The NMTC program is a project financing tool that incentivizes community development by using tax credits to attract private investment into distressed communities. This article provides information on frequently asked questions about the program.

1. What is the NMTC Program?

The NMTC Program provides a federal tax credit for investments made in traditionally underserved, low-income communities. The total tax credit is 39% of the associated investment and is claimed over a period of seven years—5% in years one to three and 6% in years four to seven.

2. How does the NMTC Program work?

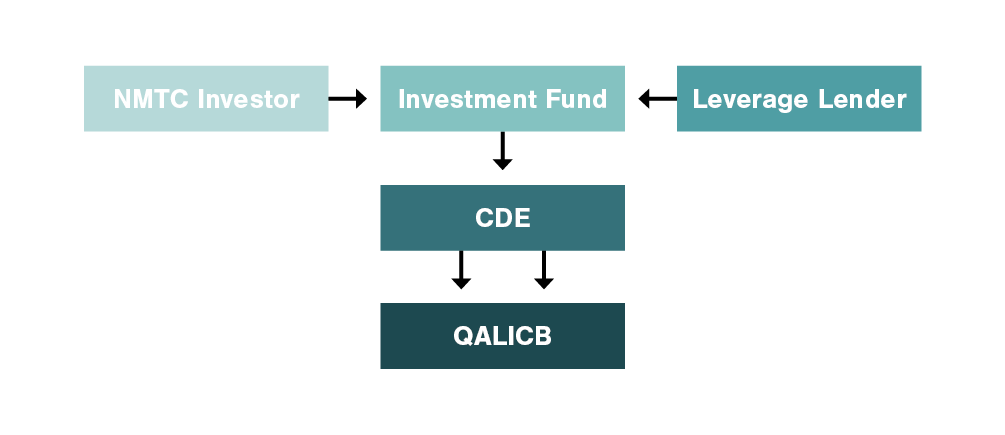

Certified community development entities (CDEs) apply to the Community Development Financial Institutions (CDFI) Fund for tax credit allocation authority. CDEs then select qualified projects to receive NMTC financing. Investors make a qualified equity investment (QEI) into the CDE in exchange for tax credits. CDEs use those proceeds to then make a qualified low-income community investment (QLICI) into a qualified active low-income community business (QALICB), aka the business or project.

3. What is a Community Development Entity (CDE)?

CDEs are financial intermediaries with a track record of making loans and investments in underserved areas. CDEs apply for tax credit allocation authority from the CDFI Fund to enable them to facilitate investments in low-income communities that ultimately generate NMTCs, which are used by investors.

4. What is a Qualified Equity Investment (QEI)?

A QEI is an equity investment in a CDE, provided that such investment is acquired by the investor in exchange for cash and substantially all the cash is used by the CDE to make QLICIs. The amount of the QEI is multiplied by 39% to determine the amount of NMTCs generated.

5. What is a Qualified Low-Income Community Investment (QLICI)?

A QLICI is either a loan or equity investment made by the CDE to a QALICB. QLICIs are predominately structured as interest-only loans and are used by the QALICB to fund qualified project expenses.

6. What is a Qualified Active Low-Income Community Business (QALICB)?

The QALICB is the business entity that will use the NMTC QLICI proceeds to fund project expenses to benefit the low-income community.

7. Who administers the NMTC program?

The CDFI Fund administers the NMTC program.

8. What is the CDFI Fund?

The CDFI Fund is a division of the U.S. Department of the Treasury that seeks to promote economic revitalization and community development in low-income communities. As part of its mission, the CDFI Fund is tasked with implementing the NMTC program and administers the allocation of tax credit authority to CDEs through a competitive application process.

9. How does a project qualify for NMTC financing?

For a project to qualify for NMTC financing, the physical location of the project must sit in an NMTC qualified census tract. A census tract will qualify if the poverty rate exceeds 20% or if the average median income falls below 80%. Also, the underlying project must not be a prohibited business, which includes:

- Massage parlors

- Gaming facilities

- Liquor stores

- Racetracks

- Tanning facilities

- Golf courses

- Some agricultural businesses

10. What is an NMTC loan?

An NMTC loan or loans are the financing provided by the CDE to the QALICB or project. NMTC loans have more favorable terms than traditional debt and are interest only for seven years. Principal payments on the NMTC loans are prohibited during the seven-year period. Moreover, a portion of the NMTC loan or loans received may be forgiven prior to any principal payment requirements begin.

11. What is the impact of the NMTC program?

NMTCs are designed to encourage investment in low-income communities. Historically, low-income communities have been overlooked by traditional capital markets. Through the NMTC program, businesses can benefit from low-cost capital, which in turn can benefit communities in the form of jobs created or greater access to community goods and services.

Per the CDFI Fund, as of the end of fiscal year 2021, the NMTC program has helped generate $8 of private investment for every $1 in federal funding; create more than 239 million square feet of manufacturing, office, and retail space; and finance more than 10,800 business.

12. Do NMTCs differ from state to state?

The federal NMTC program offsets federal tax liability, so it’s structured identically across all 50 states and territories. However, some states have enacted or are considering NMTC programs. These programs typically mirror many of the provisions of the federal program, but each state program has its own nuances, so the program’s requirements may vary from state to state.

13. What role can Forvis Mazars play in the NMTC program?

NMTC Services professionals at Forvis Mazars have substantial experience working with organizations to evaluate whether NMTC financing is a fit for qualified projects. Forvis Mazars can assist by coordinating the efforts to secure the NMTC allocation from one or more CDEs, capturing NMTC investor interest, helping with closing NMTC financing, monitoring on-going program compliance, and advising on downstream NMTC-related issues. Forvis Mazars can help clients throughout the NMTC process from education through compliance. The process includes the underappreciated and critical step of forecasting the NMTC financing transaction, a process that can take weeks or months to accurately document.

Forvis Mazars has developed a proprietary web-based software service that can help improve the speed and accuracy of NMTC transactions. We can help generate the transaction level reports that investors and CDEs need with potentially greater accuracy and in less time than traditional Excel-based services. Our approach can help investors obtain a first draft through a simple, informative information collection process generally in a matter of days rather than weeks, potentially saving time during the NMTC transaction closing process.

14. How can I start the NMTC financing application process?

The first step is to determine location eligibility. If the census tract where the project is located meets eligibility requirements, a combination of project factors including budgets, timing, and benefits to the community can help assess the likelihood of receiving NMTC financing from a CDE. Each CDE has unique investment criteria and navigating specific needs can prove time-consuming. An experienced professional can help make the process easier and assist you in gaining the best opportunity to have your project accepted.

To see how we can help you with your NMTC application process, please reach out to our NMTC team or submit a Contact Us form.