The SEC’s Office of the Advocate for Small Business Capital Formation recently released a helpful “cheat sheet” to help determine which of the SEC’s Private Fund Reform rule’s provisions apply to each type of fund.

For an in-depth review of the soon-to-be-effective final rule, see our FORsights article, “SEC Finalizes Extensive Private Fund Reforms.”

Forvis Mazars has experience providing services to fund complexes with net assets ranging from a couple million to several billion dollars. Our experience allows us to provide tailored services to help meet your unique needs. For more information, please reach out to a professional at Forvis Mazars or submit the Contact Us form below.

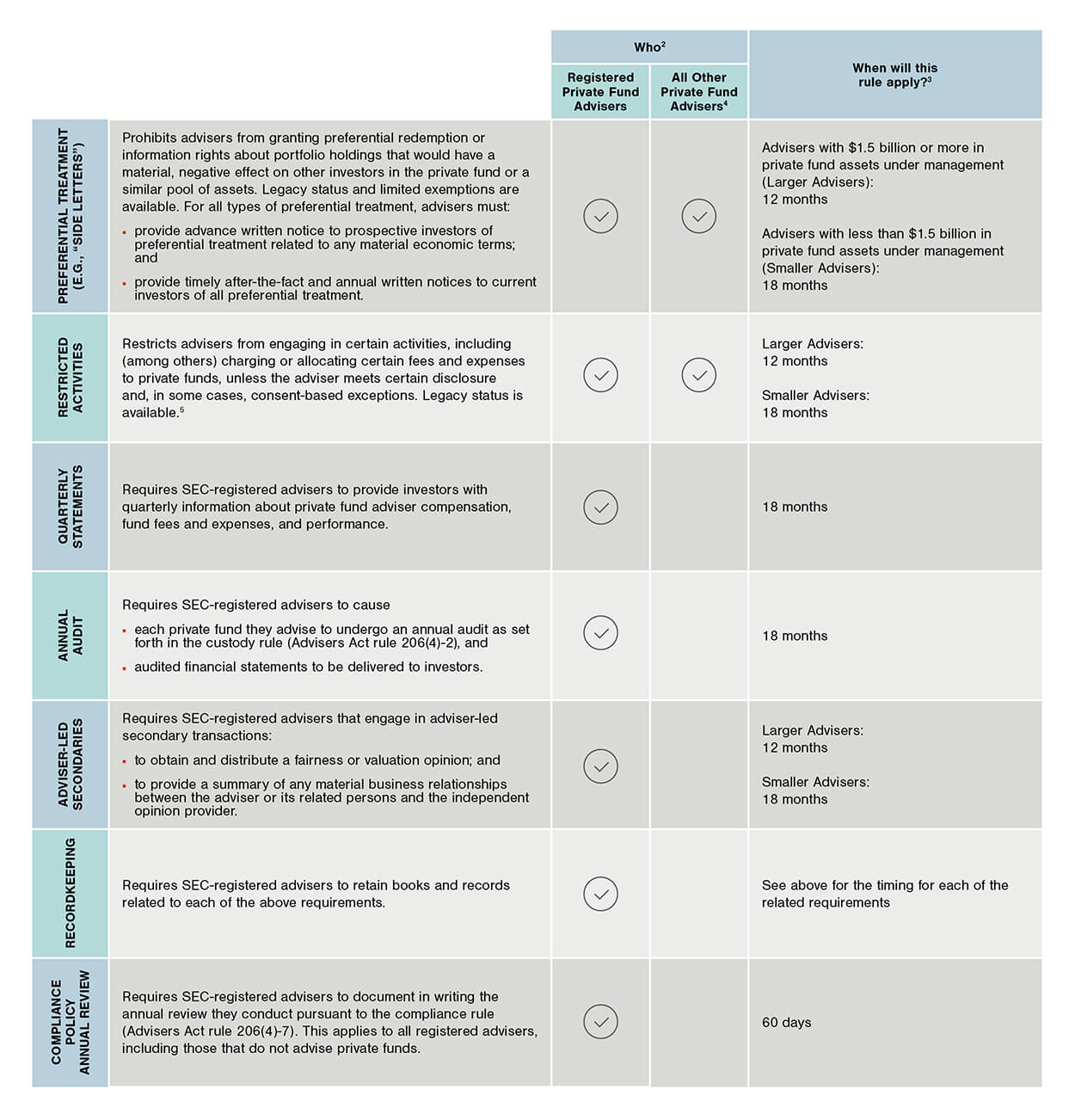

Private Fund Adviser Rules: Overview Chart

The below chart1 provides a summary overview of some of the new restrictions and requirements that apply to private fund advisers. The new Private Fund Adviser rules were adopted on August 23, 2023.

Source: sec.gov

- Prepared by staff of the Office of the Advocate for Small Business Capital Formation. It is not a rule, regulation, or statement of the SEC. The SEC has neither approved nor disapproved its content. This resource, like all staff statements, has no legal force or effect: It does not alter or amend applicable law, and it creates no new or additional obligations for any person. This resource does not provide legal advice.

- Investment advisers to securitized asset funds will not be required to comply with the preferential treatment, restricted activities, quarterly statement, annual audit, adviser-led secondaries, and record-keeping requirements of the final rules solely with respect to the securitized asset funds that they advise.

- Time periods begin after the rules are published in the Federal Register.

- Including exempt reporting advisers and other advisers who are not registered with the Commission.

- Further, an adviser may not charge fees or expenses related to an investigation that results in a sanction for a violation of the Advisers Act or the related rules.