On October 13, 2023, the SEC approved—in a three-to-two vote—new Rule 10c-1a to increase transparency in the securities-lending market by mandating disclosures for security lenders. This rule not only covers investment companies but also banks, insurers, and pension plans. Only 12 pieces of data are required, but the implementation effort is substantial; the SEC’s economic analysis indicates an initial industry implementation cost of $522 million and annual ongoing costs of $233 million.

Background

Securities lending is the market practice by which securities are transferred temporarily from one party (a securities lender) to another (a securities borrower) for a fee. Securities lenders are generally large institutional investors including investment companies, central banks, sovereign wealth funds, pension funds, endowments, and insurance companies. These arrangements help these investment pools generate incremental income. The size of the securities lending market is estimated at $1.5 trillion as of September 30, 2020.

Brokers and dealers are the primary borrowers of securities; they borrow for their market-making activities or on behalf of their customers. Brokers and dealers who borrow securities typically relend those securities or use the securities to cover fails to deliver or short sales arising from proprietary or customer transactions. Hedge funds generally are the largest securities borrowers and access the lending market mainly through their prime brokers. Brokers and dealers also may lend securities that are owned by the broker or dealer, customer securities that have not been fully paid for, and the securities of customers who have agreed to participate in a fully paid securities-lending program.

The Dodd-Frank Act delegated to the SEC the broad authority to regulate the lending and borrowing of securities.

Currently, only certain market participants, such as registered investment companies, are required to make specified disclosures regarding their securities-lending activities while other parties to those transactions are not required to report the material terms of those arrangements. Some information is voluntarily provided to vendors who provide access to that data under a subscription.

Scope

New Rule 10c-1a requires that a covered person who lends securities report details of their securities-lending transactions to a registered national securities association (RNSA), such as the Financial Industry Regulatory Authority. A covered person is defined as:

- Any person who agrees to a covered securities loan on behalf of the lender (intermediary) other than a clearing agency when providing only the functions of a central counterparty or a central securities depository

- Any person who agrees to a covered securities loan as the lender when an intermediary is not used

- The broker or dealer when borrowing fully paid or excess margin securities

Examples:

A fund is a covered person if that fund runs its own lending program and lends securities to other persons without the use of an intermediary, such as a custodian bank.

A broker or dealer who borrows fully paid or excess margin securities from its customer is the covered person for purposes of the final rule, and the customer of the broker or dealer is not a covered person.

The final rule adds to the definition for a covered securities loan1 to exclude rehypothecation transactions, and central counterparty or depository services.

Any person who loans a security on behalf of itself or another person would be a lender under the final rule, including banks, insurance companies, and pension plans.

Reporting Agent

A covered person can rely on a reporting agent that is a broker, dealer, or registered clearing agency to provide required Rule 10c-1a information to an RNSA if there is a written agreement and the reporting agent has timely access to the information. If the reporting agent is unable to provide Rule 10c-1a information to an RNSA because it lacks timely access to it, the covered person who enters into the written agreement with the reporting agent is responsible for providing such information to an RNSA.

Details Required

Covered lenders are required to provide 12 pieces of information to an RNSA, directly or through a reporting agent, by the end of day. (This is a notable change from the proposal, which would have required reporting within 15 minutes.)

Items that the RNSA would make public include:

- Legal name of the issuer of the securities to be borrowed

- Ticker symbol of those securities

- Time and date of the covered securities loan

- Name of the platform or venue, if one is used, e.g., online venue, exchange, or OTC

- Amount of reportable securities loaned

- Rates, fees, charges, and rebates for the loan

- Type of collateral provided for the loan and the percentage of the collateral provided to the value of the loaned securities

- Termination date of the loan

- Borrower type, e.g., broker, dealer, bank, customer, clearing agency, or custodian

The next business day, the RNSA is required to make publicly available the following information:

- The unique identifier assigned to a covered securities loan by an RNSA and the security identifier

- The data elements, except for loan amount

- Information pertaining to the aggregate transaction activity and the distribution of rates among loans and lenders for each reportable security and related unique identifier

On the 20th business day, the RNSA is required to make publicly available the loan amount, along with loan and security identifying information.

Additional loan terms that would be provided to the RNSA but would not be made public:

- The legal names of the parties to the loan

- When the lender is a broker-dealer, whether the security loaned to its customer is loaned from the broker-dealer’s inventory

- Whether the loan will be used to close out a fail to deliver pursuant to Rule 204 of Regulation SHO or whether the loan is being used to close out a fail to deliver outside of Regulation SHO

RNSA Fees

The final rule allows an RNSA to establish and collect reasonable fees to recover costs associated for implementation and ongoing costs of this new rule.

Compliance Dates

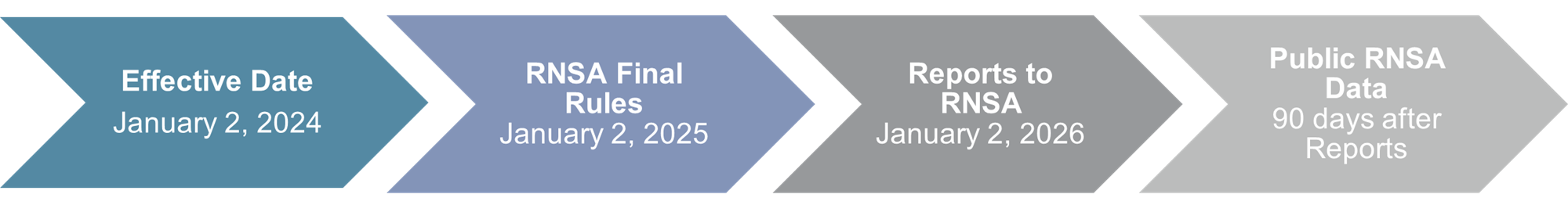

RNSAs are required to propose rules to implement Rule 10c-1a within four months of the rule’s effective date (60 days following Federal Register publication). Final RNSA rules must be effective no later than 12 months after the effective date. The reporting date for covered persons to submit information to an RNSA will be the first business day 24 months after the effective date. RNSAs will publicly report Rule 10c-1a information within 90 calendar days of the reporting date.

Conclusion

Forvis Mazars has experience providing services to fund complexes with net assets ranging from a couple million to several billion dollars. Our experience allows us to provide tailored services to help meet your unique needs. If you have questions or need assistance, please reach out to a professional at Forvis Mazars.

- 1A transaction in which one person—either on that person’s own behalf or on behalf of one or more other persons—lends a “reportable security” to another person, with exclusions for (1) positions at a registered clearing agency that result from central counterparty services or central depository services, and (2) the use of margin securities by a broker or dealer unless such broker or dealer lends such securities to another person.