Financial Modeling

We understand how critical financial models are to your decision-making process. Our team will work closely with you to understand your specific needs and help deliver results that meet your high standards. We do this through regular communication and a responsive, client-focused approach:

- Specify & Design: Through a detailed scoping workshop, we listen carefully to your objectives and project requirements.

- Build & Refine: Throughout the modeling process, we hold regularly scheduled meetings to confirm all specifications and modifications are fully addressed.

- Handover & Training: Upon model completion and delivery, we’ll conduct a training session to confirm your team has a thorough understanding of the model functionality for full adoption.

Solutions for Different Modeling Needs

- Asset & Business Development

- Capital Raising

- Regulatory Changes & Updated Requirements

- Project Feasibility, Entering a New Market

- Assets Changing Hands

- Deal Restructuring or Refinancing

- Lack of Time & Resourcing

- Asset Value Reporting

- Financial Projection & Analysis

- Asset Management, Performance, & Reporting

Our Modeling Solutions

- Single-Asset (Project Finance & PPP) Transactional Models

- Model Rebuild & Model Updates

- Financial Close Models

- Operational Models

- Portfolio Models

- Corporate Models

- Mergers & Acquisitions

- Valuations Models

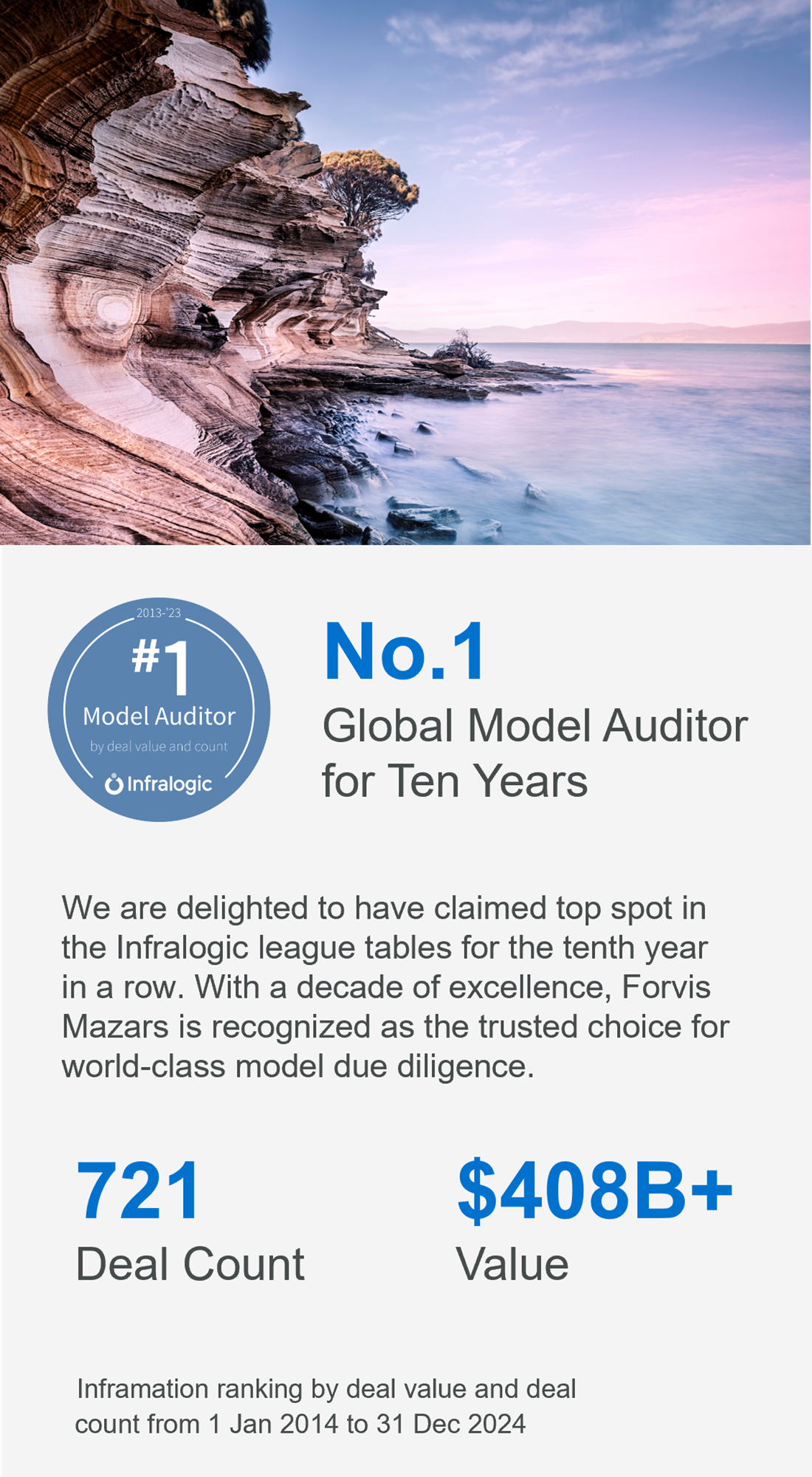

Model Due Diligence

We provide critical financial model due diligence to a wide range of clients, including domestic and international investors, sponsors, funds, investment and development banks, and developers.

We follow a consistent process to verify that every model receives an extensive and detailed review:

- Understanding Model Operations

- Automated Review

- Shadow Modeling

- Inspection

- Stress Testing

- GAAP & Tax Review

- Document Review

- Sensitivity Analysis

- Reporting

- Close/Model Sign-Off

Why Forvis Mazars?

As a recognized leader in modeling and model due diligence services, we provide specialized transaction and project support across all market sectors. Our experienced team delivers flexible, customized solutions with transparency, multidisciplinary knowledge, and an Unmatched Client Experience® to help you reach your goals.