you with decisions in this space. If you have questions or need assistance, please reach out to a professional at Forvis Mazars or submit the Contact Us form below.

Forvis Mazars Private Client services may include investment advisory services provided by Forvis Mazars Wealth Advisors, LLC, an SEC-registered investment adviser, and/or accounting, tax, and related solutions provided by Forvis Mazars, LLP. The information contained herein should not be considered investment advice to you, nor an offer to buy or sell any securities or financial instruments. The services, or investment strategies mentioned herein, may not be available to, or suitable, for you. Consult a financial advisor or tax professional before implementing any investment, tax or other strategy mentioned herein. The information herein is believed to be accurate as of the time it is presented and it may become inaccurate or outdated with the passage of time. Past performance does not guarantee future performance. All investments may lose money.