This summer, Forvis Mazars hosted its annual Houston Peer-to-Peer Credit Roundtable in its Houston office. The event brought together credit executives from several markets in Texas, sharing insights on current economic conditions, banking industry trends, and other key issues shaping the financial landscape. This article provides key takeaways from our roundtable discussion and emerging trends to watch for in your market.

Loan Delinquency

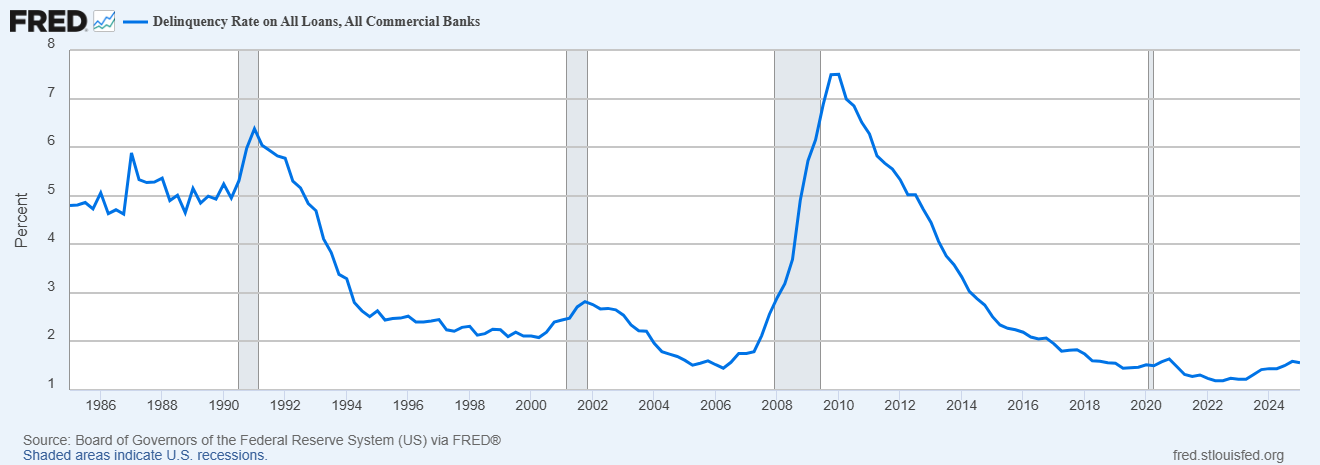

Based on reports published by the Federal Reserve System, loan delinquencies are trending upward in virtually every category. The following chart includes all loan types and reflects a steady increase in loan delinquencies since hitting a low point in 2022. The lower delinquency levels appear to have mainly resulted from government programs during and after the pandemic, which injected significant cash into the economy.

Click here to open image in a new tab

Click here to open image in a new tab

Source: Board of Governors of the Federal Reserve System (US) via FRED®

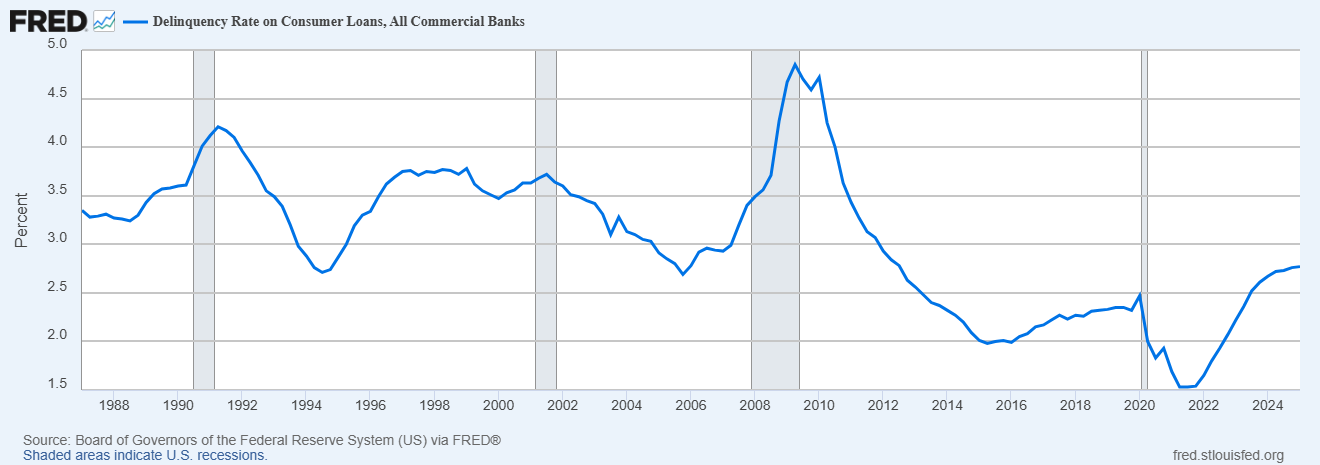

While most loan types are reflecting higher delinquency rates, consumer loans have seen the sharpest increase, as illustrated in the following chart.

Click here to open image in a new tab

Click here to open image in a new tab

Source: Board of Governors of the Federal Reserve System (US) via FRED®

While loan delinquency rates are trending upward, the preceding charts also reflect that delinquency rates remain relatively low compared to historical levels. The sharp increase in consumer loan delinquency is concerning as it may potentially be a precursor to falling consumer demand/spending. Forvis Mazars has generally observed increasing loan delinquency rates at most of our loan review clients.

According to the U.S. Bureau of Economic Analysis, consumer spending in the U.S. rose an annualized 1.4% in Q2 2025, accelerating from a 0.5% increase in Q1 2025.1 While consumer spending is still growing, the growth rates are well below those of the same periods in 2024 (2.8% and 1.9%, respectively) and the historical average of 3.3%.

Commercial Real Estate Vacancy

While vacancy rates for retail, industrial, and multifamily space appear to be relatively stable, vacancy rates for office space continue to increase. According to a recent article by Cushman & Wakefield, overall U.S. office vacancy for Q2 2025 was 20.8%, up 20 basis points from Q1 2025 and up 90 basis points from Q2 2024.2 However, the article noted that “the pace at which vacancy is increasing is slowing,” with one-third of U.S. markets seeing overall vacancy “remain flat or decline.” The article further noted positive trends in sublease inventory levels and a significantly smaller new construction pipeline. The combined effect of these factors seems to indicate that office vacancy is nearing its peak. Most of Forvis Mazars’ loan review clients have little or no exposure to large office buildings in central business districts, where the most significant office vacancy issues appear to be focused. While many of our client banks have seen more stressed office properties over the last four to five years, the levels appear to be well below the national average.

Problem Loan Levels

Our loan review team serves approximately 160 banks each year and we calculate/track a few asset quality ratios for each of those banks—with the classified loans/capital ratio being of most importance. We have observed the average for this ratio steadily decrease since its peak in the aftermath of the 2008 recession. There was a small increase in 2020 due to the pandemic, increasing from approximately 15% in 2019 to 16% in 2020. The average reached a low of around 9% in 2023 but has been steadily increasing since—it’s currently at just over 11%. While we are observing problem loan levels trending upward for our clients, and we do anticipate this trend continuing (for the time being), problem loan levels are still relatively low compared to historical levels.

CECL Accounting Standard & Tariffs

The credit executives who attended the roundtable were most interested in discussing topics related to the CECL accounting standard and tariffs. Executives expressed concerns regarding the economic uncertainty surrounding recent tariff activities and how it could/should impact their banks’ underwriting/monitoring practices. They also had various questions about CECL methodology—particularly evaluating qualitative adjustments. Interestingly, CECL has been the most requested topic by attendees each year for the past several years at this annual event.

Conclusion

Are there conflicting signals out there? Absolutely! Loan delinquencies and problem loan levels are likely to keep increasing in the near term. In the long term, much uncertainty exists due largely to economic and geopolitical concerns, including tariffs.

In times of uncertainty, we recommend returning to the basics:

- Review your loan policy/procedures to help ensure your bank’s risk appetite is appropriate for current/potential economic conditions.

- Reduce policy exceptions in underwriting.

- Scrutinize your loan monitoring processes for any potential areas for improvement.

- Be proactive in identifying risk/problem loans.

- A problem loan is a problem regardless of the risk grade assigned by the bank.

How Forvis Mazars Can Help

Our Loan Review practice is nationwide and ready to assist. If any of these insights resonate with you or you would like information on a credit roundtable near you, reach out to a professional at Forvis Mazars today to see how your institution may be impacted.