On May 10, 2023, the SEC assembled a host of industry participants to discuss various topics on municipal securities disclosures. Panelists included preparers, regulators, analysts, active and former standard setters, and securities lawyers, and topics included:

- Voluntary disclosures

- Financial Data Transparency Act of 2022 (FDTA)

- Broad risks – Cybersecurity and environmental, social, and governance (ESG) issues

- Current disclosure topics

Background

Market Size

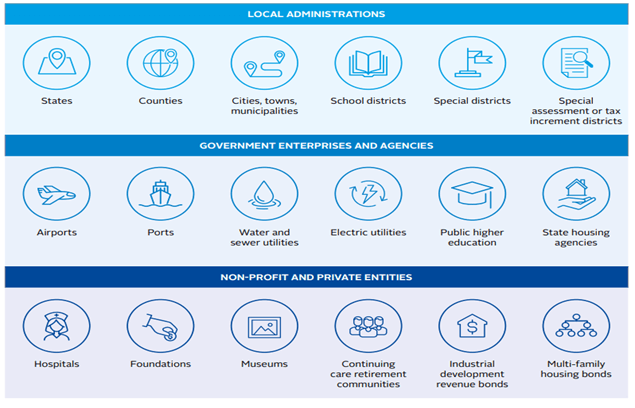

The municipal market is estimated at $4 trillion outstanding, consisting of 50,000 issuers and more than 1 million securities outstanding. While the size of the U.S. corporate bond market ($46 trillion) dwarfs the municipal market,1 the number of corporate bonds outstanding is only 30,000. Municipal bond issuers are smaller and issue less frequently than corporate issuers. Roughly 40% of municipal securities are held by individual retail investors and 20% by mutual funds.

Source: Principals for Responsible Investment2

SEC Rules

The SEC first adopted rules around municipal securities disclosure in 1989 and the last update was in 2018. SEC Rule 15c2-12 requires that underwriters of municipal securities—before bidding, purchasing, or selling a municipal security in the primary market—must obtain and review the issuer’s preliminary and final official statements and reasonably determine that the issuer has committed to provide continuing disclosures to investors. This is usually evidenced in a continuing disclosure agreement executed by the issuer at bond closing. The information to be provided includes annual financial and operating information of the kind and substance contained in the offering documents, audited financial statements, notice of the occurrence of certain events (see Appendix), and notice of any failure to meet these reporting requirements within 10 days to the Municipal Securities Rulemaking Board’s Electronic Municipal Market Access website (EMMA).

Rule 15c2-12 only applies to underwriters because the SEC is prohibited from directly regulating municipal issuers under the 1975 Tower Amendment to the Securities Exchange Act of 1934.3 In addition, municipal offerings are not subject to the pre-sale approval and consent by the SEC or to specific line-item disclosure requirements. However, municipal offerings are subject to the anti-fraud provisions of the federal securities laws and primary offering rules.

FDTA

The FDTA was enacted on December 23, 2022 and directs certain regulatory agencies (including the SEC) to jointly issue proposed rules for public comment that establish new data reporting standards on format, searchability, and transparency within 18 months. The FDTA only changes how information is submitted; it does not contain any new disclosure requirements. The FDTA requires information to be made available in an open data format that allows for digital access and bulk downloads with no restrictions. The goal is to make the information collected and made publicly available by regulatory agencies easier to access, analyze, and compare by requiring data to be posted in a machine-readable format, similar to the SEC’s requirements for the information posted to the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) by publicly traded companies, mutual funds, and other regulated entities that were introduced in 2009. The FDTA will change the way issuers and obligors of municipal securities report required disclosure information on EMMA. The Government Finance Officers Association (GFOA) has already raised concerns about the new reporting requirements, including implementation costs and the loss of unique narrative information for a specific type of issuer (state, city, public utility provider, or hospital) in the standardization of information.4

Mary Simpkins, SEC Office of Municipal Securities senior special counsel, noted that the SEC’s FDTA rulemaking details would not be finalized before 2026.

Voluntary Disclosures

There were two items that panelists agreed would be helpful from the SEC. The first was defining materiality and the second was an update to the 2020 staff legal bulletin (SLB) and the 1994 interpretive release clarifying how anti-fraud provisions apply to municipal disclosures. Both issuers and legal counsel sought greater clarity. Issuers noted that they erred on the side of caution in voluntarily posting information to EMMA. Analysts noted relevant information can be hard to find and they would appreciate more timely information.

The 1994 guidance states that when a municipal issuer releases information to the public that is reasonably expected to reach investors and the trading markets, those disclosures are subject to the anti-fraud provisions.

The SLB summarizes previous SEC statements on the application of the anti-fraud provisions to information on issuer websites; hyperlinks; public reports containing financial information or operating data; and statements made by public officials. The SLB highlights the importance of municipal issuers adopting comprehensive disclosure policies and procedures. A key component of such controls is that the appropriate financial and legal officers of a municipal issuer carefully review the information that is intended to reach investors. A municipal issuer should be able to define what information is intended for investors and to assure that such information is properly and comprehensively reviewed. Because of the 1975 Tower Amendment, the SLB is “not intended to create any legal obligation for an issuer to develop disclosure policies and procedures” and the SLB “has no legal force or effect: it does not alter or amend applicable law, and it creates no new or additional obligations for any person.”

Neither request is likely to be forthcoming, and panelists cited existing GFOA best practices for disclosures as a useful framework for navigating anti-fraud concerns.

FDTA

There was a universal lack of support among the panelists for the implementation of the FDTA. Most cited cost as the primary concern. Florida’s director of the Division of Bond Finance provided information on its project to collect, maintain, and disseminate information on tax-exempt bonds issued by units of local government and the state. This effort took five years and cost more than $2 million. Expanding the project to collect footnote disclosure would take an additional two years. Joel Black, GASB’s chair, noted that FASB XBLR ongoing support includes a dedicated staff of 10 to maintain its taxonomy. GASB staff has developed a workstream to monitor developments in electronic financial reporting, including conferring with financial statement users and following a project by XBRL U.S. to develop a taxonomy for state and local governments.

While the FDTA is technology neutral, panelists cited current private sector technology that scrapes EMMA data and potential advances in artificial intelligence that might provide access to municipal data in a more cost-effective manner.

SEC Commissioner Hester Peirce noted that the cost and operational challenges of meeting FDTA requirements could lead many municipal issuers to the private market or bank debt for future funding needs. Financial analysts were concerned that pursuing FDTA goals would reduce resources for continued improvements to EMMA.

If the FDTA were to proceed, panelists agreed that financial information would be the best place to start, although the lack of narrative information may render the data less useful to the potential users of such data.

Broad Risks

ESG

Most of the 75-minute session was devoted to ESG. Panelists lamented the politicization and polarization around this topic. The panel felt it was important to separate the labels from the underlying risks. They agreed the current extreme weather events are a real financial risk for governments. Social issues cited as areas of concern included public safety, affordable housing, and internet access. The Fitch credit rating agency currently uses a 7% weighting for ESG items in its ratings. However, market pricing currently does not distinguish between governments that have disclosed comprehensive transition and remediation plans in place compared to governments that do not, with a similar credit profile. A key takeaway was that a government should have robust processes and procedures to identify material risks in order to make timely disclosures.

Cybersecurity

Governments have a higher risk for cyberattacks as their processes are slower and systems are likely to be older. Panelists cited emerging threats from artificial intelligence developments in spoofing and impersonation attacks. The recent SEC proposal on cybersecurity will not apply to municipal issuers.

Current Disclosure Topics

Panelists highlighted a wide variety of issues: the increased use of bank loans and direct placements, the declining use of forward refundings, issuer liability for conduit offerings, investor adviser fiduciary responsibility, and recent enforcement actions (misuse of the limited offering exemption). Forvis Mazars will continue to follow these developments. For more information, reach out to a professional at Forvis Mazars.

Appendix

A notice of the occurrence of certain events would include events such as:

- Principal and interest payment delinquencies with respect to the securities being offered

- Non-payment related defaults, if material

- Unscheduled draws on debt service reserves reflecting financial difficulties

- Unscheduled draws on credit enhancements reflecting financial difficulties

- Substitution of credit or liquidity providers, or their failure to perform

- Adverse tax opinions, IRS issuance of proposed or final determinations of taxability, notices of proposed issue, or other material notices or determinations with respect to the tax status of the security, or other material events affecting the status of the security

- Material modifications to rights of security holders

- Material bond calls, and tender offers

- Defeasances

- Release, substitution, or sale of property securing repayment of the securities, if material

- Rating changes

- Bankruptcy, insolvency, receivership, or similar event of the obligated person

- Consummation of a merger, consolidation, or acquisition; acquisition involving an obligated person or the sale of all or substantially all of the obligated person’s assets, other than in the ordinary course of business; the entry into a definitive agreement to undertake such an action; or the termination of a definitive agreement relating to any such actions, outside defined contract terms, if material

- Appointment of a successor or additional trustee or the change of name of a trustee, if material

- Incurrence of a financial obligation of the issuer or obligated person, if material, or agreement to covenants, events of default, remedies, priority rights, or other similar terms of a financial obligation of the issuer or obligated person, any of which affect security holders, if material

- Default, event of acceleration, termination event, modification of terms, or other similar events under the terms of the financial obligation of the issuer or obligated person, any of which reflect financial difficulties

- 1“Research Quarterly: Fixed Income – Issuance and Trading, First Quarter 2021,” sifma.org, April 14, 2021

- 2“ESG Integration in Sub-Sovereign Debt – The US Municipal Bond Market,” unpri.org, 2021

- 3“Tower Amendment,” nabl.org

- 4“New Financial Reporting Requirements for Governments Proposed in U.S. Senate: A Costly and Burdensome Unfunded Mandate,” gfoa.org