This article originally appeared on the Ledgible website and is reprinted here with permission.

Challenges for CPAs with Crypto Data

Blockchain technology and cryptocurrencies (crypto) present a multitude of challenges for CPAs. This article will examine some of those challenges and provide helpful tips.

1. Data is king

The challenge starts with data, and “blockchain” is a fancy word for a database. Just like a business starts with transaction data to compile financial statements, a similar approach is taken to compile the overall economic impact of your crypto transactions. All of the data for on-chain transactions is accessible on a public ledger (aka the blockchain). Understanding and deciphering that data can be difficult if you are not trained in how to read blockchain explorers—unless, of course, you’re assisted with a tool like Ledgible.

2. This is a technology that is evolving quickly

One issue is the constantly evolving and complex nature of these technologies, which makes it difficult for CPAs to keep up with the latest developments and fully comprehend the information they are handling. Because of the pace of change in the industry, it has been said that spending one year devoted to crypto is like 10 years outside of crypto. Not every blockchain works the same, and not every application on the blockchain works the same.

For example, holders of the ATOM token can stake their ATOM and in exchange for securing the COSMOS blockchain, they receive ATOM tokens as a reward. Once ATOM tokens are staked, they are locked up and cannot be traded until unstaked. Contrast that with staking Ethereum (ETH) through Lido; holders of the ETH token can stake their ETH and in exchange for securing the ETH blockchain, they receive ETH tokens as a reward. However, with Lido, ETH stakers can choose to receive stETH, a liquid derivative of ETH. This liquid derivative allows stakers of ETH to effectively trade their ETH while it is locked up. Catch all that? Now imagine the data and the data format needed for CPAs to help their clients report this information. It’s complex, to say the least.

3. There is no standard tax reporting form that assists CPAs, e.g., 1099-B

Another challenge CPAs face is the complexity and nature of how taxpayers can move their crypto. For example, a taxpayer could move their crypto from a centralized exchange to a wallet through different decentralized apps and back into a centralized exchange. Centralized exchanges are not currently required to issue 1099s summarizing the total gain, loss, and income from taxpayers’ activities, but some have taken it upon themselves to at least provide something to alleviate the tax reporting burden of their customers. Complexity with tracking tax basis and proceeds arises when taxpayers transact on-chain because the blockchain, in its simplest form, is open-source code that does not act as a custodian. Therefore, there is currently no way a summarized report like a 1099-B can easily and accurately report a taxpayer’s basis and proceeds.

4. Crypto is volatile

The value of crypto also can be incredibly volatile, fluctuating significantly in short periods of time. Crypto also trades 24 hours a day, 7 days a week, and there is no open or close of market. This creates an inherent difficulty when choosing a method for converting the value of crypto back to fiat or USD. Picking a standard method and remaining consistent with that method is key.

Proper Accounting

Wallet Hygiene

An essential step to check that your crypto is properly accounted for is to keep your wallet “clean.” In the industry, wallet hygiene refers to the practice of keeping your wallet(s) organized and secure. Neglecting your wallet’s organization and security can create accounting headaches for your CPA, so it’s important to stay on top of things. Let’s look at some ways to help you maintain good wallet hygiene.

1. Security

Custodial Wallets & Accounts

The first step to good wallet hygiene is to keep your funds secure. If you plan to use a centralized exchange or other form of custodian, choose a password that is long, complex, and unique. Reusing passwords across different custodial accounts increases the chance that your password will be discovered and used to gain unauthorized access to your other custodial accounts. Keep your software up to date to take advantage of the latest security features and bug fixes. Outdated software may have vulnerabilities that attackers could exploit. Consider turning on two-factor authentication. This allows you to easily add another layer of security by requiring verification before withdrawing or sending payments.

Noncustodial Wallets

Noncustodial wallets like hardware (cold) and software (hot) wallets return ownership and custody back to the owner of the private key or seed phrase. Copying the seed phrase and keeping a backup if the original is lost can help prevent losing access to crypto funds. Protecting the seed phrase in a secure location is critical to preventing unwanted access to your wallet. Just like you wouldn’t want a bad actor having access to your online banking username and password, you also wouldn’t want a bad actor having access to your seed phrase.

2. Organization

The next step to maintaining good wallet hygiene is organization. Neglecting the designation and purpose behind each wallet can lead to issues such as mixing personal and business transactions, having too many or too few wallets, and a lack of process for reviewing and approving new wallet usage.

To improve your wallet organization, consider creating separate wallets for each specific business use along with defining a strategy for each use case. For example, you can hold your treasury-type crypto in a noncustodial cold wallet and use an exchange or desktop-based wallet for more frequent operational transactions. Consider another example of using wallet A for receiving payments from customers and wallet B for making vendor payments. Using one wallet for every type of transaction can make accounting more difficult. On the flip side, creating additional wallets just for the sake of creating them can create a lack of organization. Additional questions you should likely ask are who should have access to each wallet, how should transactions that filter through this wallet be coded on your books, and what is the expected flow of funds.

Once you determine what wallets you decide to utilize, document the existence and reason for each wallet. Maintain a document or spreadsheet that you can easily update that clearly defines each wallet and its wallet address. Focusing on wallet documentation early on can save you and your CPA a lot of time in the future. Digging through unorganized crypto data may not be the best use of your CPA’s time.

3. Using QuickBooks

A common and affordable software that a lot of small businesses use is QuickBooks (QB). Unfortunately, QB doesn’t natively support crypto, and the accounting can get very messy over time if you are inconsistent with how you report transactions. Luckily, Ledgible.io can help provide a seamless QB integration. Using the QB API in Ledgible allows users to:

- Map transactions to specific accounts in QB

- Wallet specific mapping (circling back to wallet hygiene)

- Daily sync crypto transactions to QB

Tax Code Compliance

“Cryptocurrency is here to stay, as far as I’m concerned. It isn’t going anywhere anytime soon and it’s becoming more legitimate as the years roll on,” said IRS Criminal Investigation Unit Executive Special Agent Thomas Fattorusso.1 The ever-changing and evolving aspects of crypto make it hard for tax laws and regulations to keep up. This quickly evolving innovation has led to a multitude of potential taxable income-generating sources, both for personal and business tax returns.

In general, if a taxpayer sells or exchanges digital assets, a taxable event has occurred, and the character of the transaction will either be capital or ordinary in nature. However, there also are nontaxable events.

There are four common nontaxable events related to digital assets:

- Purchasing and holding digital assets

- Transferring digital assets from one wallet to another (both wallets must be owned by the same party)

- Gifting digital assets, as long as the gift is under the annual exclusion of $16,000 per donee ($17,000 per donee for 2023)

- Donating crypto to a charitable organization (although you may be able to claim this as a charitable contribution deduction on your tax return)

The above events can generally be carried out without reporting income, gain, or loss.

There are five common events that could cause a transaction to be taxable:

- Converting digital assets to fiat currency, e.g., U.S. dollars

- Converting a digital asset to another digital asset

- Purchasing goods or services with digital assets

- Receiving digital assets for compensation, a fork, or air drop

- Receiving mining, staking, or other DeFi rewards

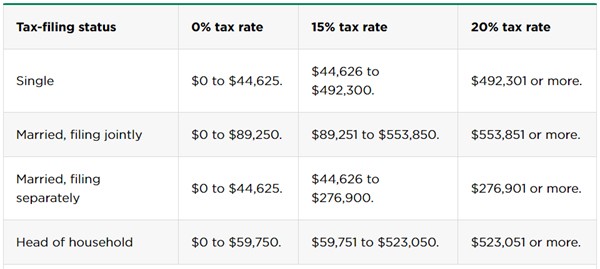

Once a taxable event has occurred, the taxpayer must determine the character of the transaction. In general, the character will either be capital or ordinary. This will determine the applicable federal tax rates.

2023 Capital Gains Tax Brackets

Source: NerdWallet.com

Converting Digital Assets to Fiat

In most circumstances, this type of transaction will result in a capital gain or loss. This is the most common event related to digital assets and a simple formula should be used to determine a taxpayer’s gain or loss. The formula is as follows:

Proceeds – Cost Basis = Gain/Loss

Proceeds: Fair market value received less any transaction/gas fees

Cost Basis: Purchase price plus any acquisition costs, e.g., transaction fees

The gain or loss will be either short term or long term. If the taxpayer has held the digital asset for exactly one year or less, it will be a short-term capital gain or loss. If the digital asset has been held for more than one year, e.g., one year and a day, it will be treated as long term. These gains or losses are then reported on Form 8949 and Schedule D of a taxpayer’s individual tax return.

Determining Cost Basis

IRS’ virtual currency FAQ guide suggests that specific identification and first-in-first-out are the only two methods available for determining cost basis; however, since IRS FAQs are nonauthoritative guidance, you may want to discuss with your CPA whether other cost basis methods could be considered, such as last-in-first-out and highest-in-first-out.

Converting a Digital Asset to Another Digital Asset

These transactions are treated the same as converting a digital asset to fiat as discussed above. The basis in your digital asset is the amount you spent to acquire the digital asset plus transaction, commission, gas fees, and other acquisition costs paid. The proceeds in your gain or loss calculation are equal to the fair market value of the digital asset sold at the time of the transaction.

Receiving Digital Assets for Compensation, a Fork, or Air Drop

When a taxpayer receives digital assets for compensation, the assets are considered ordinary income and will be taxed at the ordinary taxable income rates. Receiving digital assets for a good or service also may constitute ordinary income if the activity rises to the level of a trade or business.

In blockchain terminology, a fork happens when the blockchain diverges due to a change in protocol. Similar to a fork in the road, a chain fork creates two side-by-side blockchains that originated from the same chain. Thus, if you owned the native token to the blockchain before the fork, you will now own the original native token and the new, forked token after the fork. When this occurs, if the recipient of the new token is deemed to have constructive receipt, they will report the fair market value as ordinary income at the point in time when they have dominion and control.

Air drops are distributions of crypto coins, typically with the intention of promoting the use of the air-dropped coin. A digital asset received by air drop will generally be taxed as ordinary income.

Receiving Mining, Staking, or Other DeFi Rewards

Mining, also known as “proof-of-work” mining, is the process of validating crypto transactions that are subsequently added to the blockchain. Staking, also referred to as “proof of stake,” is the process of pledging crypto as collateral and, in return, earning a percentage-rate reward. Mining rewards are taxed as ordinary income at the current year ordinary income rates. Mining cryptocurrency, according to IRS Notice 2014-21, may cause rise to business income and, therefore, trigger self-employment tax. If the activity rises to the level of a trade or business, despite being subject to self-employment tax, the taxpayer may be able to deduct ordinary and necessary business expenses related to mining the crypto.

Because IRS Notice 2014-21 specified mining and did not mention staking crypto, further guidance is needed for clarification on the tax treatment of staking income. However, given that staking is analogous to mining, a conservative approach would be to treat staking rewards as ordinary income.

DeFi, short for decentralized finance, is a popular way to earn additional rewards through activities such as providing liquidity to liquidity pools and play-to-earn (P2E) games. Providing liquidity to liquidity pools allows decentralized exchanges to execute crypto-to-crypto trades without the capital typically provided by a centralized party. In return for providing liquidity, the liquidity provider is rewarded. P2E games are growing in popularity. In P2E, players earn rewards in the form of tokens as they play the games. Although no specific guidance from the IRS exists on DeFi activity, taxpayers are earning income through both liquidity mining and P2E gaming. Due to a lack of guidance from the IRS, a conservative approach would be to treat these rewards as ordinary income.

Crypto Regulation

Since crypto is relatively new, reporting guidelines are still being created and enforced. Originally, there weren’t very many regulations you needed to follow if you were buying, selling, or transacting with crypto, but over time it became increasingly more regulated.

An infrastructure bill passed in November 2021 will change crypto reporting requirements this year. Cryptocurrency and digital asset investors could potentially see higher taxes as the bill ultimately cracks down on IRS reporting requirements. The deal, coming in at roughly $1.2 trillion, mandates yearly tax reporting from digital currency brokers starting in January 2023. However, the effective date of the reporting has been delayed by the IRS until final regulations have been released. This will put a bigger responsibility on tax professionals to understand reporting requirements and have the tools to complete taxes from a crypto perspective.

Ledgible

Ledgible Crypto provides AICPA SOC 1 & 2 assured digital asset tax and accounting solutions for institutions, investors, and professionals. The Ledgible Crypto Platform is a helpful crypto asset solution for professionals with leading accounting firms and major crypto companies globally. Ledgible is used by thousands of firms, enterprises, investors, and professionals to help make tax reporting and accounting easy. For more information, visit ledgible.io.

Abnormal Data

Many factors play into why crypto is so difficult to track and account for. With crypto, you have 24/7 trading, nonstandard asset valuation, fringe scenarios like forks, stacking income, swaps, rewards, air drops, mining, etc. There’s no single source of data because of the 500-plus exchanges that can be used. Ledgible can directly integrate with leading professional tax software, help provide automation of crypto activity in a structured traditional format, and help make it easier for firms to handle crypto reporting and expand their service offerings to provide crypto advisory, reporting, and tax planning.

First, Ledgible helps with accessibility by connecting and aggregating crypto data from exchanges, ledgers, wallets, and platforms. Then the crypto data is compiled and standardized, helping make it accessible for a wide variety of use cases. Lastly, Ledgible data is made legible and readable for existing accounting systems, helping address the crypto data problem.

How Forvis Mazars Can Help

Since the technology of crypto moves at such a rapid pace and because crypto transactions are inherently complex, a professional at Forvis Mazars can assist you in identifying and addressing issues that are not captured by Ledgible Crypto Tax Pro. When not every transaction can be clearly identified or matched, the burden of proof lies on a taxpayer to provide documentation of cost basis. If a taxpayer is unable to provide cost basis documentation, the IRS will generally assume the cost basis is $0. For example, if taxpayer A sold 1 BTC for $20,000, but cannot provide accurate information for the purchase of the 1 BTC, all $20,000 will be reported as a gain even if Taxpayer A purchased the 1 BTC for $30,000. Professionals at Forvis Mazars can help you understand your tax situation.

Forvis Mazars, LLP makes no endorsement of Ledgible or any other software for crypto assets; and makes no representation regarding the performance or suitability of crypto assets. Forvis Mazars, LLP is not a registered investment advisor and this article is not intended to provide investment recommendations. Every tax situation is unique; if you have tax questions or need assistance, please reach out to a tax professional at Forvis Mazars.

- 1Wall Street Journal, “IRS Sees Crypto Companies as Potential Crime-Fighting Partners”